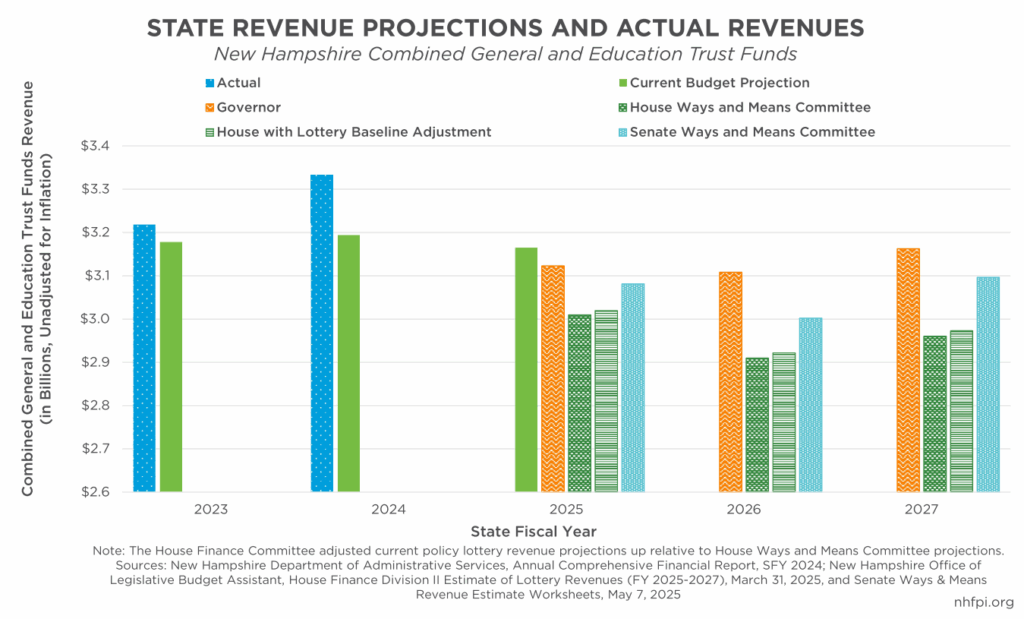

On Wednesday, May 7, the Senate Ways and Means Committee developed revenue projections for the next State Budget biennium. The Committee forecast that more money would be available than the House estimated, but expected less than the Governor, for funding the next two-year State Budget.

The House’s version of the State Budget substantially reduced proposed funding for services, including mental health, disability, and higher education supports, to meet the fiscal constraints of the lower revenue estimates produced by the House Ways and Means Committee.

Senate Projections Higher Than House Budget by $265 Million

The Committee’s estimates, which are based on current policy and assume no policy changes, for the combined General and Education Trust Funds totaled $9.1792 billion for State Fiscal Year (SFY) 2025 and the upcoming budget biennium, SFYs 2026-2027, combined.

The SFY 2025 revenue projections help inform whether there is a surplus to carry forward or a need to draw from the Rainy Day Fund to balance on June 30, 2025, which is more likely this budget cycle. Without SFY 2025 revenues included, estimated receipts for the SFYs 2026-2027 biennium would be $6.0982 billion.

The SFYs 2025-2027 total is $265.4 million higher than the figures used by the House in their baseline estimates. While the Senate Ways and Means Committee forecast was a full $299.6 million higher than the House Ways and Means Committee projections from February for the three year period, the House Finance Committee had adjusted revenue expectations from the Lottery Commission upward by $34.2 million without a policy change.

Including only SFYs 2026-2027, the Senate Committee’s revenues were $228.1 million higher than the House Ways and Means Committee revenues based on current policy. The Senate Ways and Means Committee did not make changes to the Highway Fund or Fish and Game Fund revenue projections made by the House.

House Budget’s Expanded Gambling and Fee Policies Not Incorporated

The House proposed policy changes to increase revenue. The House boosted revenues in its budget proposal by increasing fees, shifting resources from dedicated funds to the General Fund, and expanding legalized gambling, which resulted in more revenue available for the House’s version of the State Budget.

The revenue estimates compared in this analysis do not include policy changes proposed by the Governor, the House, or the Senate, and are only based on current policy. The Senate Ways and Means Committee did not incorporate the House’s proposed policy changes into its revenue projections. The Senate Finance Committee will consider whether to retain, modify, or exclude those policies from their version of the State Budget.

Closer to Governor’s Projections, But Less Optimistic About Growth

While the Senate Ways and Means Committee proposed revenue estimates that were substantially higher than the House estimates, they were only somewhat closer to the Governor’s estimates than to the House’s projections. The Governor has projected $9.3931 billion would be collected during SFYs 2025-2027, which is $213.9 million more than the new projections from the Senate Ways and Means Committee.

The Governor’s revenue estimates were helped by an expected rebound in combined business tax revenues during SFY 2026. The House Ways and Means Committee did not project a significant uptick during the biennium, but the Senate Ways and Means Committee incorporated a 7.7 percent growth rate into its revenue estimates for business taxes in SFY 2027. While a similar magnitude of growth to the Governor’s projections, it arrived later in the biennium in the Senate forecast, resulting in less overall revenue forecast during the entire period.

More Fiscal Bandwidth for Senate Finance Committee

With revenues in between the Governor’s estimates and the House’s projections, the Senate Finance Committee has more fiscal space to build a bigger budget than the House passed in early April. However, the Senate Finance Committee would need to add substantially more revenues to match the Governor’s expenditures, suggesting the final budget will be slimmer than the Governor’s proposal but not include all the reductions made by the House.

The Senate Finance Committee begins State Budget deliberations regarding potential amendments to the State Budget on Friday, May 9. The Senate is scheduled to finish its work on the State Budget by June 5.