Late last week, the Department of Revenue Administration (DRA) announced that the application period for New Hampshire’s Low- and Moderate-Income Homeowners Property Tax Relief Program opened May 1. Anyone who is interested in applying – or who would like to help a friend, family member, or client apply – can obtain the necessary forms from DRA’s website. Applications must be submitted by June 30.

Under the program, single homeowners with annual incomes of less than $20,000 and married homeowners with incomes under $40,000 can receive a rebate for some of the statewide property tax that they paid in the prior year. DRA data indicate that roughly 9,500 Granite Staters took part in the program in 2015, receiving an average rebate of $200.

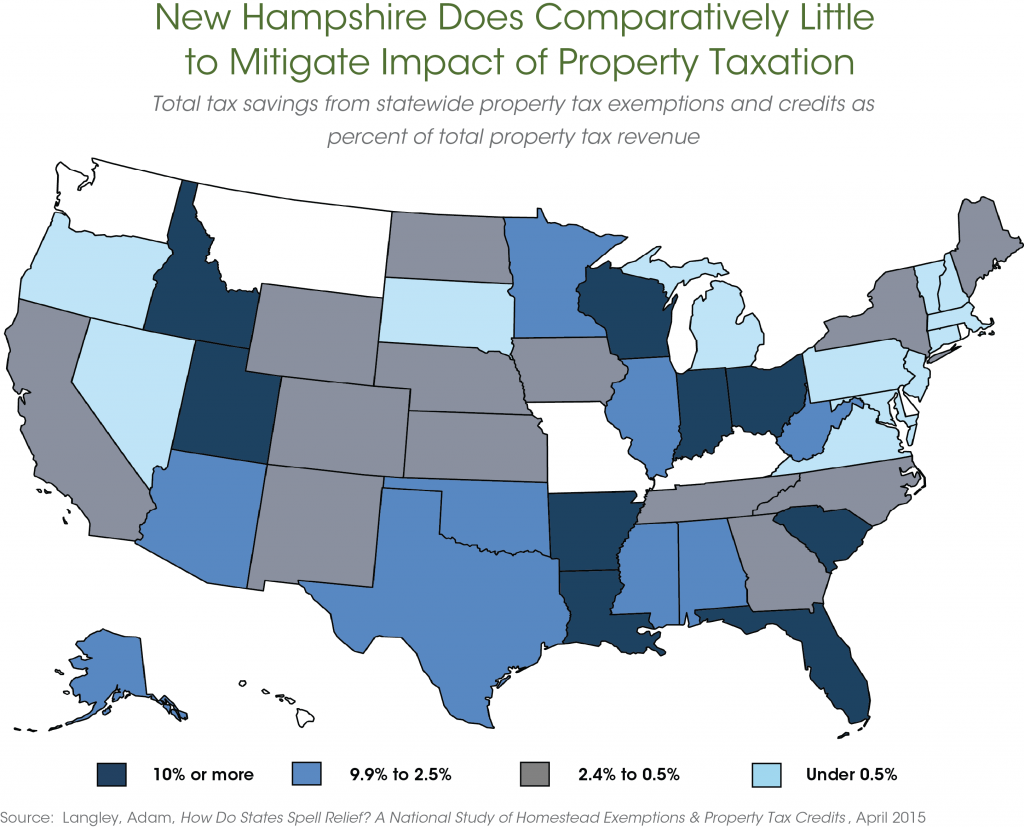

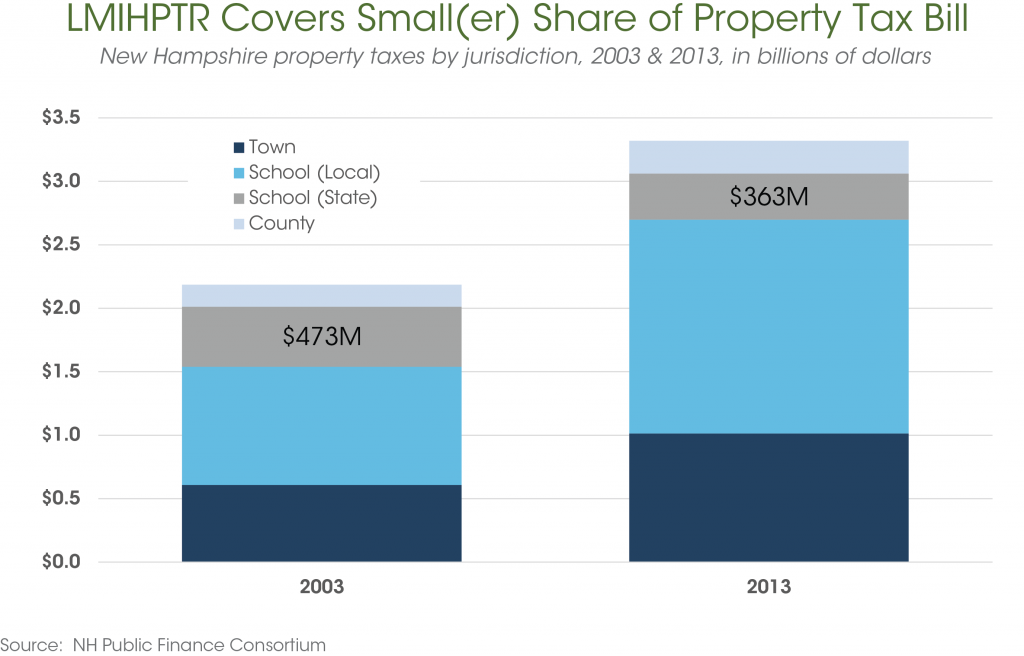

As critical as those rebates can be to individuals and families struggling to make ends meet, the program today is quite modest, both in comparison to other states and in relation to its former size. Research by Adam Langley of the Lincoln Institute of Land Policy, illustrated in the figure below, finds that, in 2012, over forty states offered some form of homestead exemption or property tax credit at the state level. New Hampshire was among the dozen states where the value of those property tax relief mechanisms amount to less than 0.5 percent of property tax revenues collected. What’s more, because it is linked strictly to the statewide property tax, the Low- and Moderate-Income Homeowners Property Tax Relief Program (LMIHPTR) now applies to a much smaller share of the total property taxes people pay than was previously the case, as the second figure reveals. In 2003, the statewide property tax amounted to $473 million – or about 22 percent of all New Hampshire property tax collections that year. In 2013, the statewide property tax yielded $363 million – or only about 11 percent of property levies overall.

In other words, the time has come to revitalize the program. One element of a larger tax reform bill that the New Hampshire House of Representatives considered this session would have updated some of the basic parameters of the program to adjust their values for inflation. This would have permitted single homeowners will incomes up to $27,500 and married couples with incomes up to $55,000 to take part in the program and would also have increased the base value of the credit by about 30 percent. Other, farther-reaching changes are possible as well, such as applying the program to all property taxes paid, rather than restricting it to the statewide property tax.

Here’s hoping that, by the time next year’s application period rolls around, policymakers will be well on their way to strengthening this important program.