While results are still preliminary, Keno gaming appears to have been legalized in seven cities around New Hampshire as a result of Tuesday’s votes. The margin of victory in Rochester for Keno legalization was reportedly only one vote and may still be subject to change or recount, but voters appear to have legalized Keno gaming in Berlin, Claremont, Laconia, Manchester, Nashua, Rochester, and Somersworth. Voters in Concord, Dover, and Keene voted against Keno gaming legalization. Franklin had legalized Keno gaming previously, and the Portsmouth City Council decided to not put Keno on the ballot. Other municipalities, including the City of Lebanon, may make decisions regarding Keno legalization next year.

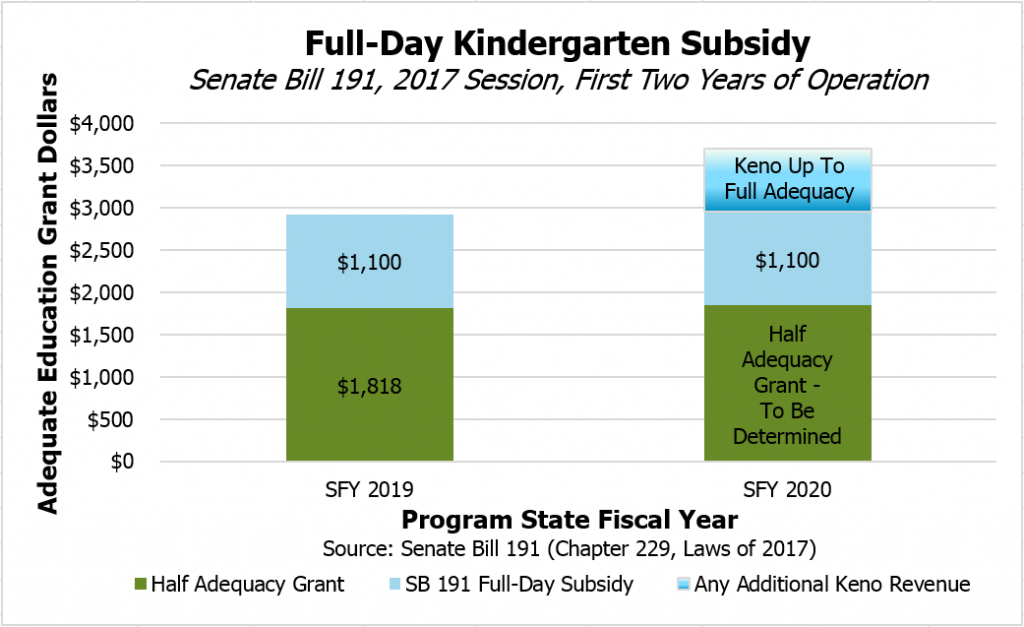

These results have implications for State policy and finances. Keno gaming was legalized under Senate Bill 191 as a way to bolster revenues for the State’s Education Trust Fund; Senate Bill 191 also pledged to provide an additional $1,100 from the Education Trust Fund for each full-day kindergarten pupil beyond the half-day adequacy grant provided elsewhere in law. The compromise legislation set forth the $1,100 requirement regardless of Keno revenue and regardless of whether Keno was legalized within a municipality; the legalization decision was left to municipal voters. Any surplus revenue Keno collects will directly add to the full-day kindergarten subsidy in State fiscal year (SFY) 2020 and beyond, up to the full adequacy grant level set for pupils in higher grades. However, starting in SFY 2019, at least $1,100 per eligible pupil must be provided for school districts with full-day kindergarten.

Published estimates of annual revenue from Keno gaming, which will be a new revenue source for New Hampshire, ranged from about $8.5 million to $12 million, depending on which version of the legislation was reviewed. The final form of the legislation did not have a published fiscal note, but was similar to another bill whose cost had been evaluated, House Bill 560, which had an $8.5 million projection for increased revenue.

When Keno gaming is rejected by municipal voters, that may increase the risk the Education Trust Fund does not collect as many dollars as projected. Although this tradeoff may affect revenues beyond the $1,100 per pupil subsidy, that subsidy is guaranteed under current law. Based on the fiscal note for the estimated $14.9 million cost of granting the full adequacy amount paid for students in grades one through twelve to full-day kindergarten students and not adjusting for changes in enrollment or adequacy aid, this $1,100 per pupil subsidy may cost approximately $9 million.

Voters may also be more inclined to expand kindergarten programs in local school districts to be full-day with this new subsidy available, as there would likely be a reduced impact on local property tax rates due to a higher subsidy from the State. As such, it is difficult to predict the number of school districts that might opt to add full-day kindergarten, increasing the cost of the State’s obligation because of the greater number of students participating.

These variables suggest that the full-day kindergarten subsidy may have to be paid for with other revenue sources contributing to the Education Trust Fund. However, when it approved the State Budget, the Legislature estimated the surplus in the Education Trust Fund and the General Fund, which can be used to support the Education Trust Fund, without Keno gaming revenue would be about $672,000 at the end of SFY 2019. If revenue collections and expenditures are as planned in the State Budget, then the cushion of surplus available to support full-day kindergarten subsidies not paid for through Keno will be very small.

As of October’s revenue collections, the revenue surplus (above the plan set by the State Budget) for SFY 2018 thus far is $5.5 million for the General and Education Trust Funds combined. Although this figure sounds promising for more surplus dollars to be available, this revenue surplus may be drawn upon by other bills passed during the 2018 legislative session, or may be used to fill unexpected needs. Also, revenue collections may not keep up with plan throughout the year, as growth in revenues was essentially zero between SFYs 2016 and 2017, and only tepid growth has continued into SFY 2018. If collections fall below plan, this revenue surplus may disappear quickly.

Should lawmakers not have Keno or surplus revenue sufficient to meet the State’s obligations under Senate Bill 191, they may have to pull resources from other priorities, find additional revenue from other sources, or reconsider their obligations.

For more on Keno gaming and kindergarten, see the Office of Legislative Budget Assistant’s Fiscal Issue Brief on Senate Bill 191. To learn about how New Hampshire collects revenue, see NHFPI’s Revenue in Review resource.