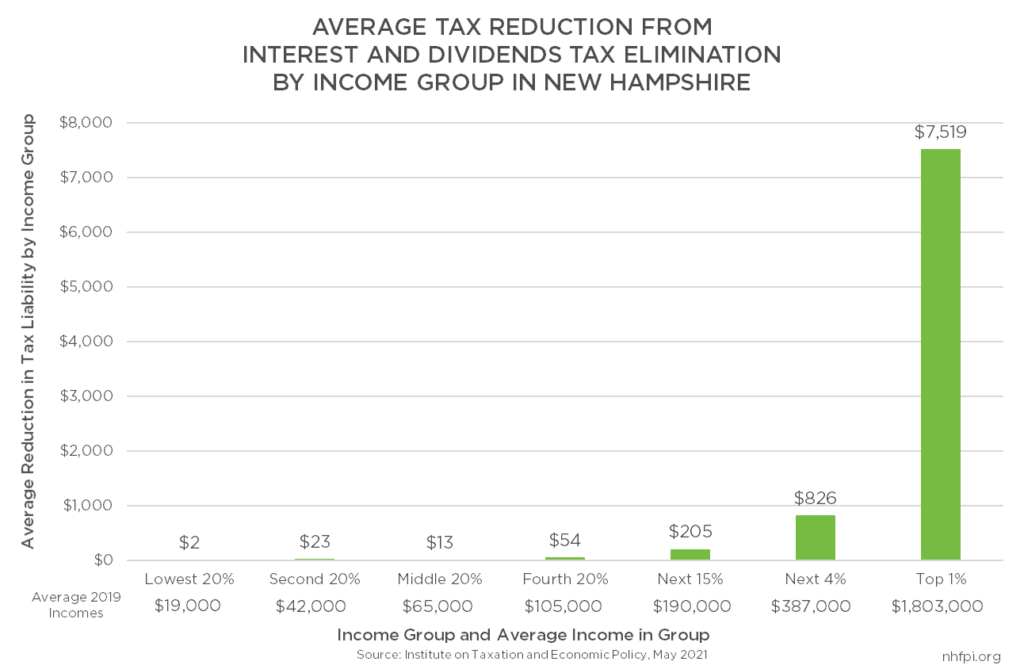

A new analysis of the proposed elimination of New Hampshire’s Interest and Dividends Tax shows nearly nine out of every ten dollars of the tax reduction would flow to the top 20 percent of income earners in New Hampshire, and almost half of the benefits would flow to the top one percent of income earners.

The analysis, conducted by the Institute on Taxation and Economic Policy using state-by-state modeling of the distributional impacts of tax policy changes, uses 2019 incomes as a baseline to show the impacts of eliminating the Interest and Dividends Tax on resident incomes.

The Interest and Dividends Tax is a 5 percent tax on income earned by individuals and certain business entities from the ownership of certain assets. In the 2018 Tax Year, the most recent for which there are published data, there were 66,284 tax filers, and more than 97 percent of those were individuals or joint filers, rather than business partnerships or estates. In 2018, filers with more than $200,000 in income taxable under the Interest and Dividends Tax, which does not include wage or salary income, accounted for nearly half of the revenue collected by this tax revenue source.

The income taxable under the Interest and Dividends Tax stems primarily from distributions, which are a transfer of property from an organization to the shareholders or interest-only holders as a result of their ownership interest, and from dividends, which are distributed to shareholders or other interest-holders in an organization based on profits. Interest, such as income generated by holding money in bank accounts, is also taxable under the Interest and Dividends Tax, but has accounted for a relatively small share of reported income under this tax in recent years. The stock market’s performance is key to understanding how much revenue this tax may generate, as dividends and distributions often flow to stock owners.

The new analysis, which accounts for all income sources and not only income taxable under the Interest and Dividends Tax, shows that people earning the highest levels of income in New Hampshire would be most likely to benefit from the elimination of the tax. New Hampshire residents with the highest one percent of income each collected an estimated $595,000 or more in 2019, with an average income of about $1.8 million. This group of income earners would receive an estimated average tax reduction of $7,519. For those residents who are in this income group and have taxable incomes under the Interest and Dividends Tax, the average tax liability reduction would be $9,587. About 48 percent of the benefits of the elimination of the Interest and Dividends Tax would flow to the highest-earning one percent of New Hampshire residents, according to this analysis.

Residents with incomes of less than $31,000 in 2019, in the bottom 20 percent of incomes in New Hampshire, would see a tax reduction averaging $2. The reduction for those with a previous tax liability would be $86, but most residents with these low incomes do not pay Interest and Dividends Tax, as many likely do not have the assets sufficient to generate this income. Retirees with lower incomes are likely represented in both the bottom 20 percent and the next 20 percent, where the average tax reduction rises to $23, and the reduction for those with a liability rises to $305. However, the middle 20 percent of income earning residents, with incomes between $52,000 and $80,000 in 2019 (and averaging $65,000), may be more likely to be comprised of residents who are earning most of their incomes from work, including salaries and wages, rather than asset ownership; as such, the average tax reduction for these middle-income Granite Staters is relatively small, at an average of $13 for all residents in this income bracket and $158 for those with a tax reduction.

The likelihood of receiving a tax reduction with the elimination of the Interest and Dividends Tax increases as overall incomes increase. These modeled estimates indicate the percentage of taxpayers in each income group who would see their taxes reduced is only 3 percent in the bottom 20 percent of earners, rising to 9 percent in the middle-income group, and 78 percent in the top one percent of income earners. Residents paying large amounts of this tax are those who are likely to have significant assets, and often higher incomes over time are required to build assets of the size necessary to generate substantial incomes from interest, dividends, and distributions annually.

The Governor’s State Budget proposal and the budget proposal passed by the House of Representatives both include a phaseout of the Interest and Dividends Tax by 2027, achieved by lowering the rates on an annual basis starting in 2023. The estimated total revenue lost due to this provision, using a static analysis conducted by the New Hampshire Department of Revenue Administration, may be $368.9 million during the phaseout period through State Fiscal Year 2028, and then another $116.9 million annually thereafter. The static analysis does not account for inflation or growth in the revenue base, such as positive performance in the stock market, which may make the actual revenue losses larger than these figures.

The Senate has passed a separate bill that would raise the exemptions for taxpayers who are older adults, blind, or have certain disabilities. This change would reduce the likelihood that lower income taxpayers, including retirees, would owe Interest and Dividends Tax of any kind while having little relative impact on the amounts wealthy taxpayers owe to help fund public services.

This new analysis, reinforced by previously-available data from the State and prior modeling, strongly indicates that the benefits of the proposed elimination of the Interest and Dividends Tax would flow disproportionately to higher-income and higher-wealth households. The COVID-19 crisis has disrupted employment for Granite Staters with lower incomes much more than those with higher incomes. National-level modeling from the Congressional Budget Office and Moody’s Analytics suggests that tax reductions for higher income households, including permanent reductions to dividends and capital gains taxes, are less effective at stimulating economic growth than other key policies, such as assistance to low-income households and infrastructure investments.

With New Hampshire emerging out of a severe economic crisis, public resources must be carefully deployed to help ensure an equitable, sustainable, and inclusive recovery.

– Phil Sletten, Senior Policy Analyst