Federal legislation in response to the employment impacts of the COVID-19 pandemic included broad expansions to unemployment insurance eligibility and benefits. This current expansion of unemployment compensation continues to support workers who are unable to find a suitable or safe job as the pandemic continues to threaten the health and well-being of many people. This expansion also supports the overall economic recovery, as prior research has shown the positive economic effects of unemployment compensation, and these additional benefits are spent in the local New Hampshire economy. The federal expansion of unemployment insurance benefits is currently set to end in September 2021 by the American Rescue Plan Act. However, more than 20 states, including New Hampshire, have announced that access to federally-expanded benefits would end earlier for their residents, along with other changes to benefits. Those groups most economically impacted by the pandemic, notably women, families with younger children, certain racial and ethnic minority groups, and workers in certain industries, have borne the most acute impacts in terms of their employment and earnings. The early discontinuation of federally-expanded unemployment benefits in New Hampshire may further limit these groups’ ability to recover and achieve economic stability, and may slow the overall economic recovery.

Uneven Employment Impacts of the COVID-19 Crisis

Both nationally and in New Hampshire, the COVID-19 crisis led to massive and uneven employment impacts throughout the economy. During April 2020, when some of the most severe economic effects of the pandemic occurred, unemployment in New Hampshire reached 16 percent, with the more rural counties of the state facing the highest levels of regional unemployment. In response to these impacts, state and federal changes to unemployment insurance expanded eligibility to workers who may not be traditionally eligible, including those who are self-employed or working part-time. Since the pandemic began, the number of initial claims for unemployment insurance in New Hampshire has been highest among certain service-based industries and areas of the economy that paid lower-than-average wages in the state. The latest data show that of the top five industries generating the most unemployment insurance claims from March 16, 2020 to March 20, 2021, four paid lower-than-average wages. This indicates that the employment and employment income losses in New Hampshire were most severe among workers earning lower wages.

Nationally, other data show that the employment impacts of the pandemic may have been more acutely felt by certain groups of individuals. Unemployment levels for Black or African American workers, Latino or Hispanic workers, and workers with lower levels of education rose to higher levels and remained elevated for longer than the national average. Levels of long-term unemployment, which is when an individual is unable to find a job for over 27 weeks, also continue to be elevated nationally in the most recent data. Additionally, parents with children, most notably women with younger school-aged children, faced the greatest employment burdens as schools and childcare centers closed for in-person attendance and have not fully reopened.

In New Hampshire, the COVID-19 crisis resulted in women making up 58.9 percent of all overall unemployment in April 2020, with more recent data showing a majority of unemployment continued to be among women. Analysis from a New Hampshire Department of Health and Human Services-commissioned report by Econsult Solutions Inc., titled Constraints on New Hampshire’s Workforce Recovery, found that women and parents with childcare duties are continuing to experience challenges in returning to work as the capacity for childcare remains below pre-pandemic levels. Notably, even pre-pandemic levels of childcare did not meet the levels of need in New Hampshire, with only 60 percent of identified needs met.

Lingering Challenges Facing Granite Staters and the Economy

Since mid-2020, many economic indicators have improved from their most severe levels. Unemployment has been trending downward, as has the number of individuals initially applying for, or continuing to receive, unemployment compensation in New Hampshire. The most recent estimate of seasonally-adjusted state level unemployment is 2.8 percent for April 2021, having returned to pre-pandemic levels. The most recent data from early May in New Hampshire show that levels of initial weekly claims for unemployment continued along a downward trajectory as the economy recovers and more individuals are able to safely return to work.

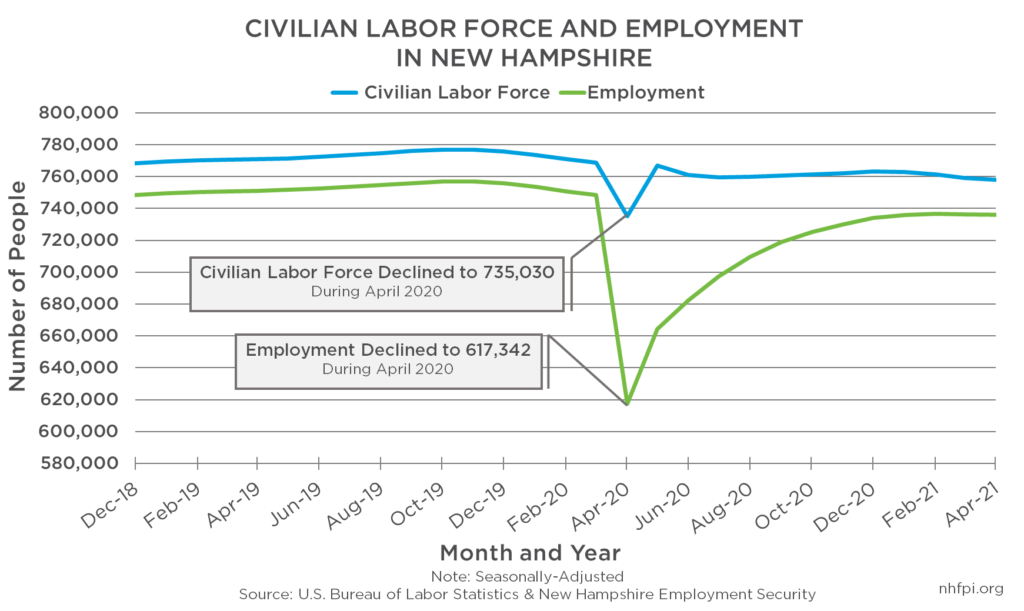

However, despite the unemployment rate estimate declining and returning to pre-pandemic levels, other key labor market indicators have yet to recover, partly due to the uneven nature of the impacts of this economic crisis. Overall, the labor force is also below pre-pandemic levels; the seasonally-adjusted April 2021 labor force in New Hampshire is estimated at about 11,500 fewer individuals than March 2020 levels, which were measured in the middle of the month and represented the period of just before the pandemic’s employment impacts in the state. The labor force measures all individuals over the age of 16 who are classified as employed or unemployed, meaning they either have a job, or do not have a job and are available to work and have searched for work in the last four weeks. The decline in the labor force in New Hampshire throughout the pandemic indicates that fewer individuals were employed or searching actively for work while unemployed. This most recent data from April 2021 show that there continue to be individuals detached from the labor force, and research suggests this may be due to childcare constraints and health risks of the virus. Notably, the trajectory of labor force indicators have not been completely positive, as from February 2021 to March 2021 the labor force declined by nearly an estimated 2,000 individuals, and from March 2021 to April 2021 it declined further by nearly 2,000 more individuals in New Hampshire.

Overall employment levels are also below pre-pandemic levels. More than 12,000 fewer New Hampshire residents had jobs in April 2021 than did in March 2020, or just before the pandemic’s employment impacts in the state, despite the recovery thus far. While there have been significant employment gains since the crisis’s nadir, additional research from Harvard and Brown Universities shows that the numbers of lower- and middle-wage jobs in the state are still below pre-pandemic levels, while higher-earning jobs recovered quickly and have actually increased in number since the pandemic began.

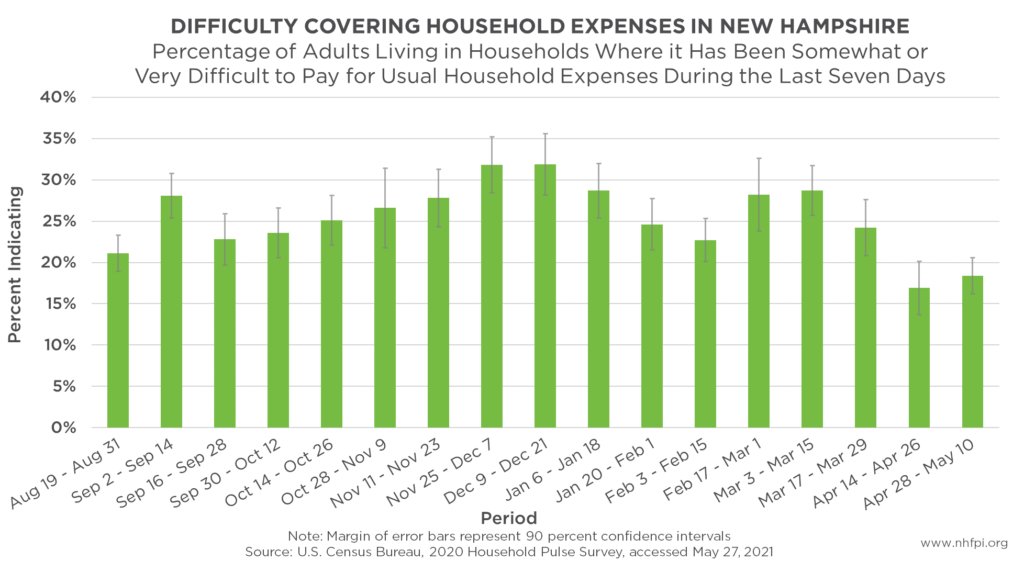

These factors, along with the continued lingering challenges identified by U.S. Census Bureau’s Household Pulse Survey data indicate that, while the unemployment rate has recovered, many individuals and families continue to face economic challenges. The survey indicated that nearly half of New Hampshire adults reported a loss of household employment income between March and July 2020. Additionally, at the end of 2020, about one in four households expected future employment income losses, and about one in three reported difficulty paying for usual expenses in New Hampshire. The Household Pulse Survey also estimated that from August 2020 to May 2021, between one in three and one in six households in New Hampshire indicated it had been somewhat or very difficult to afford usual household expenses in the last seven days. Individuals with childcare duties, notably women with younger and school-aged children, and groups most impacted by the health and economic challenges of the pandemic have the greatest need for continued support.

The Early End of Federal Unemployment Insurance Benefits

Expanded unemployment insurance benefits provide support for individuals facing challenges in finding employment or returning to the workforce as a result of the pandemic. These benefits also stimulate local economies and aid in spurring an overall economic recovery. Several programs have been implemented, extended, and modified throughout the pandemic. Currently, Federal Pandemic Unemployment Compensation (FPUC), Pandemic Unemployment Assistance (PUA), and Pandemic Emergency Unemployment Compensation (PEUC) are the major temporary federal provisions helping ensure that Granite Staters in need of unemployment aid can receive it. These provisions allow for extended benefits, expand eligibility to include individuals not traditionally eligible for unemployment insurance such as self-employed workers, and provide additional benefits of $300 per week. Despite the lingering impacts to the labor force, and challenges in returning to work for certain groups, on June 19, 2021 the state will end these federally-expanded unemployment programs. This end date is ahead of the original September 2021 timeline. Additionally, the State has reinstated the pre-pandemic work search requirement effective May 23, 2021 and has instituted a bonus system where workers who find work and remain employed for eight weeks can receive $500 or $1,000.

The extended and expanded benefits have been integral in the recovery thus far and may be having a larger multiplier effect in terms of their impacts to the overall economic recovery. Looking to the recovery from the last recession provides insights on the impacts of expanded unemployment benefits. Analysis from Moody’s Analytics from early 2009 found that every federal dollar invested into new unemployment insurance benefits generate $1.61 in economic activity. Additionally, Moody’s found that in 2015, when the economy was significantly stronger and much further along in the recovery, each additional federal dollar invested in unemployment benefits generated $1.01 in economic activity. This signifies that the expansion of unemployment insurance benefits the overall economy both while supporting those in need during a recession and further along in the economic recovery as well.

Looking Ahead

Certain individuals continue to face challenges in their ability to return to work or find suitable and safe work. Groups that have been most impacted by the pandemic’s economic effects, and those who are facing additional responsibilities for childcare, are able to receive support through the broad federal expansions to unemployment insurance eligibility and benefits. While the state unemployment rate has recovered, there are significantly fewer people in the labor force as of April 2021, an indication that some Granite Staters may have been unable to search for work due to the continued impacts of the pandemic and have relied on these federally-expanded benefits to help make ends meet. In addition to the direct support these benefits provide, the potential overall economic benefits for the recovery are also significant. Despite these factors, the State of New Hampshire has announced these extended and expanded benefits will end June 19, 2021, ahead of the federally-set September 2021 end date. The groups continuing to experience economic and employment hardships due to the pandemic may face additional challenges as a result of the early termination of these federally extended and expanded unemployment benefits. Additional targeted investments may be needed to help ensure the ongoing economic recovery is sustainable and reaches all Granite Staters equitably.

– Michael Polizzotti, Policy Analyst