Under current law, the New Hampshire Health Protection Program, which provides 47,000 people across the state with access to affordable health insurance, will be terminated at the end of 2016 in the absence of legislative action. Should the program be allowed to expire, not only would thousands of hard-working Granite Staters find it impossible to pay for health care coverage, but the state would forego the hundreds of millions of dollars in federal matching funds that the program now attracts.

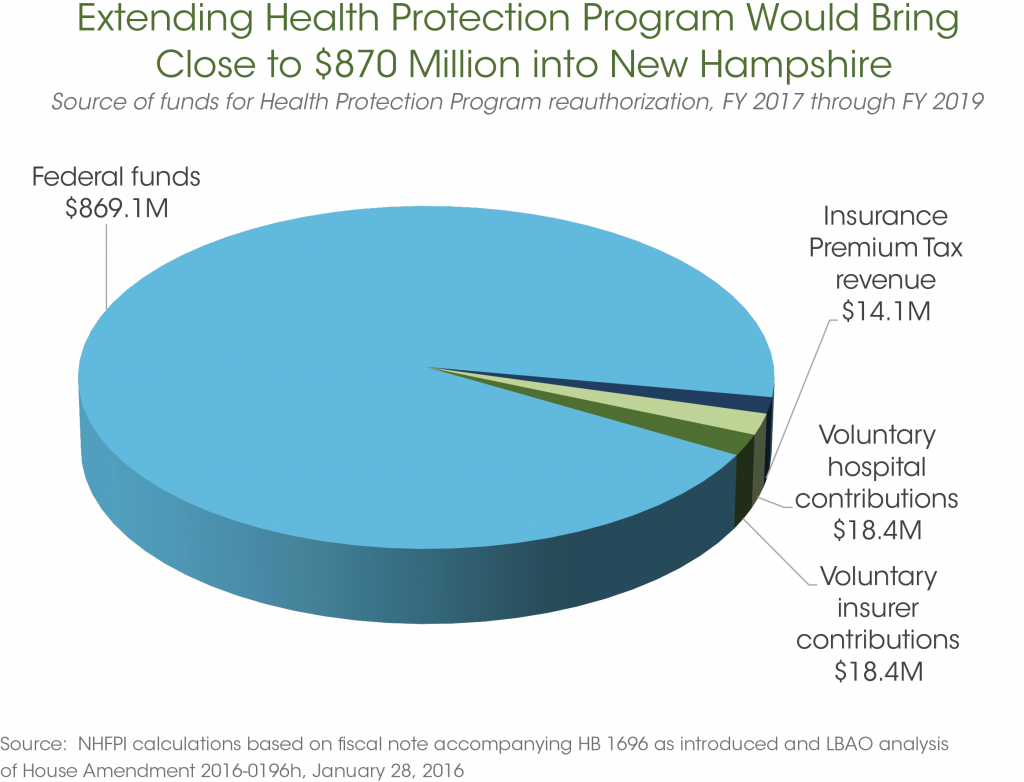

Legislation – an amended version of HB 1696 — now before the House Committee on Health, Human Services, and Elderly Affairs would extend the Health Protection Program through the end of 2018 and thus forestall such outcomes. Indeed, analyses conducted by the Office of the Legislative Budget Assistant (LBA) of the underlying bill and the proposed amendment suggest that their enactment would bring $869.1 million in federal funds into the New Hampshire economy between FY 2017 and FY 2019. Moreover, the LBA’s analyses reveal that, while the state would incur approximately $50 million in costs to extend the Health Protection Program through 2018, such costs would be covered by $14.1 million in additional Insurance Premium Tax revenue, as well as by voluntary contributions totaling $18.4 million each from the state’s hospitals and from insurance companies operating in New Hampshire.

More specifically, based on the fiscal note accompanying the original version of HB 1696, the New Hampshire Department of Health and Human Services anticipates that the gross benefit costs for extending the Health Protection Program from the end of 2016 until the end of 2018 would amount to $208.3 million in FY 2017, $458.9 million in FY 2018, and $252.7 million in FY 2019.[i] In turn, the amendment to HB 1696 offered on January 28 by the bill’s chief sponsors, Representative Joe Lachance and Senator Jeb Bradley, stipulates that such costs would be met via the following means:

- Federal funds – Under the Affordable Care Act, the federal government is responsible for the vast majority of the benefit costs associated with the Health Protection Program. In particular, 95 percent of those costs would be paid by federal aid in calendar year 2017, 94 percent in 2018, and 93 percent in 2019. These matching rates would translate into $197.9 million worth of federal funds for the latter half of FY 2017, $433.7 million in FY 2018, and $237.5 million in FY 2019, should HB 1696 and its accompanying amendment be enacted into law.

- Additional Insurance Premium Tax revenue – New Hampshire currently levies an Insurance Premium Tax on licensed insurance companies based on the amount of premiums written in the state. Consequently, by extending health care coverage to tens of thousands of Granite Staters, the Health Protection Program ensures that the Insurance Premium Tax yields more revenue than would otherwise be the case. The proposed amendment to HB 1696 mandates that any increase in Insurance Premium Tax revenue attributable to the Health Protection Program be allocated towards defraying program costs. The New Hampshire Department of Insurance projects that $9.2 million will be available in FY 2018 due to this effect and that $4.9 million will accrue in FY 2019.

- Voluntary contributions from hospitals and insurers — The amendment would require the New Hampshire Department of Health and Human Services to calculate the net state share of the costs for the Health Protection Program, after the application of federal funds and any additional Insurance Premium Tax revenue. Under the terms of the amendment, 50 percent of that net share would come from voluntary contributions from acute care hospitals and 50 percent would come from health insurance companies operating in the state. LBA estimates that such contributions would total $5.2 million from each set of entities in FY 2017, $8.0 million each in FY 2018, and $5.2 million each in FY 2019.

______

[i] Costs for FY 2017 represent the costs for extending the program beyond its currently scheduled expiration date of December 31, 2016; similarly, costs for FY 2019 are significantly lower as the end of calendar year 2018 falls halfway through that fiscal year. Further, these estimates do not include any administrative costs the Department may incur in administering the program.