New Hampshire’s state and local governments have considerable flexibility to respond to the health and economic crises caused by the COVID-19 pandemic with coming federal assistance. On May 10, 2021, the U.S. Treasury Department released guidance describing the uses and limitations for the flexible funding appropriated to states, counties, cities, and towns by the latest federal aid package, passed in March 2021, in response to the pandemic. The U.S. Treasury Department recommended recipients use their funds to bring the pandemic under control, support economic stabilization for households and businesses, and address systemic public health and economic challenges that contributed to the disproportionate impacts of the pandemic on some groups and communities. States cannot use these funds to directly or indirectly offset lost revenue from tax reductions, but the provisions in the U.S. Treasury Department’s guidance will likely permit states to enact small tax reductions without penalty, depending on trends in revenue growth and other identified offsets.

Significant New Assistance

The American Rescue Plan Act (ARPA) includes more than $1.8 trillion in appropriations, including $350 billion for state and local governments nationwide for flexible purposes through the Coronavirus State and Local Fiscal Recovery Funds (CSLFRF). In total, ARPA will very likely bring significantly more than $4 billion to New Hampshire through various forms of assistance, including the CSLFRF. As of February 2021, aid to New Hampshire from prior assistance packages had totaled more than $9 billion.

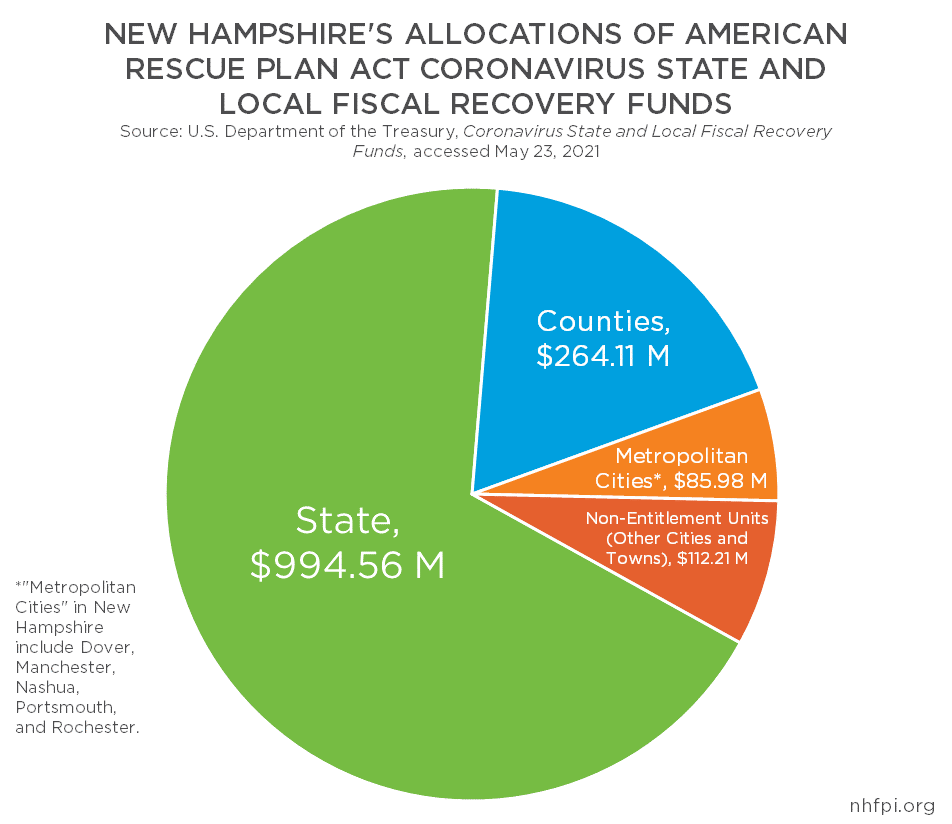

Combined, state and local governments in New Hampshire are to receive approximately $1.457 billion in flexible CSLFRF dollars, a substantial portion of the total aid flowing to the state from the latest round of legislation. The funding is set to arrive in two tranches, one in May 2021 and one a year later, for local governments and for states with more limited increases in their unemployment rates. The State of New Hampshire will receive a combined total of nearly $994.56 million.

Counties in New Hampshire will receive a total of about $264.11 million, with the largely population-based allocation method resulting in Coos County being appropriated just over $6.13 million and Hillsborough County receiving $81.00 million.

Other units of local government in New Hampshire are divided into “metropolitan cities,” which are identified based in part on the existing Community Development Block Grant program, and “non-entitlement units of local government,” which includes municipalities and certain other towns or townships. New Hampshire has five cities identified as metropolitan cities: Dover, Manchester, Nashua, Portsmouth, and Rochester. These five entities are allocated $85.98 million in funding based on a modified version of the Community Development Block Grant formula, with individual appropriations ranging from $43.28 million for Manchester to $6.15 million for Rochester. Non-entitlement units of local government in New Hampshire have been appropriated a total of almost $112.21 million, to be provided to the State of New Hampshire and then distributed by the State based on population to the non-entitlement units.

Permitted Uses and Provided Examples

The statutory language in ARPA identifies four different, broad types of uses for these flexible funds, and also identifies specific limitations. The U.S. Treasury Department, in the Fact Sheet accompanying the extensive Interim Final Rule released in May 2021, identified four purposes for the relief provided through the CSLFRF:

- “Support urgent COVID-19 response efforts to continue to decrease spread of the virus and bring the pandemic under control”

- “Replace lost public sector revenue to strengthen support for vital public services and help retain jobs”

- “Support immediate economic stabilization for households and businesses”

- “Address systemic public health and economic challenges that have contributed to the inequal impact of the pandemic on certain populations”

The Interim Final Rule, as well as a companion Frequently Asked Questions document and a Quick Reference Guide, provide both more details and examples of eligible uses, including recommendations for use from the U.S. Treasury Department.

The Department identified that CSLFRF recipients have a broad range of eligible uses to support families, businesses, and communities hardest hit by the COVID-19 public health emergency, and that, in areas where there has been a negative economic impact for the pandemic, recipients have broad latitude to deploy these funds to address those negative economic impacts. Paired with this significant flexibility, the Department urges public input and community engagement in developing plans for use of these funds.

The guidance expressly permits the use of these funds for a wide variety of purposes related to COVID-19 mitigation, including vaccination programs, medical care, testing and contact tracing, support for access to health services to populations particularly vulnerable to the pandemic, purchases of personal protective equipment, funding for public communication efforts, ventilation improvements in key facilities, enhancement of public health data systems, and other responses.

The funding can also be used to address behavioral health needs that have been exacerbated by the pandemic, including mental health or substance misuse treatment, crisis interventions, overdose and infectious disease preventions, and efforts to promote access to primary and preventative care.

In response to the economic impacts, governments can use these funds to assist households and families, small businesses, nonprofits, and impacted industries. Assistance to households could include, but is not limited to, cash or food assistance, housing and utility payment assistance, legal aid to prevent eviction or homelessness, emergency assistance for home repairs or weatherization, internet access assistance, or job training.

Both assistance to households and investments in communities, including investments to address disparities in health outcomes, have a broader range of eligible activities to respond to the pandemic when the households or communities have low incomes, as the U.S. Treasury Department reviews significant evidence that these communities have been disproportionately harmed by the pandemic

Eligible services for certain qualifying communities (primarily based on Census Tract boundaries) include expanded housing supports, such as affordable housing development, improving access to housing and assistance to address homelessness, housing navigation services, and lead paint remediation. More general housing infrastructure projects are not permitted outside of these disproportionately-impacted communities.

While there are limitations on general infrastructure projects, ARPA specifically permits the use of CSLFRF appropriations for necessary water, sewer, and broadband infrastructure projects. Broadband projects have to reach certain upload and download speeds to be eligible, and they must be targeted at underserved communities. Eligible water and sewer construction includes a wide range of projects that would be eligible under currently federally-supported clean water and drinking water revolving funds; these projects could be new systems or replacing existing lines, as well as water storage, source decontamination, nonpoint source pollution management, wastewater treatment, water conservation, watershed pilot projects, and certain other measures.

Governments may use funds for a wider variety of purposes if they are offsetting revenue shortfalls due to the pandemic. Funding has to be used on services for residents, and as such cannot be used for debt financing or certain other purposes that do not directly provide services. Revenue shortfalls are counted based on revenue from general revenue collected during State Fiscal Year 2019, with an assumed growth rate based on recent history, and revenue shortfalls measured relative to those baselines at the ends of calendar year 2020, 2021, 2022, and 2023. CSLFRF resources can be used to offset revenue losses for public sector operations to the extent that actual revenue falls below that projected amount.

The U.S. Treasury Department also details the provision permitting use of CSLFRF resources to support premium pay for essential workers. Premium pay is permissible within certain limits, up to an additional $13 per hour to supplement wages paid and with a limit of $25,000 in aggregate per worker, and written justification is required above a certain relative threshold. Essential workers are identified as workers needed to maintain continuity of operations in essential critical infrastructure, with some local flexibility for designating critical work, and those performing work with regular in-person interactions or regular physical handling of items that were also handled by others. Workers for public sector or third-party entities may be eligible, and essential critical infrastructure sectors include healthcare, public health and safety, childcare, education, sanitation, transportation, and food production and services. The Department also noted that pay could be applied retrospectively, such as for work completed during the pandemic in 2020.

Alongside establishing and supporting new services, the U.S. Treasury Department highlights that conducting outreach to connect people to health and social services is a permitted activity. The Department identifies that public benefits navigators may be funded with the CSLFRF to help people access services. Many of these services may be new and temporary, so people may need additional guidance accessing them, especially those in underserved communities. Also, the pandemic has made many people newly eligible for services over time, and accessing these services may be a new experience for these applicants, who might benefit from guidance.

Prohibitions on Certain Uses

The U.S. Treasury Department also provided specific limitations and prohibitions on the use of CSLFRF resources, including more details on the specific restrictions on uses. Particularly, the Department’s guidance interpreted a statutory provision in ARPA preventing the use of aid to states to offset federal tax reductions relatively narrowly, leaving considerable room for small tax policy changes without putting federal assistance dollars at risk.

ARPA includes language that forbids states from using their funds to “either directly or indirectly offset a reduction in the net tax revenue…resulting from a change in law, regulation, or administrative interpretation” during the period under which funds can be spent, which lasts until the end of 2026. The Department’s guidance constructs a baseline, using tax revenues collected during State Fiscal Year 2019 (before the pandemic struck) and applying an inflation adjustment, to determine whether a tax reduction is large enough to trigger the provision. If a tax reduction does not result in revenues dipping below that baseline, or below inflation-adjusted State Fiscal Year 2019 tax revenue, then the changes would not trigger the provision that costs the State federal funds on a dollar-for-dollar basis.

If tax policy changes that reduce revenue do occur and revenues dip below that baseline, then the State would lose a corresponding amount of federal funds unless the State could identify offsetting revenue increases or spending reductions that could be directly tied to that tax revenue reduction. Any spending reductions could not come from a State department, agency or authority that also received support from these flexible federal funds.

Generally, the CSLFRF resources cannot be deposited into pension funds or rainy day funds. They cannot be used to pay for principal or interest for ongoing debt, nor can they be used by the State to increase the Unemployment Compensation Fund balance beyond the level on January 27, 2020, when the pandemic public health emergency began in the United States. These funds also cannot be used to substitute for the State matches for other federal funds, such as supplanting the State’s funds used to match and draw down federal Medicaid dollars. Additionally, the funds generally cannot be used to cover government pandemic-related expenses from before March 3, 2021, and cannot be used for general economic or workforce development outside of pandemic-related impacts.

All fund expenditures must be incurred by December 31, 2024; while funds do not need to be completely expended by that date, they must be obligated by the end of 2024. The expenditures must be completed by December 31, 2026.

Guidance Encourages Support for an Equitable Recovery

While the U.S. Treasury Department provides substantial flexibility, the Department provides guiding examples and encourages certain uses, including those focused on long-term recovery. Permissible uses expand for the communities and families hit hardest by the pandemic, broadly including addressing health disparities and the social determinants of health, investing in housing, reducing educational disparities, and promoting healthy environments for children.

The Department’s guidance specifically identifies that the flexibility of these funds permits state and local governments to address both short- and long-term challenges, noting “these resources lay the foundation for a strong, equitable economic recovery, not only by providing immediate economic stabilization for households and businesses, but also by addressing the systemic public health and economic challenges that may have contributed to more severe impacts of the pandemic among low-income communities and people of color.”

Between these federal funds and the substantial surplus being built by recent State revenues, New Hampshire has a significant amount of resources to address both short-term needs and long-term problems. This guidance for use of one-time, flexible federal aid provides the framework to make significant, transformative investments and support a recovery from the COVID-19 crisis that benefits all Granite Staters.

– Phil Sletten, Senior Policy Analyst