On March 31, the New Hampshire Senate passed HB 1696, which would reauthorize the New Hampshire Health Program through the end of 2018. The Senate’s action affirms the approval of the same bill by the House of Representatives on March 9 and sets the stage for Governor Hassan to sign the measure into law.

Created in 2014, the Health Protection Program provides access to affordable health care to low-income adults who would otherwise be ineligible for traditional Medicaid coverage or to receive federal subsidies to purchase a health plan through the New Hampshire Health Insurance Marketplace. As of February 28, the program served just over 49,000 Granite Staters, but, had the legislature failed to approve HB 1696, it would have expired at the end of this year.

The following provides a short summary of the key elements of HB 1696 and how they compare to current law, as well as a table presenting that same information.

Program Benefits and Delivery

At present, participants in the Health Protection Program generally receive health care coverage via commercial insurance plans they have selected through New Hampshire’s Health Insurance Marketplace. (The exception is those participants who are medically frail, who continue to be covered through the state’s traditional Medicaid program.) The state then uses federal funds to cover the costs of such plans. HB 1696 maintains this basic approach.

Cost Sharing

Under current law, individuals who participate in the Health Protection Program and who have incomes under 100 percent of federal poverty level (FPL) do not face premiums, deductibles, or co-payments. (For a single person, 100 percent of FPL amounts to nearly $11,800.)

However, participants with incomes between 100 and 138 percent of FPL (the latter being the maximum income at which one is eligible for the program or about $16,240 for a single person) do face deductibles and co-pays for some services. For example, at present, they must pay $3 for each visit to a primary care physician or $8 to see a specialist. The total amount of deductibles or co-pays a program participant incurs in a given year cannot exceed 5 percent of household income under federal law.

HB 1696 keeps in place the deductibles and co-pays that certain participants now face under current law and requires all program participants, regardless of income, to make an $8 co-pay for emergency room visits for non-emergency purposes, a charge that would rise to $25 for each subsequent non-emergency visit.

Work Requirements

Under current law, program participants who do not currently have a job are referred to the Department of Employment Security for assistance in finding employment.

HB 1696 requires program participants who do not have children, who meet the federal definition of “able-bodied,” and who are currently unemployed to engage in a combination of the following activities for at least 30 hours per week to be eligible for benefits:

- subsidized or unsubsidized employment;

- job training;

- job search;

- community service;

- some forms of education, and;

- the provision of child care services under select circumstances.

However, program participants who are temporarily disabled, participating in a state-certified drug court program, or providing medically necessary care to a dependent are exempt from such activities.

Importantly, HB 1696 makes the provisions instituting these work requirements “severable” from the rest of the bill. That is, if such requirements were found to violate federal law or if the Centers for Medicare and Medicaid Services were to reject New Hampshire’s plan to implement them, program participants would not have to meet them to receive health coverage and the Health Protection Program would remain in place through 2018.

Financing

The federal Affordable Care Act (ACA) provides funding to the states to expand their traditional Medicaid programs to serve low-income adults or, as New Hampshire has elected to do, to help such adults purchase private-sector health insurance. The ACA stipulates that the federal government will cover 100 percent of such benefit costs from 2014 through 2016; 95 percent of such costs in 2017; 94 percent in 2018; 93 percent in 2019; and 90 percent in 2020 and beyond. Thus, as the Health Protection Program was initially structured to last only through 2016, currently 100 percent of its benefit costs are federally funded.

Under HB 1696, New Hampshire will continue to receive federal funds, at the rates detailed above, to help cover the vast majority of the costs associated with the Health Protection Program. However, since HB 1696 extends the program beyond the period during which all benefit costs are matched by federal funds, some state costs for continuing the Health Protection Program will arise.

HB 1696, in turn, meets the state’s share of costs through a combination of:

- any additional Insurance Premium Tax revenue arising from the Health Protection Program, and;

- voluntary contributions from the Foundation for Healthy Communities and other charitable foundations as well as from health insurers operating in New Hampshire. More specifically, HB 1696 requires the New Hampshire Department of Health and Human Services to calculate an amount equal to (1) the net state share of the program costs for the Health Protection Program, after the application of federal funds and any additional Insurance Premium Tax revenue plus (2) any costs the Department faces for administering the Health Protection Program. HB 1696 stipulates that no more than 50 percent of that sum will come from health insurance companies operating in the state.

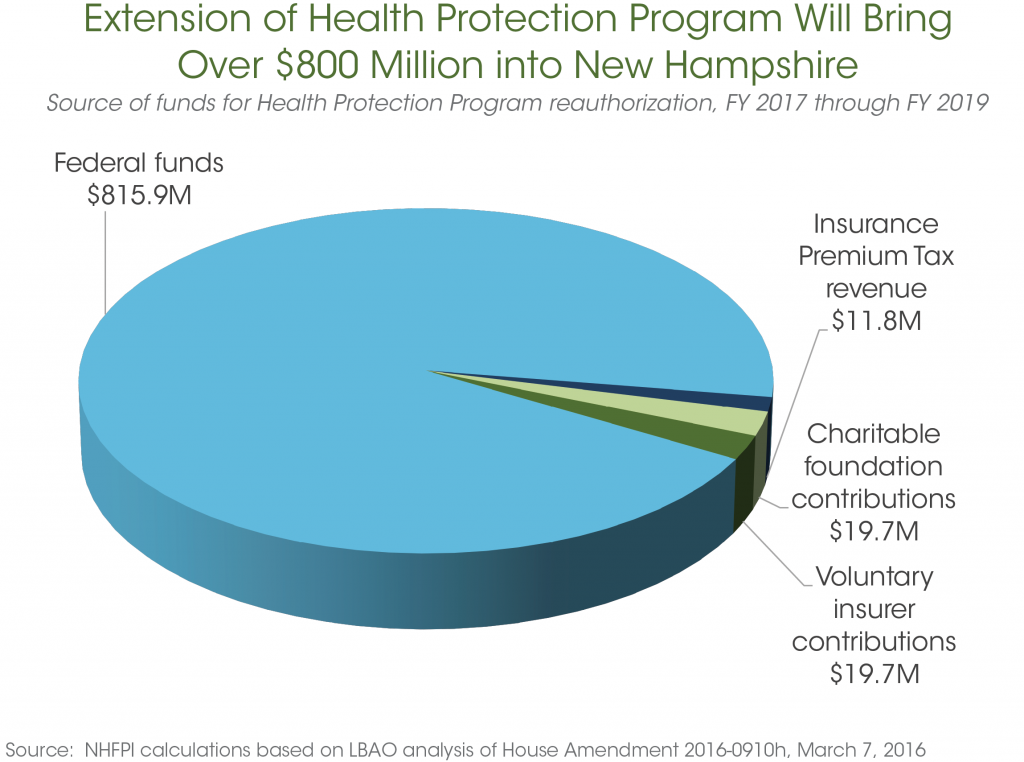

More specifically, as the graph below illustrates, the total cost for reauthorization is expected to amount to $867 million between FY 2017 and FY 2019. However, the vast majority of that sum – roughly $816 million – will be covered by federal funds. Insurance Premium Tax revenue attributable to the program’s reauthorization is projected to total close to $12 million, with voluntary contributions of nearly $19.7 million each anticipated from insurers and charitable foundations over this time frame.

“Circuit Breaker”

The legislation (SB 413) that originally created the Health Protection Program included provisions – which are often referred to as a “circuit breaker” – intended to ensure that New Hampshire would not face additional costs should the federal government reduce funding for states below the levels stipulated in the ACA. So, under current law, if federal funding for the Health Protection Program were to fall below the 100 percent match specified in the ACA for the 2014 through 2016 period, the program would be terminated. HB 1696 contains similar provisions: should the federal match rate fall below the levels noted above (95 percent in 2017 and 94 percent in 2018), the program would end within 180 days.

Program Termination

HB 1696 extends the Health Protection Program through December 31, 2018. However, in addition to the “circuit breaker” described above, the bill requires the Department of Health and Human Services to determine, on a quarterly basis, whether the combination of federal funds, additional Insurance Premium Tax revenue, and voluntary contributions are sufficient to meet program costs for the impending quarter; if they are not, the program would, again, be terminated within 180 days.

Evaluation Commission

HB 1696 creates a new commission to evaluate the effectiveness and the future of the Health Protection Program, particularly its use of federal dollars to help low-income adults purchase private-sector health care plans (an element of the program known as “premium assistance”). The commission would consist of fifteen members:

- three members of the House of Representatives (including one member of the minority party);

- three members of the Senate (including one member of the minority party);

- the Commissioner of the Department of Health and Human Services;

- the Commissioner of the Department of Insurance, and;

- seven members of the public, including:

- a representative of a private health insurer (appointed by the Senate President);

- a representative of a hospital within the state (appointed by the Speaker of the House);

- a private citizen (appointed by the Senate President);

- a current Health Protection Program participant (appointed by the Speaker of the House);

- a licensed physician (appointed by the Governor);

- a licensed mental health professional (appointed by the Governor), and;

- a masters level licensed alcohol and drug counselor (appointed by the Governor).

The Commission is charged with examining the program’s finances among other subjects. It is also tasked with evaluating options, other than general funds, for financing the continuation of the program beyond 2018 and, should the program continue, whether to maintain its current premium assistance approach or to return to the system of managed care that New Hampshire now employs in its traditional Medicaid program. The Commission will report its findings by the end of 2017.