Granite Staters face a significant housing shortage, and relatively flexible funds made available through the American Rescue Plan Act can be used to create more affordable housing. The statewide median price of a single-family home rose 54 percent from January 2018 to January 2022, and the 2021 two-bedroom rental vacancy rate was 0.6 percent. The housing shortage increases costs for families and inhibits the growth of the state’s workforce.[1] Up to 435,200 Granite Staters may be income-eligible for housing assistance and for access to affordable housing developments financed by these funds.

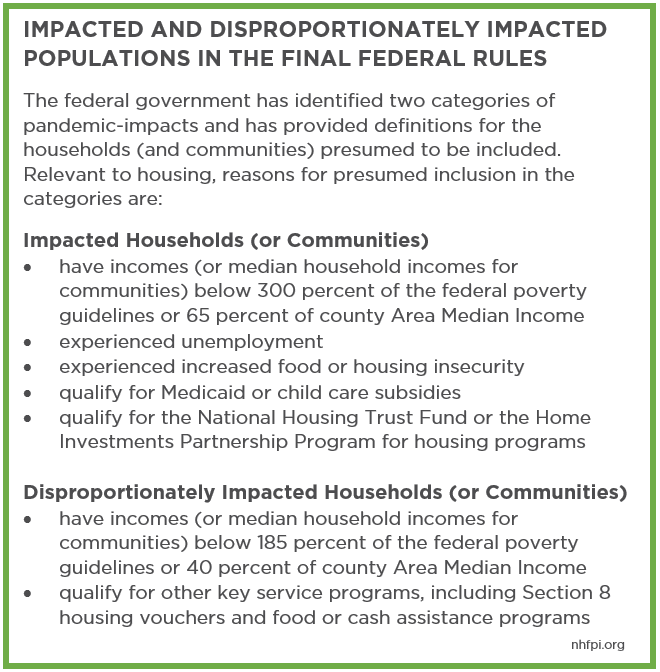

The federal American Rescue Plan Act supplied the State with about $995 million in relatively flexible Coronavirus State Fiscal Recovery Funds (CSFRF). CSFRF dollars can be used for many housing-related services for people with low and moderate incomes. Eligible uses for households either identified as “impacted” or “disproportionately impacted” (see box) by the pandemic include assistance for rent, mortgage payments, utilities, unpaid property taxes, home weatherization, counseling and legal aid to prevent eviction and homelessness, temporary housing to prevent homelessness, and relocating to neighborhoods with higher levels of economic opportunity. The federal government also provided certain opportunities for using CSFRF dollars for the development of affordable housing to support impacted communities. The CSFRF rules also largely apply to local governments for Coronavirus Local Fiscal Recovery Funds use.[2]

Housing Development

The final federal rules expand on the interim rules and permit more opportunities for development. For “impacted” populations, rules permit:

- development, repair, and operation of affordable housing and services or programs to increase long-term housing security

- funding policy interventions to increase the supply of affordable and high-quality living units

- rehabilitation or preservation of affordable rental housing or affordable homeownership units

Additional uses permitted only in “disproportionately impacted” communities include:

- rehabilitation, renovation, maintenance, or demolition of vacant buildings when such demolitions do not reduce the supply of occupiable housing units for low-income residents

- securing vacant properties and the environmental remediation or greening of properties

- conversion of vacant or abandoned properties to affordable housing

Certain targeted affordable housing developments, such as housing for individuals in recovery, are also permitted. The federal rules consistently specify that development is permitted for affordable housing.

Many Granite Staters Are Impacted or Disproportionately Impacted

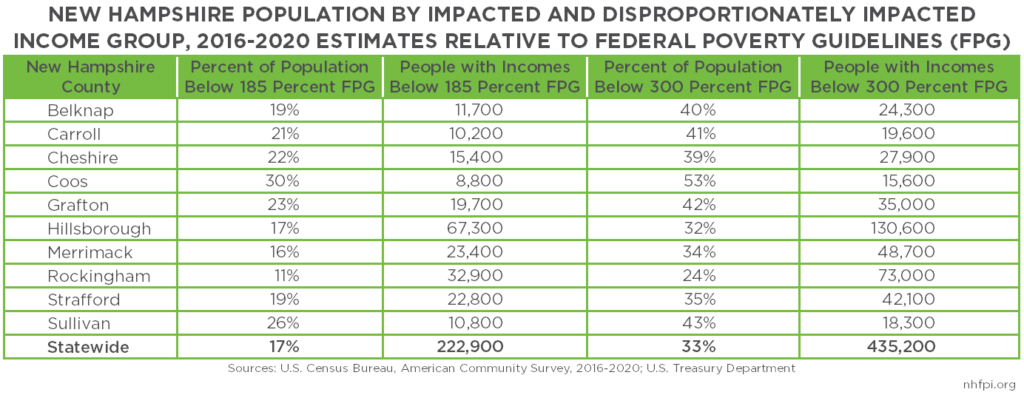

Permitted affordable housing development could serve many Granite Staters within the framework of these rules. An average of about 435,200 Granite Staters had annual incomes below 300 percent of the federal poverty guidelines during 2016-2020, and approximately 222,900 had incomes below 185 percent of the federal poverty guidelines.[3]

Other Potential Funding Opportunities and Limitations for Housing

Federal rule permits governments to use a portion of the CSFRF to replace public revenue identified as lost to the pandemic. Governments have broad latitude to use these revenue replacement funds for government services. New Hampshire has drawn revenue replacement funds from the CSFRF based on 2020 revenue shortfall amounts, some of which have already been deployed by the State.

Other relevant limitations exist beyond the expanded uses permitted under revenue replacement provisions. For example, states cannot use the CSFRF for general economic or workforce development, or planning activities for future economic growth, that does not respond to the pandemic’s negative economic impacts. Federal rules add justification requirements for capital projects over $1 million.

–

[1] Data from the New Hampshire Association of Realtors, New Hampshire Housing, New Hampshire Employment Security, and the U.S. Bureau of Labor Statistics. See NHFPI’s March 2022 presentation The New Hampshire Economy in 2021 and 2022 for details.

[2] For the Interim Final Rule and the Final Rule, see the U.S. Treasury Department’s Coronavirus State and Local Fiscal Recovery Funds web page. See also NHFPI’s May 2021 post Federal Guidance Details Uses of Flexible Aid for State and Local Governments.

[3] Based on the U.S. Census Bureau’s American Community Survey, using five-year data.