Since the inception of the New Hampshire lottery in 1964, the first of its kind among the states, its profits have gone to school districts in New Hampshire as required by the State Constitution. Over time, the lottery has brought in an increasing amount of revenue for the State and has become more important for funding public schools.

Lottery Growth in Dollars

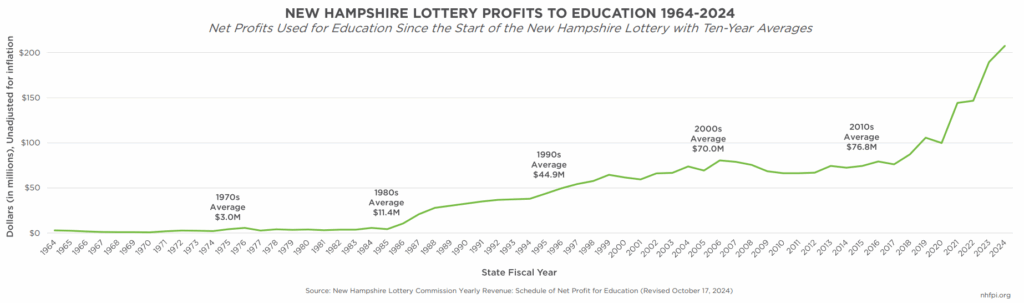

Lottery profit growth has made the State lottery an important source of education funding. In dollars, lottery profits were relatively small (between about $836,000 and $5.7 million) until the late 1980s, when they began to rise. They continued to trend upward through the 2000s and early 2010s, when they stagnated between $59 and $80 million each year. Especially since 2019, New Hampshire has experienced a significant increase in yearly lottery profit, exceeding $207 million in State Fiscal Year 2024.

Not all lottery revenue is used directly for education, as the Lottery Commission is self-funded and must pay administrative costs and prize payouts from its revenues. The percentage of total lottery revenue transferred to education from 1964 to 2024 is 29.2 percent, though this proportion was higher in the earlier years of the lottery, ranging between 35.1 percent to 54.5 percent during the first decade.

Lottery Revenue as a Share of Education Expenditures

In 2000, New Hampshire created the Education Trust Fund (ETF). The Lottery Commission transfers its profits to that fund. Until 2019, lottery transfers comprised between six and 10 percent of actual education expenditures from the ETF. Since 2019, there has been an uptick, with the proportion exceeding 10 percent every year except 2020, and in the last two years, reaching almost 17 percent.

Policy Implications

Reliance on lottery funds to support K-12 education in the state can create some uncertainty for budgeting. Lottery is a relatively volatile revenue source because it is sensitive to changes in consumer preferences. Lottery is also associated with gambling addiction. If lottery consumers choose to stop spending money on gambling, which is not mandatory like property taxes, there may be fewer funds available for education.

Legalized gambling also disproportionally impacts people with low and moderate incomes, because resources spent playing the lottery may account for a higher percentage of income for individuals in lower-earning households. The differences are even greater because participation is either similar or higher among people with lower incomes. Although the lottery is voluntary, participation is correlated with financial illiteracy, introducing equity concerns.

Lottery profits are approaching one-fifth of ETF expenditures. The recently passed biennial budget expands State-sponsored gambling through video lottery terminals. As the lottery becomes more important for funding New Hampshire’s schools, so do conversations about its strengths and weaknesses as a revenue source.