The Low and Moderate Income Homeowners Property Tax Relief program is a rebate program operated by the State of New Hampshire’s Department of Revenue Administration that provides a relatively small amount of property tax relief to homeowners with limited incomes. Applicants have until June 30, 2019 to apply for a rebate, and may find the required forms on the Department of Revenue Administration’s website.

Eligible homeowners must earn $20,000 per year or less for a single homeowner or $40,000 per year or less if a person is married or a head of a household. The rebate is based on the assessed value of the property, with a cap in the calculation limiting consideration to the first $100,000 of estimated property value. The rebate is higher for those with lower incomes, based on different income brackets ranging from less than $12,500 for a single person up to a $35,000 to $40,000 bracket for a married person or head of a household. These dollar figures are not adjusted for inflation, and were first written into law in 2001. There are bills that were considered both in the House and the Senate during the 2019 Legislative Session to update these figures, but both have been tabled or rereferred after passing their originating chamber.

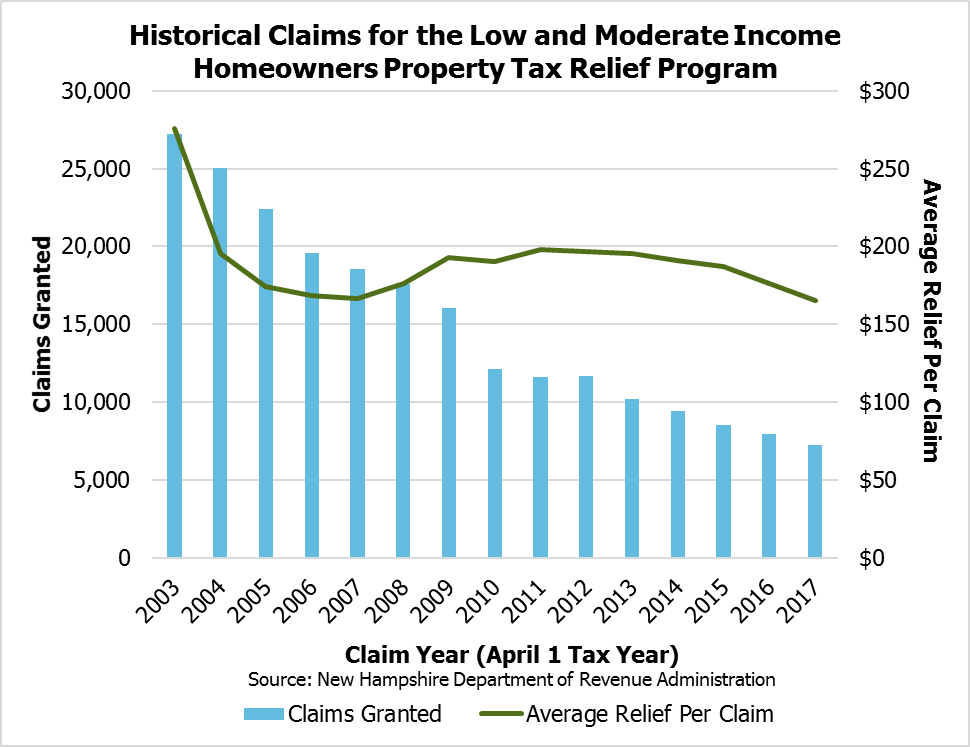

The average rebate is relatively small compared to the overall amount of property taxes paid per capita in New Hampshire, and program use has been decreasing even as the inflation-adjusted aggregate amount levied by property taxes statewide has been increasing. The estimated amount of property tax revenue collected in New Hampshire during 2016, based on a survey of state and local governments conducted by the U.S. Census Bureau, was about $3,000 per capita, including people who do not own homes and for each member of a family who might be living in a home. The average amount of property tax relief provided through the Low and Moderate Income Homeowners Property Tax Relief program was approximately $170 in both 2016 and 2017, based on historical claims data from the Department of Revenue Administration.

The program provides a rebate relative to the homeowner’s liability under the Statewide Education Property Tax, which accounts for about 10 percent of all property taxes paid to the State and to local governments in New Hampshire combined. Most property taxes are paid to local governments, such as counties, municipalities, and school districts, which have very limited options for collecting tax revenue other than the property tax.

For more information on the sources through which the State raises revenue, see NHFPI’s Revenue in Review resource.