New Hampshire revenue collections for the month of October continued to rely primarily on interest from State cash holdings to generate a surplus relative to the State Budget’s targeted amount for the month. Key State revenue sources, including combined business taxes and the Meals and Rentals Tax, fell short of their monthly targets, while others aligned with or exceeded the planned amounts for the month.

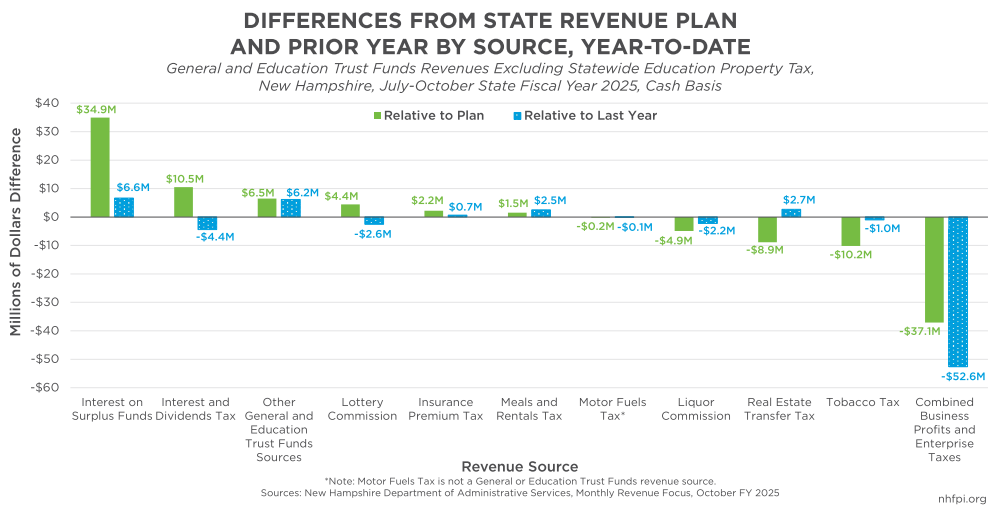

According to new State data, the General Fund and Education Trust Fund brought in a combined $164.1 million in revenue for October, the fourth month of State Fiscal Year (SFY) 2025 after it began in July. This amount was $19.0 million (13.1 percent) above the monthly target given in the State Revenue Plan, which is generated from projections incorporated into the State Budget. Following trends from prior months, revenue during October benefited primarily from interest generated from State cash holdings, which was a key driver of the month’s surplus. Interest paid to the State for cash holdings has totaled $42.9 million thus far for SFY 2025, with $9.3 million collected in October alone. State cash holdings have been mainly impacted by increased interest rates nationwide since 2022, combined with significant State cash reserves, including from one-time federal grants.

Revenue generated through the Lottery Commission was a large contributor to October’s overall surplus relative to the State Revenue Plan. These revenues, which flow solely to the Education Trust Fund, were $6.7 million above plan for the month and $4.4 million above plan for SFY 2025 thus far, demonstrating a better performance in October compared to the prior two months.

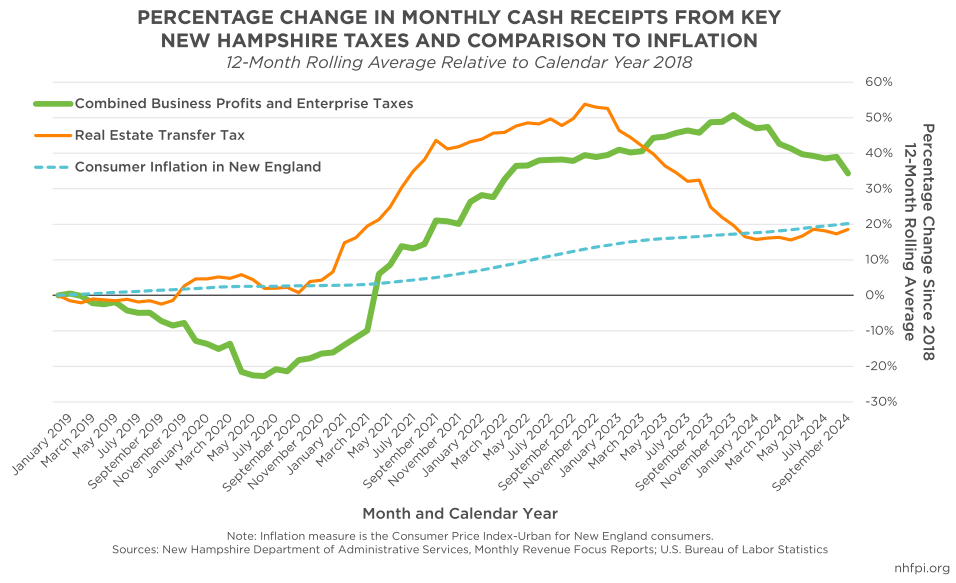

While not contributing as much to October’s surplus as Lottery Commission revenue did, revenue generated from the Real Estate Transfer Tax (RETT) exceeded the State Revenue Plan for the first time since April 2023; the $20.1 million collected from this tax in October was $1.2 million (6.3 percent) above plan for the month and up $2.8 million (16.2 percent) from October 2023. Due to less favorable receipts in prior months, however, RETT revenue remained $8.9 million (10.7 percent) below plan for SFY 2025 as of the end of October. Revenue generated from the RETT is largely driven by single-family house sales, which have been impacted by the state’s ongoing housing shortage and rising prices. Revenue growth generated from the RETT has declined since its peak in October 2022, after growing substantially between SFY 2019 and SFY 2022. The decline in RETT may have stopped, potentially as rising house prices have offset reduced sale volumes.

Elevated interest rates and stock market performance have also contributed to larger amounts of revenue generated by the State’s Interest and Dividends Tax, which taxes income derived from wealth, including interest from savings and shares from stocks or business ownership. Collections from the Interest and Dividends Tax were above plan by $0.4 million (7.7 percent) for the month of October and $10.5 million (50.0 percent) above plan for the year, bringing in a total of $31.5 million in revenue for SFY 2025 thus far. While this tax has continued to generate more revenue than last year, it is only a temporary source of revenue surplus, as the Interest and Dividends Tax is scheduled to be repealed in 2025.

Combined business tax revenue, encompassing both the Business Profits Tax and Business Enterprise Tax, continued to fall just under target amounts in October, slipping $0.9 million (2.7 percent) below plan for the month and ending October at $37.1 million (12.0 percent) below plan for SFY 2025 thus far. Underperformance in September generated most of this shortfall relative to the State Revenue Plan. Despite continuing to run under planned levels, combined business taxes generated $32.6 million in revenue for the month, and remained the largest contributor to the State’s total combined revenue collected in the General and Education Trust Funds. While October is not a crucial month for business taxes, the next quarterly estimate payments collection for businesses in December will provide more insight into whether business tax receipts may fall short of planned amounts for the year.

Other key sources of State revenue also show underperformance for October. Despite bringing in the second largest sum of revenue for the month, collections from the Meals and Rentals Tax fell below plan by $0.9 million (3.0 percent). Although October’s collections were slightly below the target, collections from this tax remained $1.5 million (1.2 percent) above plan for SFY 2025 thus far. Revenue from the Tobacco Tax, which has been in a long-term decline, also fell below the monthly target by $0.1 million (0.5 percent) in October, and were $10.2 million (13.3 percent) behind plan for SFY 2025 through the end of last month. Revenue generated from the Liquor Commission fell $1.7 million (13.2 percent) behind planned amounts for the month, and were $4.9 million (11.5 percent) behind plan for SFY 2025.

While October is still early in the State Fiscal Year, ongoing trends from previous months suggest that the State may face future challenges with its revenue streams. Despite likely being a temporary revenue source, interest on State cash holdings continues to serve as the primary driver of revenue growth. In addition, ongoing underperformance of revenue generated from the State’s two primary business taxes, paired with the forthcoming repeal of the Interest and Dividends Tax that primarily benefits households with higher incomes, will likely require expenditure reductions to avoid budget deficits in SFY 2026. As the State nears the next phase of developing the new State Budget, the performance of key revenue streams during the coming months will provide insight into potential difficulties facing policymakers during the State Budget process.

– Jessica Williams, Policy Analyst