New analyses of the elimination of New Hampshire’s Interest and Dividends Tax show that the reduction in tax revenue disproportionately benefits individuals and households with high incomes while significantly reducing revenues available for public services.

Revenue projections included in the Governor’s budget proposal and estimates from the New Hampshire Department of Revenue Administration (DRA) suggest revenues will fall substantially during the upcoming budget biennium, as the planned phaseout of the Interest and Dividends Tax begins to take effect. Starting in 2023, the tax rate is reduced by one percentage point every year until the tax is eliminated completely in 2027.

Other information published by the DRA shows that more than half of the tax revenue was paid by households with more than $200,000 in interest, dividend, and distribution income in Tax Year 2020, which does not include income from wages, salaries, capital gains, or other income sources. For an individual filer to generate this $200,000 amount of income taxable under the Interest and Dividends Tax, rates of return ranging from the 1.51 percent average S&P 500 stock dividend yield in 2020 to a more robust 5 percent annual return rate suggest the wealth required would range from $4 million to $13.4 million (see Asset Ownership table below). New economic modeling also indicates that more than nine of out every ten forgone tax dollars would benefit the top 20 percent of households by income, and more than half of the tax reduction would benefit the top 1 percent of households.

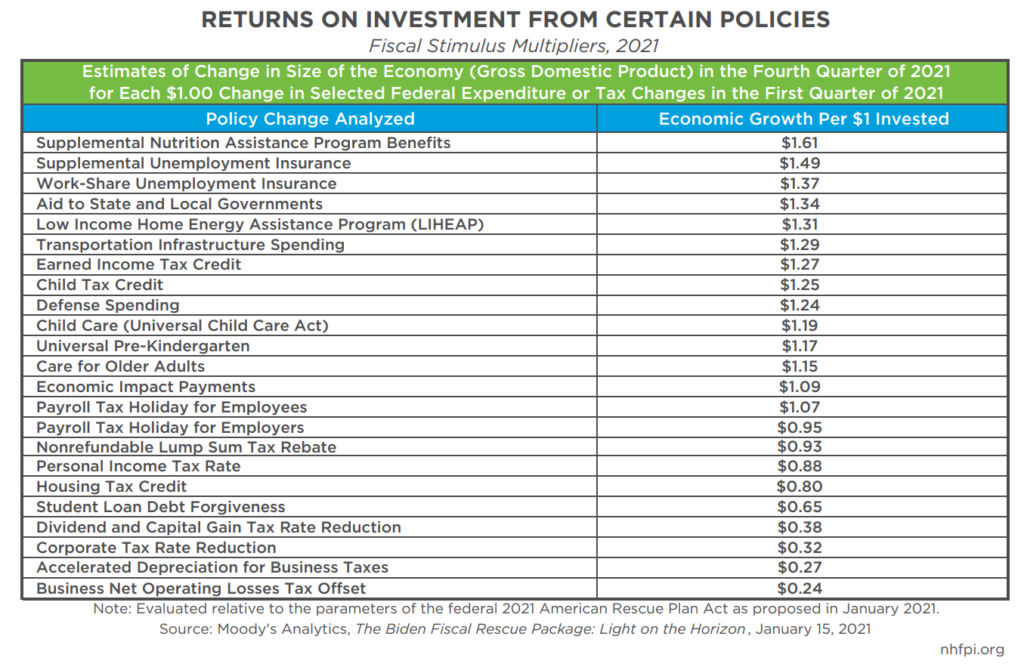

Both public and private sector national economic modeling suggests that tax reductions to high income households, including reductions in dividends and capital gains taxes, are relatively ineffective economic stimulus compared to food assistance, aid to individuals who have become unemployed, and income supports for individuals with low and moderate incomes.

Taxing Income Generated by Wealth

The Interest and Dividends Tax is a 4 percent tax on income earned by individuals and specific types of business entities from the ownership of certain assets. Established in 1923, the Interest and Dividends Tax had a tax rate of 5 percent from 1977 to 2022, dropping to 4 percent in 2023 as part of an eventual phaseout plan enacted in the current State Budget. Due to the delayed phaseout, most of the revenue losses will not appear until the next State Budget, and will continue and grow larger with each reduction in the tax rate.

The income taxable under the Interest and Dividends Tax stems primarily from distributions, which are a transfer of property from an organization to the shareholders or interest-only holders as a result of their ownership interest, and from dividends, which are distributed to shareholders or other interest-holders in an organization based on profits. Dividends paid by corporations, mutual funds, partnerships, limited liability companies, and associations under certain circumstances are taxable. Interest, such as income generated by holding money in accounts at banks, is also taxable under the Interest and Dividends Tax, but has accounted for a relatively small share of reported income under this tax in recent years. Taxable income under the Interest and Dividends Tax does not include income from Individual Retirement Accounts, federally-defined employee benefit plans from employers, certain bonds, capital gains, stock dividends paid in the form of new stock, tax-deferred investment plans, certain mutual fund arrangements, or certain college tuition savings plans.

At a fundamental level, to be required to pay Interest and Dividends Tax, an individual, household, estate, or partnership must have wealth that generates sufficient income without labor and without selling an asset. For example, the stock market’s performance can help policymakers project how much revenue this tax may generate, as dividends and distributions often flow to stock owners. That income is generated from asset ownership. While partnerships and estates may have to pay Interest and Dividends Tax in certain circumstances, 97.5 percent of the 68,664 filers in Tax Year 2020 were individuals or joint filers.

The levels of income generated passively from owning these assets must meet certain filing thresholds to be taxable under New Hampshire law. An individual must collect at least $2,400 in these forms of income generated from assets, or $4,800 for joint filers in a household, to have to file for the Interest and Dividends Tax. The first $2,400 of this income is also exempt from taxation for Interest and Dividends Tax filers, with additional exemptions of $1,200 for adults aged 65 years and older, who are blind, or who are younger than 65 years but have a disability that makes them unable to work. For example, if an individual filer who is 67 years old owns $1,500,000 worth of stock and receives $75,000 in dividend payments from their investments in 2023, that $75,000 would be taxable under the current law at 4 percent. However, that $75,000 is reduced to is $72,600 by the $2,400 exemption, and then an additional $1,200 due to the exemption for taxpayers 65 years of age or older reduces the taxable income to $71,400. The total tax liability would be then 4 percent of that total, or $2,856.

These limitations on taxable income under the Interest and Dividends Tax result in a relatively small percentage of Granite Staters paying this tax. While many households may have some interest income from savings accounts, or income from retirement accounts, both the filing thresholds and exemptions mean most households do not pay State taxes on those forms of income. The total of 68,664 tax filers in Tax Year 2020 is the equivalent of 9.4 percent of the 727,340 federal income tax filers in New Hampshire that year; these figures count a couple filing jointly as a single filer. Translating the number of filers into individuals, economic modeling from the Institute on Taxation and Economic Policy suggests that about 179,000 individuals, including 132,900 adults filing as individuals or a couple, will pay or be in a family that pays Interest and Dividends Tax for 2023. With a state population of 1,377,529 individuals in the 2020 Census count, the estimated 179,000 directly affected by this tax represents about 13.0 percent of Granite Staters.

Available Data on Tax Filers

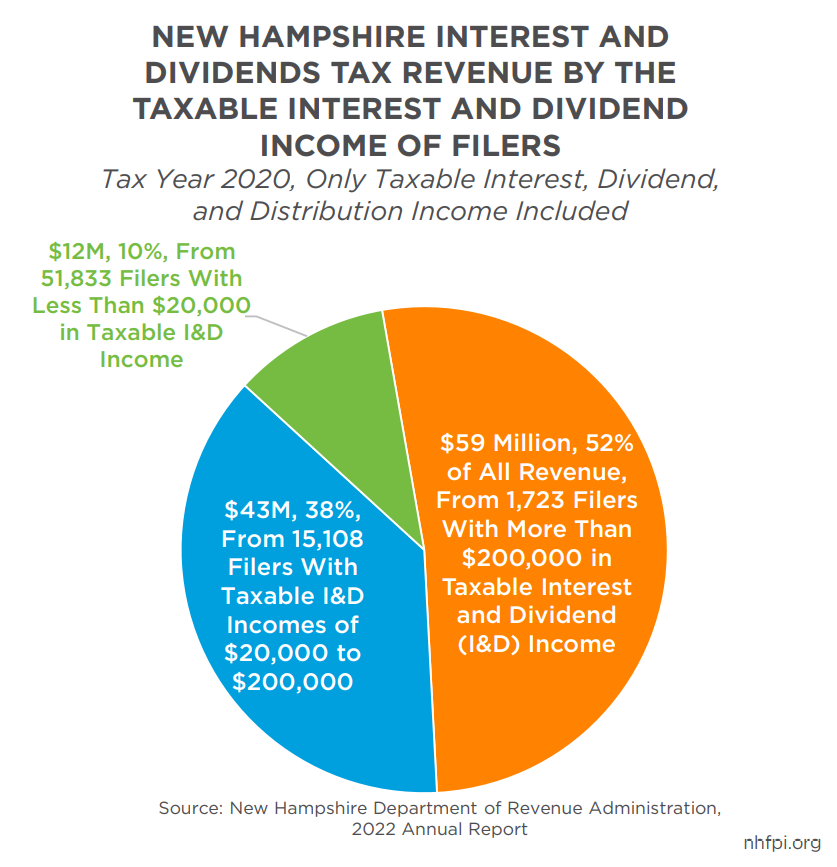

The DRA’s published data show that more than half of the tax revenue during Tax Year 2020 was paid by households with taxable interest, dividend, and distribution income of at least $200,000. Compared to a statewide median household income from salary, wages, and other sources of about $88,500 in 2021, these households with more than $200,000 in taxable interest, dividend, and distribution had well above the resources available to most Granite Staters without counting any wage, salary, or capital gains income.

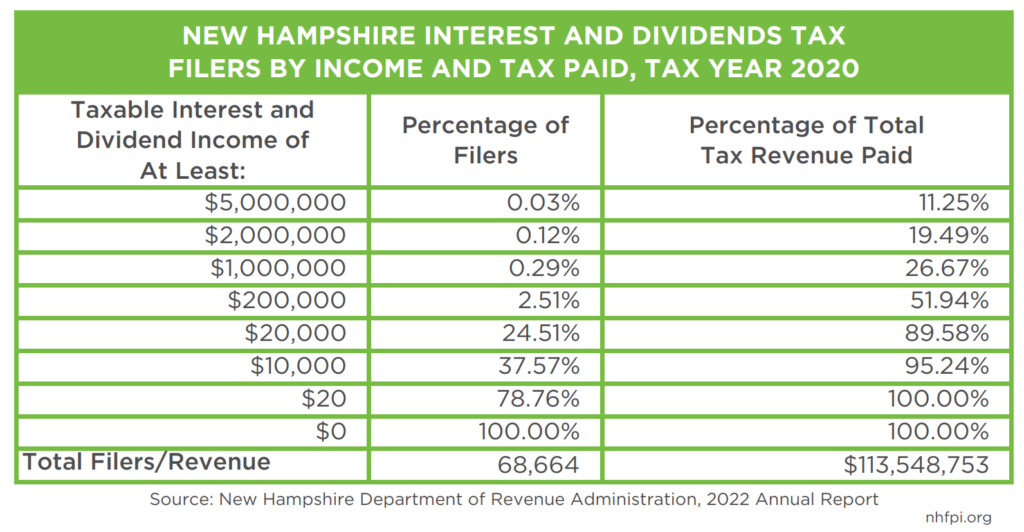

The DRA reported the Interest and Dividends Tax collected $113.5 million in Tax Year 2020. Of that total, 1,723 taxpayers, or 2.5 percent of all filers, paid $59.0 million (52 percent) of the total tax revenue collected. These were taxpayers who collected more than $200,000 in income from interest, dividends, and distributions without any income from paid labor or from selling assets. Within this group, the 20 filers (0.03 percent of filers) with the largest payments, or those with more than $5 million of taxable income from interest, dividends, and distributions alone, paid $12.8 million (11.3 percent) of the total tax revenue; the next 61 filers (0.09 percent of filers), with interest, dividend, and distribution incomes between $2 million and $5 million in Tax Year 2020, paid another $9.4 million (8.2 percent) of the Interest and Dividends Tax revenue collected. The remaining 97.5 percent of filers, outside of this group of high-wealth individuals and households, paid about 48 percent of the revenue collected by the Interest and Dividends Tax.

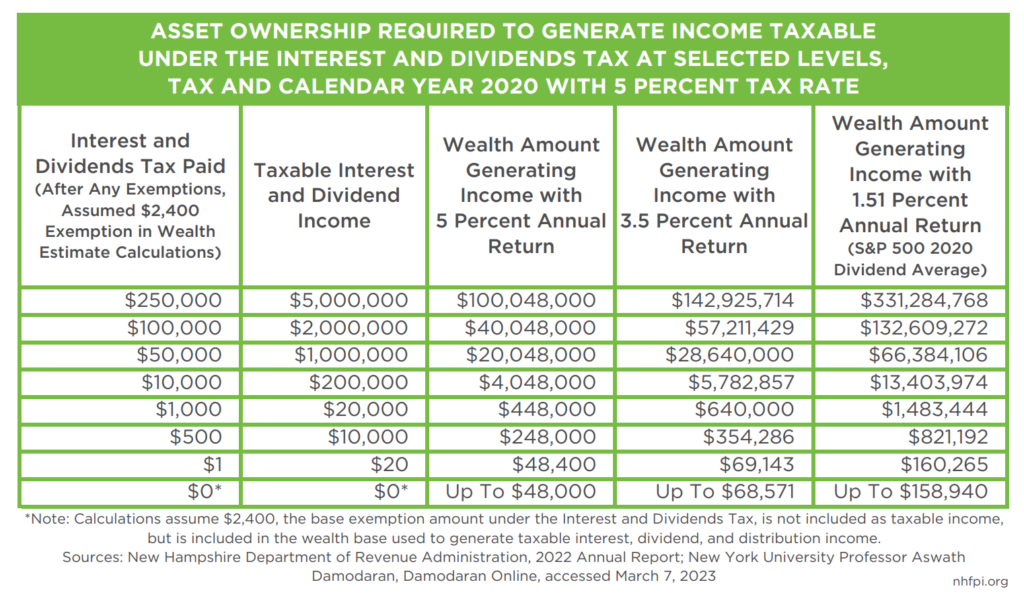

Generating large incomes from interest, dividends, and distribution income taxable under the Interest and Dividends Tax requires a substantial amount of wealth. An individual or family receiving more than $200,000 in taxable dividend income, for example, might be earning a relatively strong dividend yield of 5 percent annually, which means the underlying dividend-paying assets owned by that individual or family generating that income would be at least $4 million. A more modest dividend yield of 3.5 percent would translate into assets of more than $5.7 million, and yield rates that matched the average calculated rate paid by the S&P 500 stocks in 2020 of 1.51 percent would suggest filers with more than $200,000 in dividend income would own assets totaling more than $13.4 million in value. For Interest and Dividends Tax filers with more than $5 million in dividend income, the wealth required to generate that income through dividends would range from $100 million to $331.3 million at these rates of return. The collection of such wealth, in the form of these incoming-generating assets owned by individuals and families, was likely aided by relatively high annual incomes in many circumstances.

Economic Modeling of a Repeal's Impacts by Income

Additional analysis beyond the tax return data published by the DRA can provide more insight into the incomes of individuals and family households that would benefit the most from a repeal of the Interest and Dividends Tax. Households with higher overall incomes are more likely to have a greater percentage of their assets in stocks and bonds, which generate income that may be taxable under the Interest and Dividends Tax. New analysis conducted by the Institute on Taxation and Economic Policy using state-by-state modeling of the distributional impacts of tax policy changes uses estimated 2023 incomes, from any source, as a baseline to show the impacts of eliminating the Interest and Dividends Tax on household incomes.

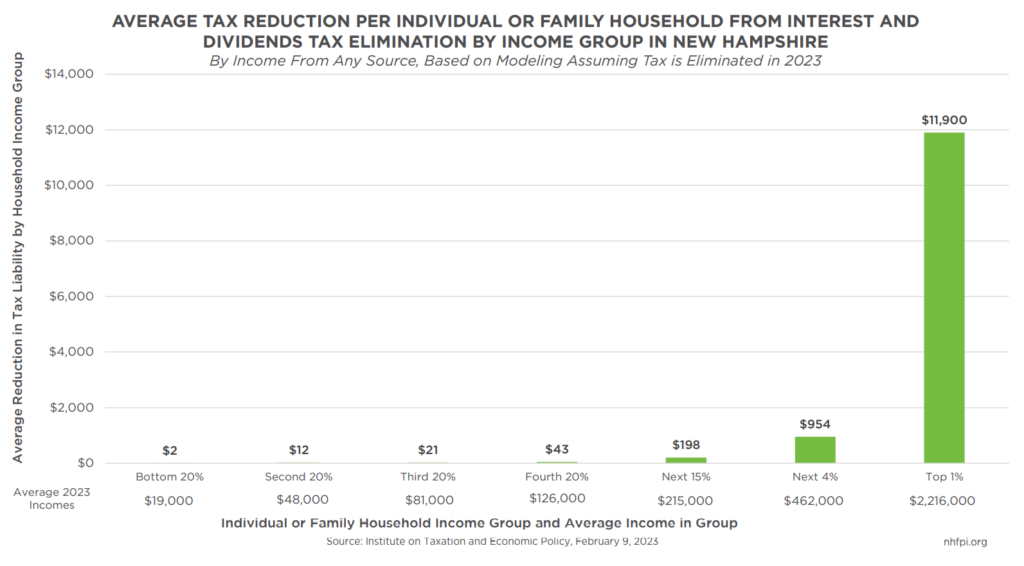

These estimates show that the dollars of forgone public revenue from the elimination of the Interest and Dividends Tax would flow disproportionately to individual or family households with high incomes. About 92 percent of the dollars that would have been taxed would stay with households in the top 20 percent of income earners, including income from any source, while 8 percent of the benefit would flow to the bottom 80 percent of households. Within the top 20 percent, slightly more than 58 percent of all the benefits of Interest and Dividends Tax elimination would flow to the top 1 percent of households by income, which represents households with $703,000 or more in income per year, with an average of $2.216 million per year in income across that highest group.

Of those households in the bottom 80 percent, about 7 percent would see a tax reduction, while 31 percent of households in the top 20 percent of incomes would receive a tax break. About 88 percent of households in the top 1 percent would receive a tax break, while less than 2 percent in the bottom 20 percent of households by income would see a reduction in taxes. The bottom 20 percent of households includes households with incomes below $35,000 per year, and have an estimated average income of $19,000 per year in 2023.

These aggregate tax reductions result in a distributional impact of eliminating the Interest and Dividends Tax that benefits higher-income households substantially more than households with lower incomes. The average tax reduction for a household in the top 1 percent, across all households in that group, would be $11,900 in 2023. For the approximately 88 percent of households that pay Interest and Dividends Tax in that group, the average reduction in tax liability would be about $13,559.

Compared to the average income of $2.2 million within this small group of households, the tax break is a relatively limited amount of money, but it is substantially larger than the tax reductions experienced by other income groups. The average tax benefit from eliminating the Interest and Dividends Tax for any household with incomes in the 4 percent that is immediately lower than the top 1 percent falls from $11,900 to $954. The average tax reduction in the middle 20 percent of households, with an average income of $81,000, that were previously paying Interest and Dividends Tax would be $156, and fall to $21 for all households across this group.

Granite Staters with the lowest household incomes, less than $35,000 per year and averaging $19,000 annually, would see an average tax reduction of $113 for the less than 2 percent of households in this group that actually would receive a tax break. The average across all households in this group would be a savings of approximately $2 in 2023.

Forgone Revenue and Economic Stimulus

The phased repeal of the Interest and Dividends Tax will begin to substantially impact State revenues in the upcoming State Budget biennium, and revenue estimates forecast by the Governor and the DRA show those reductions in State General Fund revenues.

The Governor’s revenue estimates show the Interest and Dividends Tax falling short of its predicted $135 million in revenue generated for State Fiscal Year 2023 by $22.2 million in State Fiscal Year 2024, with another additional drop of $23.4 million in State Fiscal Year 2025. Relative to the estimates for the current year, the Interest and Dividends Tax is projected to generate $67.8 million less revenue during the upcoming budget biennium because of the tax rate reductions. Figures from the DRA also suggest a decline of about $67.8 million as a midpoint estimate.

When the phaseout of the Interest and Dividends Tax was first considered in 2021, the Interest and Dividends Tax had been generating less revenue than is forecast for State Fiscal Year 2023 due in part to 2020 stock market performance, but its repeal still had a substantial forecasted impact. The estimated total revenue lost due to this provision, using a static analysis conducted by the DRA, was projected to be approximately $368.9 million through State Fiscal Year 2028, and then another $116.9 million thereafter. That static analysis did not account for inflation or growth in the revenue base, such as enhanced performance in the stock market, which has already boosted the Interest and Dividends Tax base and likely will continue to grow taxable income in future years.

These revenue losses are substantial relative to planned expenditures in the coming State Budget biennium. The $67.8 million loss of revenue is more than the State contributes in operating support to the Community College System of New Hampshire each year, and more than half the amount of general revenue sharing the State provided to all municipalities within its borders in State Fiscal Year 2023 from Meals and Rentals Tax revenue collections. An eventual loss of approximately $135 million per year is the equivalent of losing nearly all revenue currently used to fund the Department of Corrections, the combined budgets of the State’s Departments of Fish and Game, Labor, Employment Security, and the State Veterans’ Home, or about 77.1 percent of the State’s budgeted share funding for services to individuals with developmental disabilities for State Fiscal Year 2023.

A reduction in funding towards these services could have negative impacts on household budgets and the state’s economy overall while providing little economic benefit. National-level modeling from the Congressional Budget Office and Moody’s Analytics suggests that tax reductions for higher income households, including permanent reductions to dividends and capital gains taxes, are less effective at stimulating economic growth than other key policies, such as assistance to low-income households and infrastructure investments.

For example, Moody’s Analytics estimated an additional dollar in food assistance through the Supplemental Nutrition Assistance Program in the first quarter of 2021 would have boosted the size of the overall economy by $1.61 by the end of 2021, as individuals would have spent their income support on food in the local economy. Supplemental unemployment insurance would have boosted the economy by $1.49 per dollar invested over the same time period, as unemployed individuals with fewer other resources would have quickly used these benefits in the economy. The same analysis estimated a dividend and capital gain rate reduction would generate $0.38 for each dollar of foregone revenue, while a corporate tax rate reduction would generate $0.32, and a business net operating loss tax offset would produce $0.24 on the dollar in return on investment.

Property taxes, the most significant state or local tax in New Hampshire, consume a larger percentage of household income for families with moderate and low incomes than they do among households with high incomes. Reducing property taxes, through either general reductions or targeted relief, could potentially provide relatively effective economic stimulus by adding resources to households with low and moderate incomes. While recent federal and state aid has provided a likely temporary reprieve, the total amount of local property tax revenue charged statewide increased every year between 2012 and 2020 after adjusting for inflation, increasing by an average of 1.7 percent more annually than the rate of consumer inflation in the northeastern United States.

With an elevated risk of a recession during the next State Budget biennium and a potential rise in the need for services, public resources must be carefully raised and deployed to help ensure sufficient funding for programs serving Granite Staters and to provide support for an equitable and inclusive economy.

– Phil Sletten, Research Director

Note: This post was updated on April 1, 2023 to correct an error related to the application of the $2,400 exemption to taxable income.