Lawmakers seeking to pass bills that require spending will be watching the surplus carefully next session. Any bills that call for spending money during the 2018 Legislative Session require either more revenue to come in than expected under the current State Budget or a new revenue source to be established. November’s tax revenue receipts gave legislators reason to be optimistic, but the surplus may disappear if receipts from subsequent months fall lower than planned. December is a key month for business tax revenues, for example, and a small percentage change in collections may erase all of November’s gains or add to them. State policymakers may also face challenges from unexpected needs or Keno revenue shortfalls, which would hamper the State’s ability to pay its obligations to subsidize full-day kindergarten.

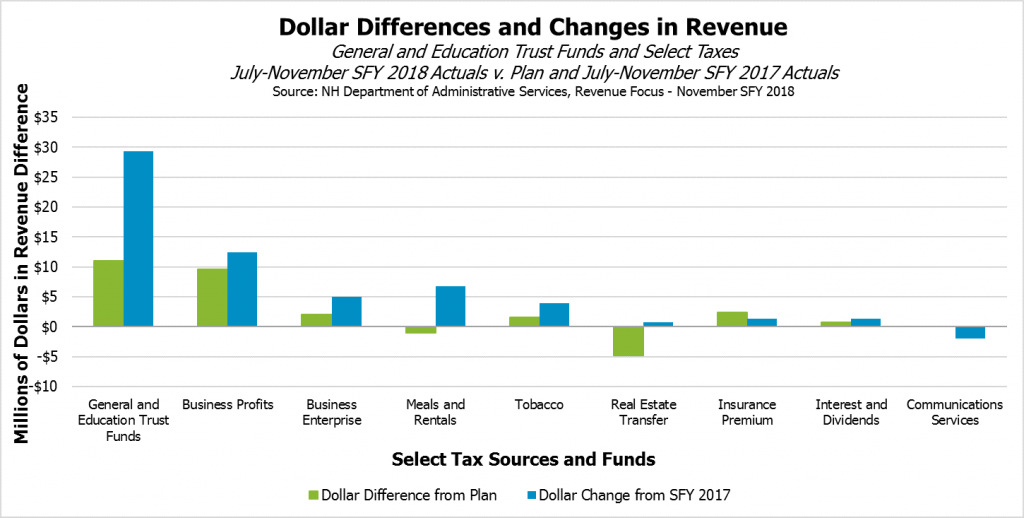

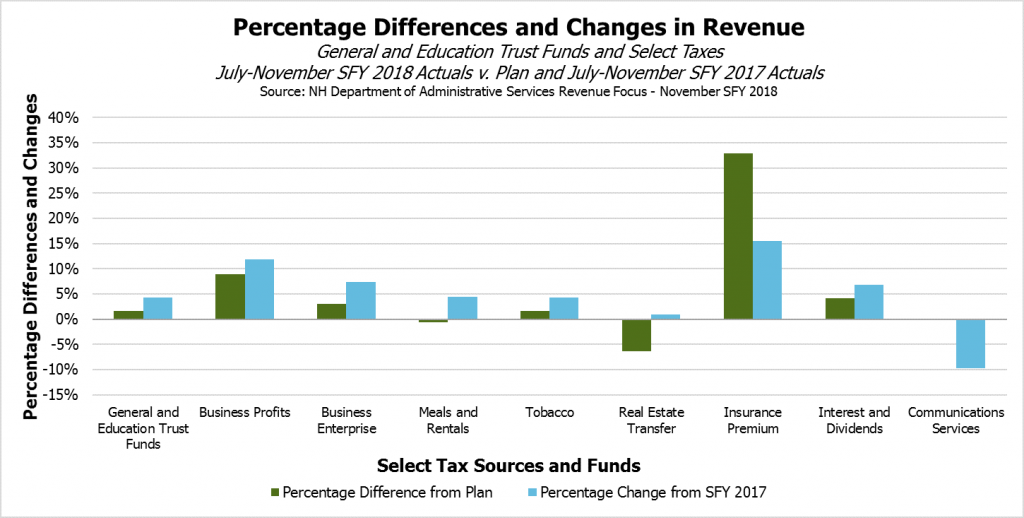

Revenue collected during November for New Hampshire’s General and Education Trust Funds exceeded planned receipts by $5.5 million (5.4 percent), buoyed by lower business tax refunds than last November but reduced due to lower than anticipated Real Estate Transfer Tax receipts, which were $1.4 million (9.7 percent) below plan and only slightly above this month last year. So far in State fiscal year (SFY) 2018, which began July 1, the General and Education Trust Funds have a cash surplus of $11.0 million (1.6 percent) above plan.

The two primary business taxes together are $11.7 million (6.6 percent) above plan, with the Business Profits Tax outperforming the Business Enterprise Tax relative to both last year’s receipts to date and this year’s State revenue plan.

However, two key tax sources, the Meals and Rentals Tax and the Real Estate Transfer Tax, continue to perform under plan. The Real Estate Transfer Tax has brought in only $0.7 million (1.0 percent) more revenue than it did from July to November of SFY 2017, although the sales data from October (which provides November revenues) show the number of transactions up from last year while prices remained essentially the same; this is the reverse of trends in recent months toward higher prices and lower sales volumes resulting from a housing market with low supply.

The Insurance Premium Tax is well above plan in percentage terms (32.9 percent), but this performance has provided only $2.4 million in cash surplus dollars through November 30. Early payments from the Utility Property Tax also boosted the Education Trust Fund in November, although those receipts may lead to a reduced total for next month. The Tobacco Tax underperformed in November, but remains above plan and year-to-date relative to SFY 2017. Revenues from the Communications Services Tax remain on target (albeit well below last year’s revenues), and revenue from the Lottery Commission is up $2.5 million (9.7 percent) relative to plan while Liquor Commission revenue is down $0.7 million (1.1 percent).

For more information on State revenue collections, see NHFPI’s Revenue in Review resource.