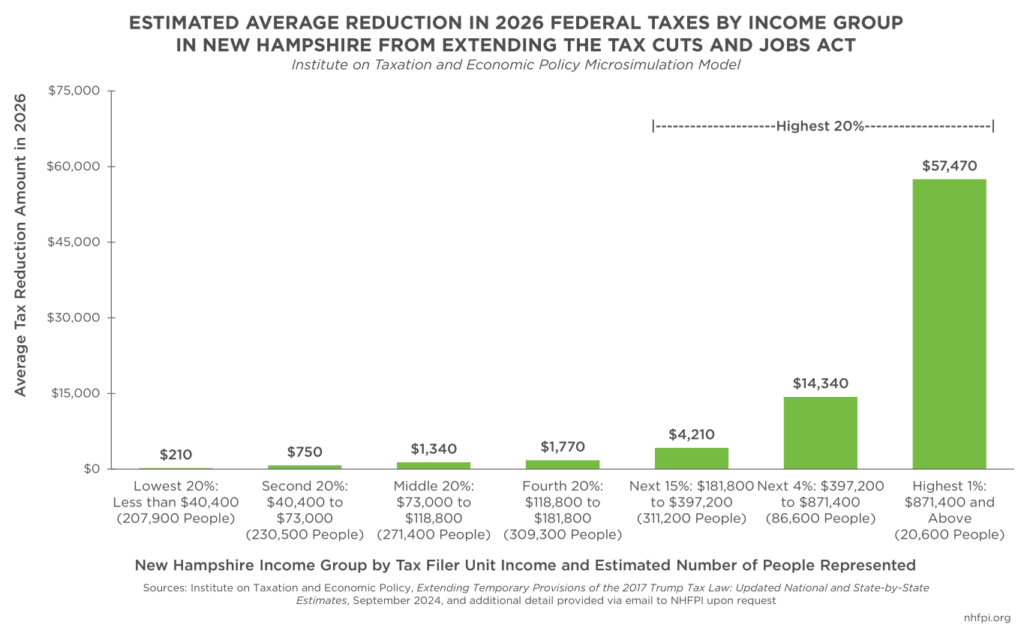

The federal Tax Cuts and Jobs Act, enacted in 2017, made both permanent and temporary changes to federal tax law, including significant changes to the personal income tax code that expire after 2025. U.S. Congress will likely consider whether to alter or extend these provisions next year. Analysis conducted and published by the Institute on Taxation and Economic Policy suggests that the highest income taxpayers disproportionately benefit from the increased exemptions for the Estate Tax and the deduction for qualifying pass-through business income. While taxpayers in the lowest 20 percent of the income scale would receive an average reduction of $210 in taxes paid by extending the Tax Cut and Jobs Act, taxpayers with incomes of $871,400 and higher, who are estimated to be in the top one percent of New Hampshire residents by income in 2026, would have an average tax reduction of $57,470.

To learn more, see NHFPI’s September 2024 blog: Federal Policymakers Will Consider Tax Changes Benefitting Higher-Income Granite Staters in 2025.