New Hampshire’s next two-year State Budget will support services during a critical time in the recovery from the COVID-19 crisis. The needs of New Hampshire residents will likely be fast-changing and difficult to anticipate, as public health risks associated with the virus may be volatile. Governments may have to respond rapidly to shifting conditions, particularly those agencies providing public health and economic supports. Enacted federal policies will provide significant assistance to residents and the economy in the coming months. However, Granite Staters with low incomes and limited resources have been disproportionately impacted by the crisis, and the recovery may not fully reach those residents without additional intentional public policy support. The services funded during the next State Budget biennium will be key for helping ensure New Hampshire’s recovery from this crisis is inclusive, equitable, and sustainable.

The State Budget proposal approved by the New Hampshire House of Representatives makes several key changes from the Governor’s proposal, which provided the basis for the changes made by the House Finance Committee and approved by the House. The House’s budget proposal shifts funding away from health and social services, substantially reducing funding to the New Hampshire Department of Health and Human Services without specifying which areas the reduced funding levels would impact. The House voted to make several changes to health and social services beyond these substantial funding reductions relative to the Governor’s proposal, including removing a proposed family medical leave insurance program, closing the Sununu Youth Services Center, and removing the appropriation for a new forensic psychiatric facility. The House also allocated more resources to road, bridge, and local transportation aid funding, and to study the potential merger of the university and community college systems. The House’s budget would boost funding for major school building aid projects and certain special education services, and would transfer funds to support a one-time reduction in the Statewide Education Property Tax. This change and other tax policy adjustments proposed by the House would reduce net State tax revenues during the biennium by an estimated $157.7 million, based on the House’s estimates. A provision of the American Rescue Plan Act indicates states may lose a dollar of federal aid for every dollar in net State tax revenue reductions resulting from policy change, and tax revenue reductions potentially risk the State foregoing similar amounts of federal aid during the budget biennium as well, depending on final federal regulations.

This Issue Brief examines key components of the New Hampshire House of Representative’s State Budget proposal for the next two fiscal years and focuses on changes made relative to the Governor’s budget proposal, incorporating comparisons to the current State Budget for context in certain areas. The Issue Brief also reviews revenue projections and proposed changes to State tax policy contained in the House’s State Budget proposal. For comparisons between the Governor’s proposal and the current State Budget, see NHFPI’s Issue Brief on the Governor’s State Budget proposal.[i]

The Topline Changes

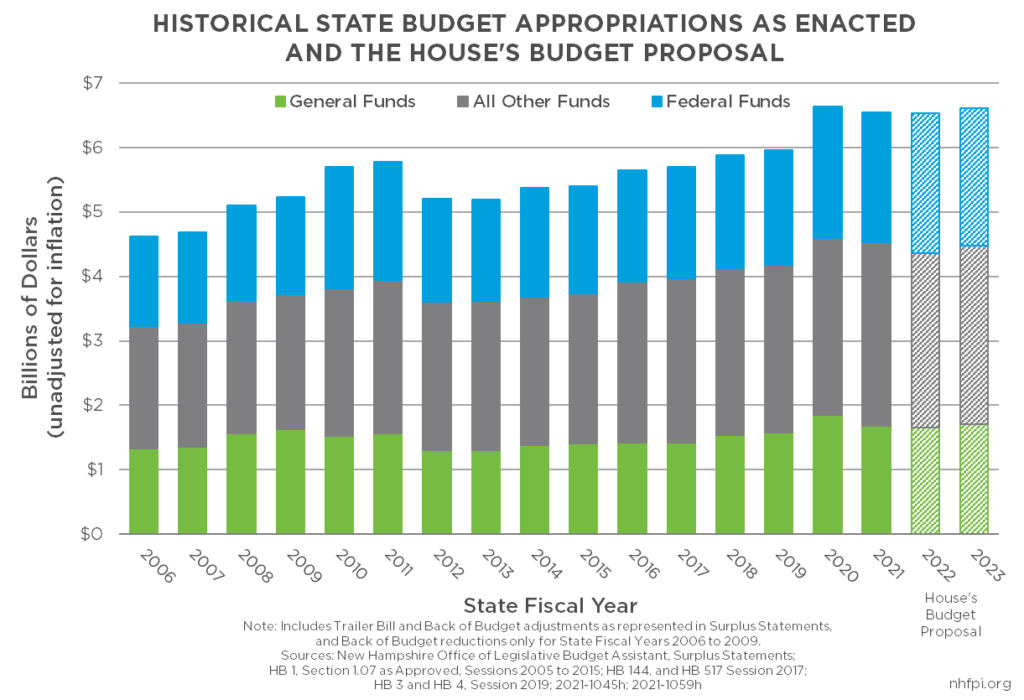

The House’s proposed budget for State Fiscal Year (SFY) 2022 and SFY 2023 would reduce appropriations relative to the current State Budget, deviating from the trend of increasing aggregate appropriations in budget cycles since the SFYs 2012-2013 State Budget. The House’s proposal, net of interagency transfers related to information technology services and including both Trailer Bill appropriations and non-specific reductions in the back of the Operating Budget Bill, would appropriate $13.149 billion during SFYs 2022 and 2023, which would be a 0.3 percent decrease from the comparable SFYs 2020-2021 State Budget total originally enacted in September 2019.[ii] On a yearly basis, the total State Budget would be 0.2 percent smaller in SFY 2022 than the originally-enacted amounts for SFY 2021, and would grow by 1.2 percent from SFY 2022 to SFY 2023.

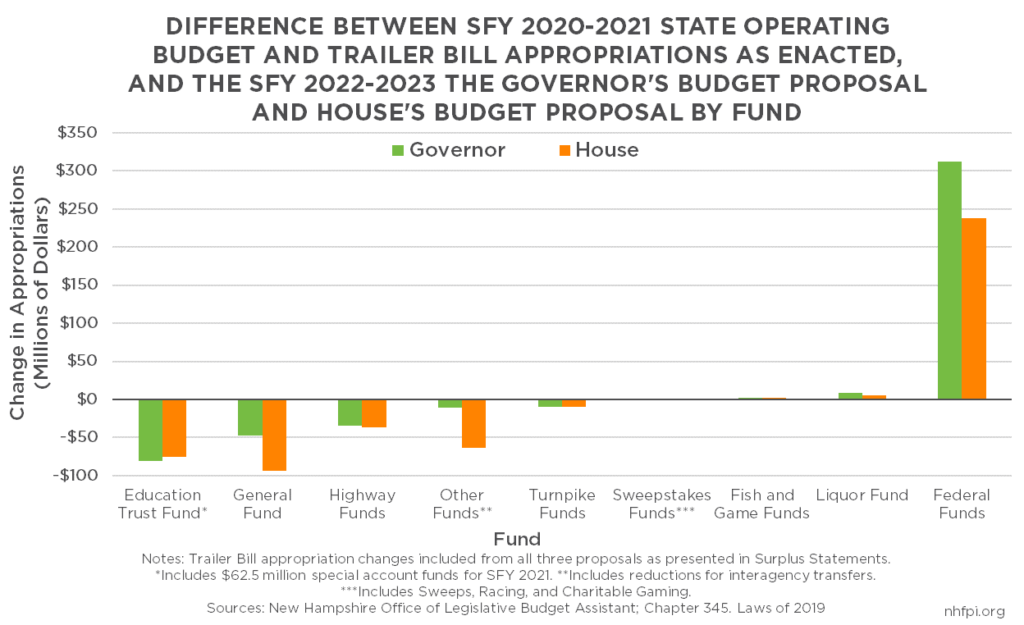

The House proposed some key changes in funding levels in different areas relative to both the Governor’s budget proposal and current policy. Of the State Budget’s major funds, which are the legal structures organizing State Budget appropriations, the Governor and the House both budgeted for the largest dollar increases in Federal Funds. The House budgeted for about $74.5 million fewer federal dollars than the Governor’s anticipated $312.0 million (7.7 percent) increase, totaling a $237.5 million (5.8 percent) increase. Of this $74.5 million decrease, approximately $67.7 million is attributable to a change in budgeting practice for an information system upgrade. The House’s proposed budget does not incorporate any new federal aid from the American Rescue Plan Act.

Incorporating the expenditures in the current State Budget’s Trailer Bill, the Governor’s budget would appropriate $47.0 million (1.3 percent) less from the General Fund. The House’s budget would further reduce General Fund appropriations, dropping the total by $94.3 million (2.7 percent) compared to the current State Budget. Both the Governor and the House anticipated a $134.1 million (7.8 percent) lapse, or a planned amount of underspending at State agencies, for the General Fund in SFY 2021. The House proposed a higher lapse requirement than the Governor, planning agencies would underspend their General Fund budgets by $71.0 million (4.2 percent) in SFY 2022 and $98.2 million (5.7 percent) in SFY 2023. The House boosted these estimates in part because of anticipated efficiencies at the New Hampshire Department of Health and Human Services (DHHS), modified from efforts proposed by the Governor.

Both the Governor and the House would appropriate fewer dollars from two key funds related to transportation, the Highway Fund and the Turnpike Fund. Under the House’s proposal, the Highway Fund would decline by $36.9 million (7.0 percent) relative to the amounts budgeted in 2019 for the current biennium, while the Turnpike Fund would decline by $9.6 million (2.8 percent), the same decline proposed by the Governor. These allocations likely reflect expected changes in revenue from taxes on gasoline sales and reduced traffic through Bureau of Turnpikes tolls, and do not reflect the House’s added General Fund support for the Department of Transportation.

Both the House and the Governor would also appropriate less than the current State Budget to the Education Trust Fund, which holds the funding for grants for local public education to school districts. Including Trailer Bill appropriations, the total reduction in the Education Trust Fund would be $80.4 million (3.6 percent) in the Governor’s proposal, while additional appropriations from the Fund in the House’s proposal would limit the decline to $75.0 million (3.4 percent). These declines reflect both reduced enrollment, as grants are allocated on a per pupil basis, and the decision to not continue the targeted aid provided in the current State Budget to communities with less relative taxable property wealth and more students from low-income families.

Expenditure by Category of Government Services

All State Budget expenditures are allocated to one of six categories based on the service area of each department. These six categories are designed to cover all areas of State government operations, and include General Government, Justice and Public Protection, Resource Protection and Development, Transportation, Health and Social Services, and Education.

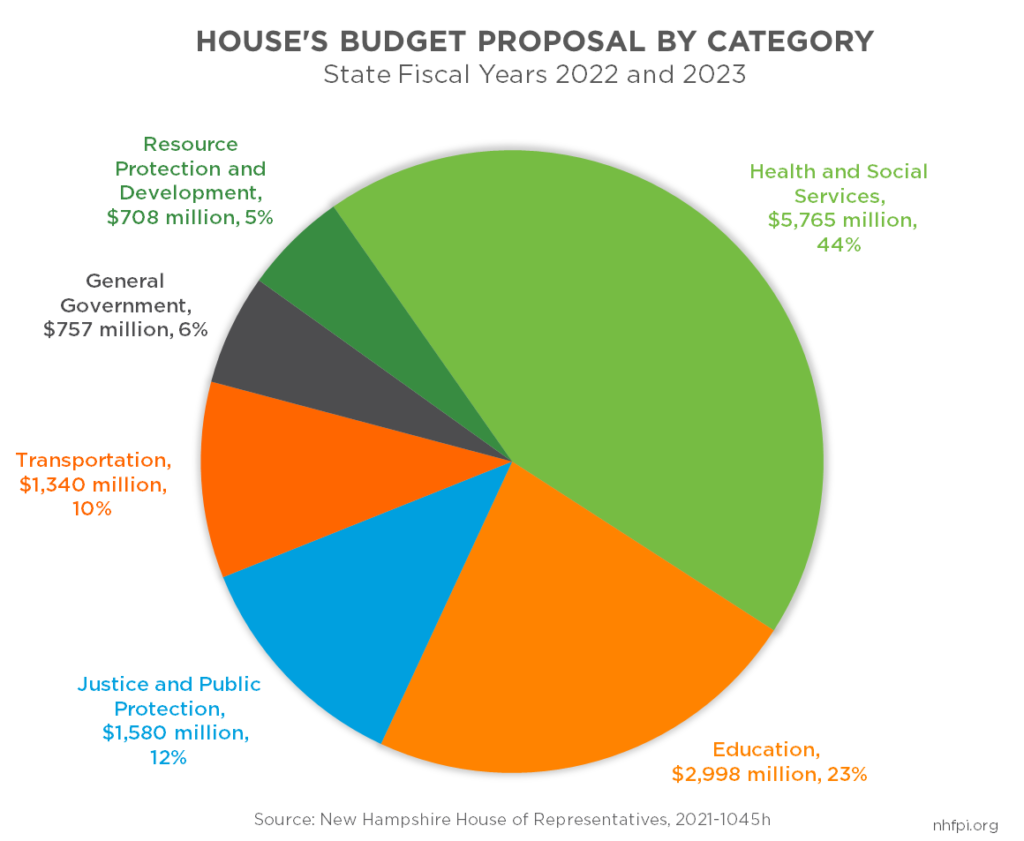

The House’s budget proposal would, as the current State Budget does, allocate the plurality of funds to Health and Social Services, with Education receiving just over a fifth of appropriations. Justice and Public Protection would receive the next largest appropriation, with nearly $1.6 billion (12.0 percent) appropriated during the biennium, including General Fund and Federal Fund appropriations as well as appropriations from all other funds. Transportation would follow with $1.3 billion (10.2 percent), General Government with $757.0 million (5.8 percent), and Resource Protection and Development with $708.2 million (5.4 percent).

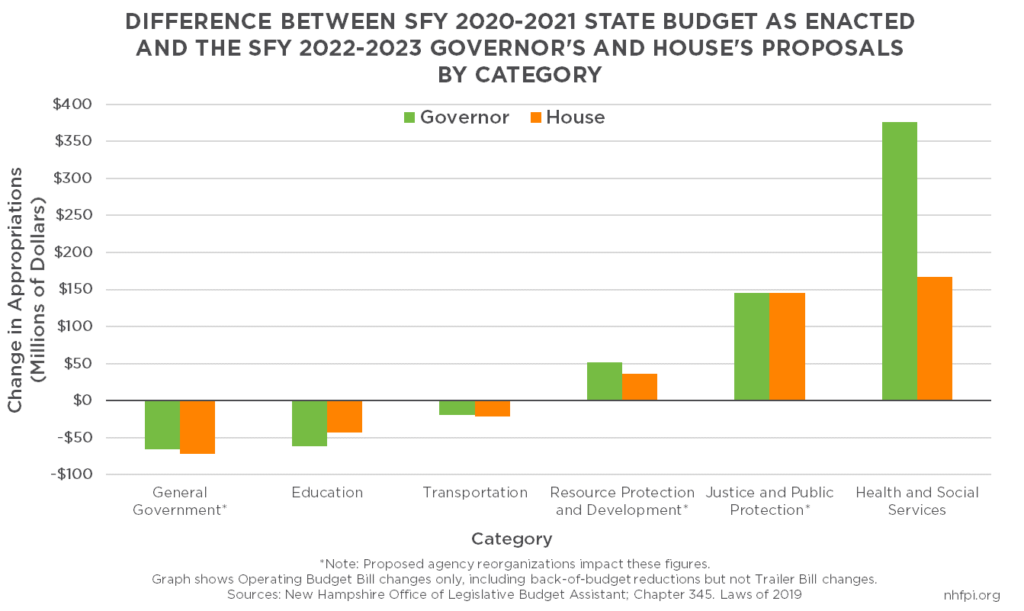

The largest dollar increases, relative to the current State Budget as passed and not including Trailer Bill appropriation changes, would go to Health and Social Services, which is almost entirely comprised of the DHHS budget. Accounting for back-of-budget changes, the House proposal would increase Health and Social Services by $166.7 million (3.0 percent) over the current budget as enacted, significantly less than the Governor’s proposed increase of $375.7 million (6.7 percent). The difference reflects the back-of-budget reductions proposed by the House, the proposed closure of the Sununu Youth Services Center, and moving $67.7 million in federal funds for an information technology upgrade out of the State Budget.

Education, the next-largest category in the State Budget, would see a lower level of funding relative to the current biennium under both the Governor’s and the House’s proposals. The majority of expenditures in this category are driven by the Adequate Education Grants paid to local governments to fund public education on a per pupil basis; this category also includes funding for the University and Community College Systems, operations at the New Hampshire Department of Education, the Police Standards and Training Council, and the Lottery Commission, which generates revenue to support the Education Trust Fund. Neither the Governor’s nor the House’s proposal would continue the one-time, targeted grants to local governments included in the current version of the State Budget, although the House would boost funding for education relative to the Governor’s proposal through building and special education aid. The Governor would reduce spending in the Education category by $61.4 million (2.0 percent), while the House would reduce spending by $42.7 million (1.4 percent).

General Government would see the largest dollar decline relative to the current biennium in both budgets, with reductions of $66.0 million (8.0 percent) proposed by the Governor and $71.7 million (8.7 percent) proposed by the House. A significant portion of this decrease, about $17.6 million, appears to result from reported one-time savings in State retiree health insurance benefits. Another component of this change is due to the Office of Strategic Initiatives, formerly the Office of Energy and Planning, shifting in part to the newly-proposed Department of Energy and in part to the Department of Business and Economic Affairs. The House removed nearly $6.0 million in funding from the Governor’s Scholarship Program, shifting those funds to educational and vocational programs in the Department of Corrections. The House also proposed adding several staff members in the Department of Administrative Services for analysis, administration, and project management, and removes staff from the New Hampshire Housing Appeals Board. The House shifted funding for reimbursing sheriff’s departments for court security from the Department of Administrative Services to the Judicial Branch, and added funding for auditors to the Department of Revenue Administration.

The reorganization associated with the creation of the Department of Energy, shifting court security reimbursement responsibility and funding to the Judicial Branch, and adding funding for the Department of Corrections all would shift allocations from General Government to Justice and Public Protection. Justice and Public Protection would see only a slightly larger increase in the House’s proposal than the Governor’s in aggregate, with the House increasing appropriations by $145.9 million (10.2 percent) over the current biennium. This increase in the House due to shifting resources from General Government was offset by a reduction in funding for law enforcement personnel at the Liquor Commission, as the House removed the law enforcement components of the Liquor Commission’s responsibilities.

Transportation funding would decline slightly more in the House’s proposal than in the Governor’s proposal, falling $21.2 million (1.6 percent). However, the House added funding for the Department of Transportation through the Trailer Bill, whose appropriations are not included in these figures, with $19.0 million in General Fund appropriations.

Resource Protection and Development funding would increase by $36.4 million (5.4 percent), substantially less than the Governor’s proposed $52.0 million (7.7 percent) increase. The primary difference in the House’s proposal is the removal of $15.6 million in State aid grants to municipalities for water pollution control and public water systems that the Governor would have maintained.

Proposed Changes by State Agency

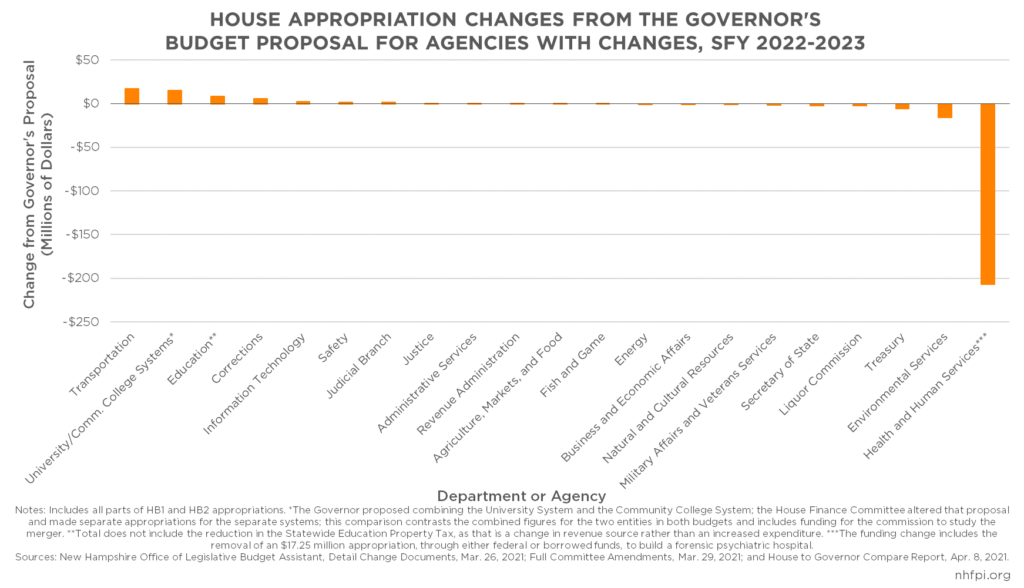

State agency-level analysis provides additional insight into the changes proposed by the House relative to the Governor’s budget. The previous analyses comparing budget categories and funds provide comparisons between the two-year budgets proposed by the Governor and the House, and the two-year State Budget approved by policymakers in 2019. The analysis of State agency budgets in this section compares the House’s budget proposal to the Governor’s proposal only, and does not reflect the changes proposed by the Governor relative to the currently-enacted State Budget.[iii]

Of the 38 agencies identified independently in the Governor’s State Budget proposal, the House did not change appropriations in 17 (44.7 percent) of them, although some of those agencies saw proposed policy changes that did not affect appropriations.

The largest decrease in funding proposed by the House relative to the Governor’s proposal is in the DHHS. In aggregate, the decline in funding for the DHHS proposed by the House, including both back-of-budget reductions and Trailer Bill changes, was $206.9 million during the biennium relative to the Governor’s proposal. The next largest decrease proposed is in the Department of Environmental Services, where the House proposal budgets $15.6 million less than the Governor due to a reduction in grants to local governments. The Treasury Department would see a reduction of $6.0 million relative to the Governor’s proposal, due to the defunding of the Governor’s proposed contribution to the Governor’s Scholarship Fund. The Liquor Commission’s appropriations would be reduced by about $2.6 million, resulting from the proposed removal of 21 law enforcement personnel from the Commission. The House would also transfer $2.0 million of funds currently at the Secretary of State’s office to the Department of Justice for the FRM Victims’ Contribution Recovery Fund.

The House proposed to increase the Department of Transportation’s funding by the largest dollar amount of any State agency, relative to the Governor’s proposal. The House allocated $19.0 million in General Funds to add support for operations and transportation block grants to local governments, as well as an additional nearly $3.2 million in Federal Funds for State bus services. The House also proposed an increase to the University System and the Community College System relative to the Governor’s combined appropriations for both systems; based on the outcome of a study commission, the House would delay or prevent the process of merging the two systems envisioned by the Governor, and would add funding for the Community College System to support dual and concurrent enrollment. The House added appropriations for the Department of Education to support special education aid for local school districts. The House proposed adding funding to the Department of Corrections, including to fund 21 positions to support education and vocational programs, and separately added shared services positions at the Department of Information Technology.

Agency Reorganizations

The House retained much of the Governor’s proposed reorganizations of State agencies. However, the House did make some changes to the two primary reorganizations proposed by the Governor: a new Department of Energy and the merger of the University and Community College Systems.

The University System and the Community College System

The Governor’s budget proposal would combine the University System of New Hampshire and the Community College System of New Hampshire, and provides a single appropriation for both entities in SFY 2023. These entities are currently incorporated separately in statute and have separate grants of General Fund money to support their operations. There are four schools within the University System of New Hampshire: the University of New Hampshire, Plymouth State University, Keene State College, and Granite State College, all of which offer four-year degrees.[iv] The Community College System of New Hampshire includes seven colleges with 12 locations: White Mountains Community College, River Valley Community College, Lakes Region Community College, NHTI – Concord’s Community College, Great Bay Community College, Manchester Community College, and Nashua Community College.[v]

The Governor’s budget would quickly combine the two Boards of Trustees into a single, fifteen-person body, all appointed by the Governor, and have a deadline of July 2023 for creating a new, single entity. The House, however, would establish a commission to study the merger and determine, by January 2022, whether a merger should occur. If the commission determines a merger should occur, it would be required to propose legislation to create a completed merger by July 2023, the same deadline as the Governor’s proposal.

The commission would be comprised of four appointees from the University System of New Hampshire, four appointees from the Community College System of New Hampshire, and three members appointed by the Governor. The appointees from the University and Community College Systems would be required to include the chairpersons of the boards of trustees for each institution and the chief executive or administrator from each institution. The commission would have a $1.5 million appropriation to help assess the value of such a merger.

The Department of Energy

The Governor has proposed the creation of the Department of Energy, which would be the result of combining several existing organizations within State government. The new Department of Energy would be created from the energy-related components of the Office of Strategic Initiatives (OSI), the re-established Office of Offshore Wind Industry Development, and the Public Utilities Commission (PUC).

The House largely retained the Governor’s proposal, but proposed some reorganizations to the structure of the new Department. The House would move some positions within the proposed Department into different areas of the new structure and make other technical corrections to the language.[vi]

Health and Human Services

With the COVID-19 pandemic severely impacting the health and economic well-being of many Granite Staters, increased needs for health and social services over the next two years renders this already key area of State-supported services even more critical. The DHHS is the largest State agency and administers several critical programs, including Medicaid, the Food Stamp Program, and Temporary Assistance for Needy Families, all of which include significant amounts of federal funding support. Medicaid, which provided health coverage for more than 215,000 Granite Staters at the end of February 2021, totaled approximately $2.1 billion in expenditures in SFY 2020, with more than half of those expenditures funded by the federal government.[vii]

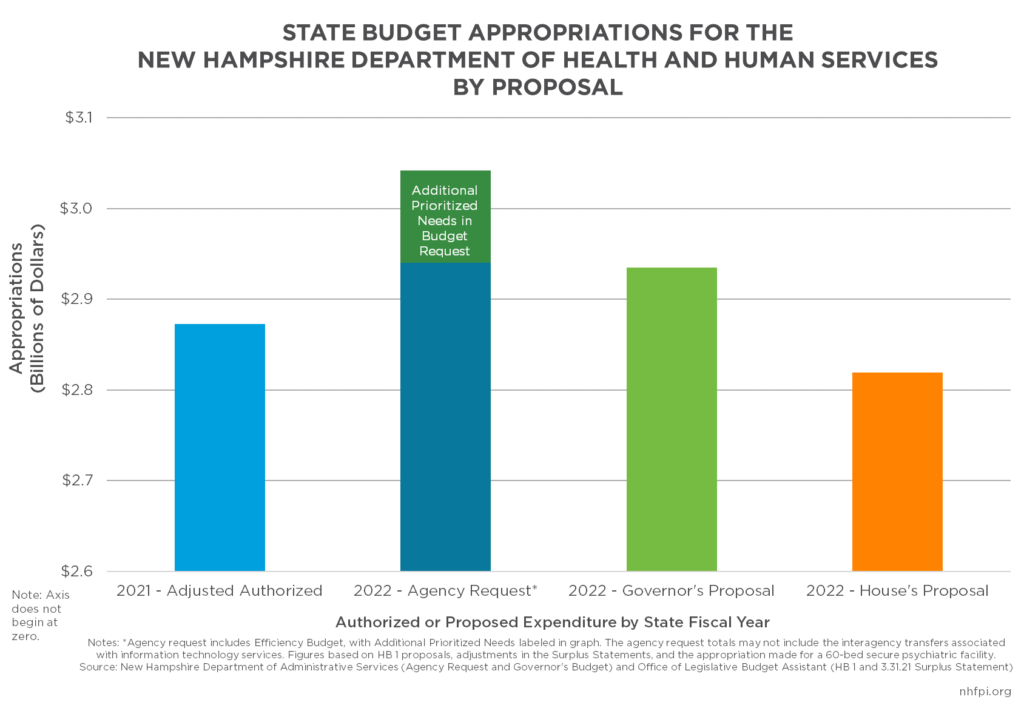

The House’s budget proposal would reduce funding to the DHHS by $206.9 million relative to the Governor’s budget proposal. The total funding appropriated to the DHHS by the House in SFY 2022 would be $53.9 million (1.9 percent) lower than the funding currently authorized in the DHHS SFY 2021 adjusted authorized budget. The House’s budget proposal would in aggregate, fund the DHHS at higher levels than originally enacted in the current State Budget, but changes to expenditures during the pandemic have added DHHS appropriations since the current budget’s enactment. A portion of the difference is also due to the House choosing to move $67.7 million in federal funds for an information technology upgrade out of the State Budget.

Back of the Budget Funding Reduction

The largest single modification to the DHHS budget made by the House was a back-of-budget reduction in appropriations. The “back” of the budget typically refers to the section of the Operating Budget Bill that follows the individual budget line and includes text that can impact multiple appropriation lines. A back-of-budget reduction requires an agency or agencies to spend less than the appropriations set forth in the budget lines elsewhere in the Operating Budget Bill. Typically, these savings must be found by agency management and do not specify areas for reductions, although past back-of-budget reductions have focused on particular areas or operations that encompass several budget lines. Back-of-budget reductions are legally required expenditure reductions, and resultingly provide less flexibility for agencies than expected lapse targets.

The House budget would require the DHHS to reduce General Fund appropriations from their budget lines by $50.0 million over the course of the biennium, with $30.0 million drawn from the first year of the biennium’s appropriations and $20.0 million from the second year. The areas for these reductions are unspecified, but the proposed statute would require the DHHS not draw funds from three areas: developmental services, including services for those with acquired brain disorders and in-home support services for children; the Children’s Health Insurance Program, a component of Medicaid; and county programs, such as the State’s funding share for nursing facilities and other long-term care services.

This $50.0 million reduction in General Fund appropriations may have an impact on the DHHS’s ability to draw down federal funding. About half of the DHHS budget is supported by federal funds, with many of those dollars coming through Medicaid. Medicaid provides federal matching funds for State appropriations to support access to health care for individuals with low incomes or limited resources; reductions in State General Fund appropriations may result in fewer State dollars available to match federal revenues as well, potentially reducing the amount of federal funding flowing to support services in New Hampshire.[viii]

Back of the Budget Reduction for Positions

In addition to the $50.0 million reduction, the House proposed a second back-of-budget reduction to appropriations for the DHHS. This second reduction focused on removing currently vacant but funded positions. The total reduction during the budget biennium would be $22.6 million in General Fund appropriations, without specifying amounts for individual budget years. The amendment would eliminate approximately 226 positions and limit the DHHS to having no more than 3,000 full-time authorized positions during the biennium. The DHHS would be required to report to the Joint Legislative Fiscal Committee as to which budget lines would be reduced in each September of the biennium for the reductions made in that fiscal year.

Closure of the Sununu Youth Services Center

The House’s budget proposal would close the Sununu Youth Services Center (SYSC) in SFY 2023. The SYSC is a secure institutional setting for individuals under age 18 who have been court ordered to such a setting and participate in behavioral programs.[ix] In recent years, the number of individuals served by SYSC has been declining to a substantially smaller number than the facility’s capacity.[x]

The House’s proposal would close the SYSC on July 1, 2022. Children currently detained at the SYSC would have to be transferred to the most clinically appropriate environment before that date, and no funds could be transferred or committed from other sources to support SYSC after that date. The House would also establish a commission to examine the closure of the SYSC and identify changes in other supports for children needed by those impacted by the SYSC’s closure, with a report due by the end of September 2021. The House’s proposal appropriates $2.05 million for the closure of the facility, including placement of children who cannot be in community settings and training for State employees who would lose their jobs in a closure. The building that is currently the SYSC would be transferred to the Department of Administrative Services.

Child Care Funding Assurance

In the Governor’s budget proposal, the Child Development Program in the Human Services Division also saw about $15.2 million less allocated during the Governor’s proposed budget biennium than in the current State Budget, with the reductions concentrated in employment-related child care funding. These dollars do not appear to be offset by funding increases elsewhere in the budget proposal.

As the public health impacts of the COVID-19 crisis recede and more workplaces open, child care will provide a critical service, enabling more Granite Staters to return to work.[xi] The House did not add funding for employment-related child care relative to the Governor’s proposal, but did vote to authorize the DHHS to draw funding from available Temporary Assistance to Needy Families federal funds if needed to avoid a waitlist for services.

Appropriation for Financial Review Recommendations

In the Governor’s proposal, the DHHS would receive approximately $10.0 million to implement certain recommendations from the financial review conducted by the management consulting firm Alvarez & Marsal. These funds would support the streamlining of certain agency operations to support greater efficiency and accountability. Alvarez & Marsal began working with the DHHS during 2020 to conduct a strategic assessment of DHHS operations, produce cost savings, increase efficiency, improve service delivery, and consider the operational and financial impacts of the COVID-19 pandemic.[xii]

The House reduced this appropriation to $3.3 million for the biennium. House Finance Committee members sought to remove funding for the proposed changes to the service system supporting individuals with developmental disabilities, and reduced the appropriation by an amount equivalent to that portion of the project. However, the proposed statutory language remains the same as proposed by the Governor. The House also anticipated additional savings at the DHHS because of the funding for these provisions, and increased the lapse estimate by $4.0 million in General Funds in the first year of the biennium, and $6.2 million in the second year.

Defunding Forensic Psychiatric Hospital

The Governor proposed setting aside $17.25 million in any federal assistance for revenue replacement or budget relief that comes to the State to construct a 60-bed forensic psychiatric hospital on the grounds of New Hampshire Hospital. If federal relief does not arrive by the end of December 2021, the Governor would authorize use of other State funds or borrowing to construct such a facility. This facility would be considerably larger than the 25-bed facility envisioned in the current State Budget.

The House removed this provision in the State Budget, opting instead to engage another House committee and shift this proposal to a separate process, rather than authorizing the use of federal funds or borrowing in the Trailer Bill.

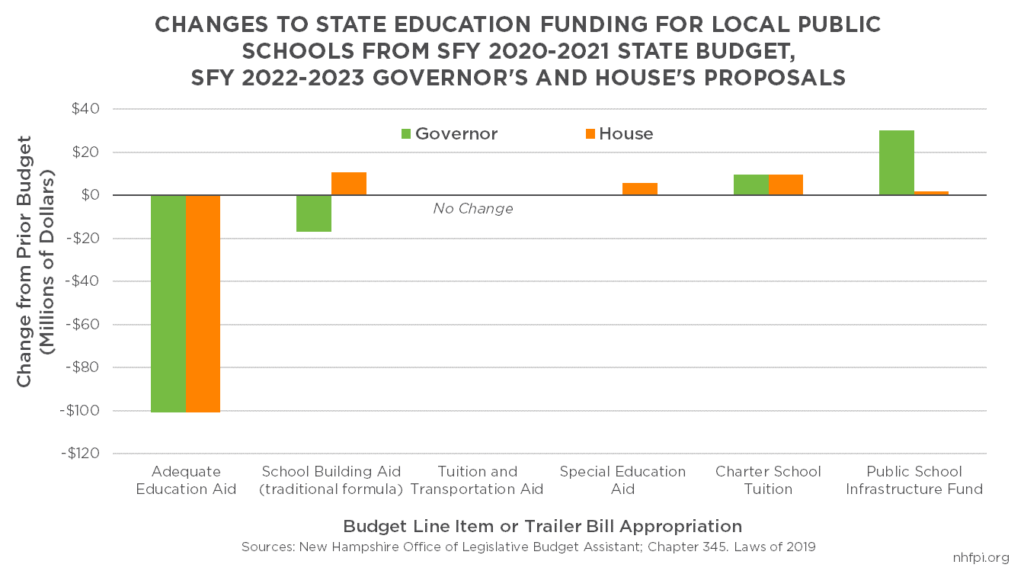

Local Public Education

The Governor’s budget proposal included significant funding reductions for local public education relative to the current budget biennium, due to both anticipated lower public school enrollment and the discontinuation of funding targeted at communities with more children from low-income families and lower taxable property values per student. The House would also keep the lower levels of projected enrollment and discontinue the one-time targeted funds in the current State Budget. However, the House added funding for school building assistance and special education students.

School Building Aid

The House voted to add school building aid for local school districts to the Governor’s budget proposal. The House proposed an additional $27.836 million be provided through the traditional school building aid formula, which would be divided into $17.278 million in the first year of the biennium and $10.558 million in the second year. This aid, appropriated in the Trailer Bill, would be further divided into $8.0 million to accelerate the remaining school building aid debt payments from past projects, and the remainder would be used to support new projects in the school building aid queue. The $50.0 million cap on school building aid grants for construction or renovation projects would be lifted for the biennium, and the Department of Education would be required to develop and maintain a ten-year plan for school building aid projects. The Department of Education reports there are about $104.2 million in school building aid applications for SFYs 2022 and 2023, and substantially more from applications ranging from 2011 to 2020 that have not been funded by the State.[xiii]

To fund this additional appropriation, the House voted to reduce the Governor’s appropriation to the Public School Infrastructure Fund. Created in 2017 as a result of an amended infrastructure fund proposal in the Governor’s recommended budget that year, the aid provided to local school districts by the Public School Infrastructure Fund is directed by the Governor, in consultation with the Public School Infrastructure Commission. The Fund’s resources are deployed for certain types of projects, including safety upgrades, fire code compliance changes, fiber optic connections, compliance with the Americans with Disabilities Act, and emergency readiness. Most of these projects have been relatively small projects (compared to the school building aid requests) that were designed to improve the security of school buildings.[xiv] The House would expand use of the funds to include energy-efficient school buses, as the Governor proposed, but would reduce the appropriation from $30.0 million over the biennium to $2.0 million, making Education Trust Fund appropriations available for the traditional school building aid formula appropriations.

Special Education Aid

The House’s budget proposal would appropriate an additional $5.6 million for Special Education Aid. Separate from the aid provided in the Adequate Education Grant funding formula, Special Education Aid is designed to provide additional State support to school districts for students with needs that are relatively high compared to average per-student expenses. When this aid is not sufficiently funded in the State Budget to meet the expected contributions, the amount of assistance is prorated based on budgeted funding.[xv] The Governor proposed funding Special Education Aid at the same levels as in the current State Budget. The House proposed boosting those levels to ensure the State’s contribution was not prorated.

Retroactive Funding for Full-Day Kindergarten

The House also voted to provide $1.9 million in additional funding for adequate education grants to support full-day kindergarten. This funding applies to SFY 2021 and SFY 2020, including retroactive application to fund full-day kindergarten operations based on the funding they would have received if current laws had been in effect during SFY 2020.

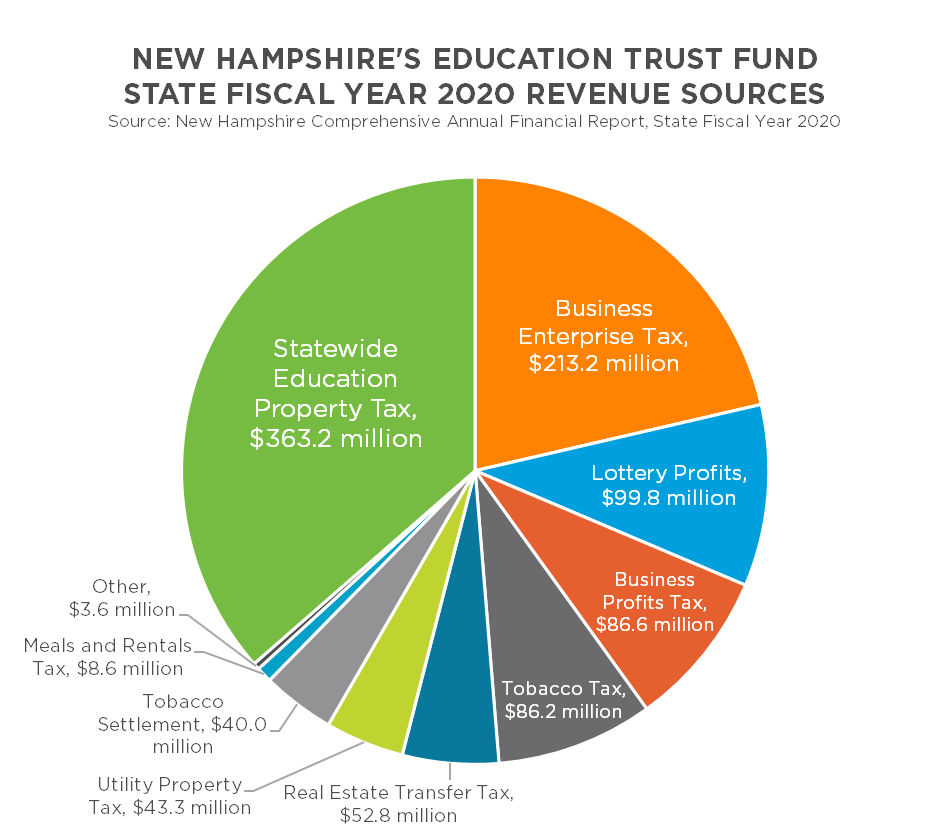

Statewide Education Property Tax Reduction

In the single-largest dollar change from the Governor’s budget proposed by the House is a one-year reduction of the Statewide Education Property Tax (SWEPT). The SWEPT is a State tax that supports the Education Trust Fund. The State requires local governments to apply this property tax in their jurisdictions, based on calculations conducted by the Department of Revenue Administration, to raise money to support local public education and offset a certain portion of the State’s statutory obligation to fund local public education under the education funding formula. The State does not collect any revenue from the SWEPT; all money is raised and retained locally.

The State calculates the amount to be collected by each jurisdiction based on an estimate of taxable property value statewide and the target amount to be collected statewide. The SWEPT is targeted to raise $363.0 million annually in statute, with no adjustments for inflation and regardless of changes in taxable property value statewide.

The House’s budget proposal would reduce the SWEPT’s target amount to be raised by $100.0 million in SFY 2023, targeting it to raise $263.0 million that year. However, it would not change the obligation the State has to fund local public education. This reduction in revenue would be offset by other revenue sources supporting, and savings held in, the Education Trust Fund. The House would also transfer $63.3 million from the General Fund to the Education Trust Fund to support this $100.0 million revenue reduction while maintaining obligations under the State’s education funding formula.

While this one-time reduction is a $100.0 million drop in State revenue in SFY 2023, it effectively requires local governments to raise less in local property taxes. That reduction would be offset by additional aid from the State coming from other revenue sources. This change would send more State-sourced aid to school districts in SFY 2023, rather than requiring them to raise such revenue locally to fulfill the State’s obligations.

However, this provision supplies aid in a less targeted manner than the one-time aid provided in the current State Budget, which builds on the existing funding formula to target aid to communities with less taxable property wealth per student and with higher concentrations of students from families with low incomes. This provision may also trigger the loss of $100.0 million in federal funds to the State that would otherwise be provided by the American Rescue Plan Act; that federal statute includes a stipulation that federal funds may not be used to directly or indirectly offset net State tax revenue reductions, with a dollar-for-dollar reduction in federal aid relative to State revenue reductions between March 2021 and December 2024. If the SWEPT were altered to raise $100.0 million less, that may result in a loss of $100.0 million in federal aid in addition to the foregone $100.0 million in State tax revenue, depending on the final regulations promulgated by the federal government and subsequent federal decisions.

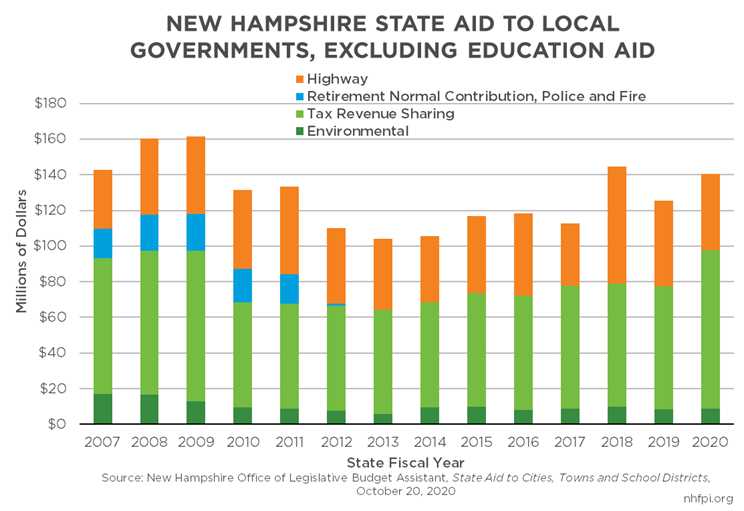

Non-Education Aid to Local Governments

The House voted to make changes to non-education aid to local governments relative to the Governor’s budget proposal as well. The House retained a core element of the Governor’s proposal, permitting more funding to flow through the Meals and Rentals Tax municipal revenue sharing formula, that will add revenue sharing to municipalities. However, the House also reduced revenue sharing for municipalities through environmental grants. Additionally, the House boosted Medicaid-related funding to county governments.

The House removed $15.6 million in grants to cities and towns from the Department of Environmental Services budget. These grants would be provided to municipalities to support water and wastewater infrastructure and water pollution mitigation. The House defunded these grants, and added a provision to the Trailer Bill specifically authorizing the Department of Environmental Services to request additional funds every six months during the biennium if General Fund revenues are above the State Revenue Plan.

The House added funding for county payments for nursing home and community-based care, which had been reduced by the Governor’s budget proposal. County governments pay for a portion of long-term supports and services delivered via Medicaid for adult county residents. The State and county governments split these costs, and the federal government matches the combined contributions of the county governments and the State government through the Medicaid program. The Governor had proposed reducing the State’s contribution to these funds by $20.8 million (67.5 percent) in the two years relative to the amount budgeted in the SFYs 2020-2021 State Budget as enacted. The House added $29.1 million in General Funds to offset county costs over the biennium, also reducing the total appropriation to reflect a smaller amount of nursing home beds expected to be used in the biennium statewide. The House also voted to include language in the Trailer Bill to limit the future increases in expenditures for counties to two percent per year, and to require any future enhanced matching fund supports from Medicaid to offset the county portion of costs, rather than the State potion. Additionally, the House voted to disburse $9.7 million in additional credits to counties for SFY 2021, based on their relative population aged 65 and older and enrolled in Medicaid.

The current State Budget includes $40.0 million in grants, $20.0 million per year, provided to cities and towns. Neither the Governor nor the House proposed continuing those grants into the next State Budget biennium.

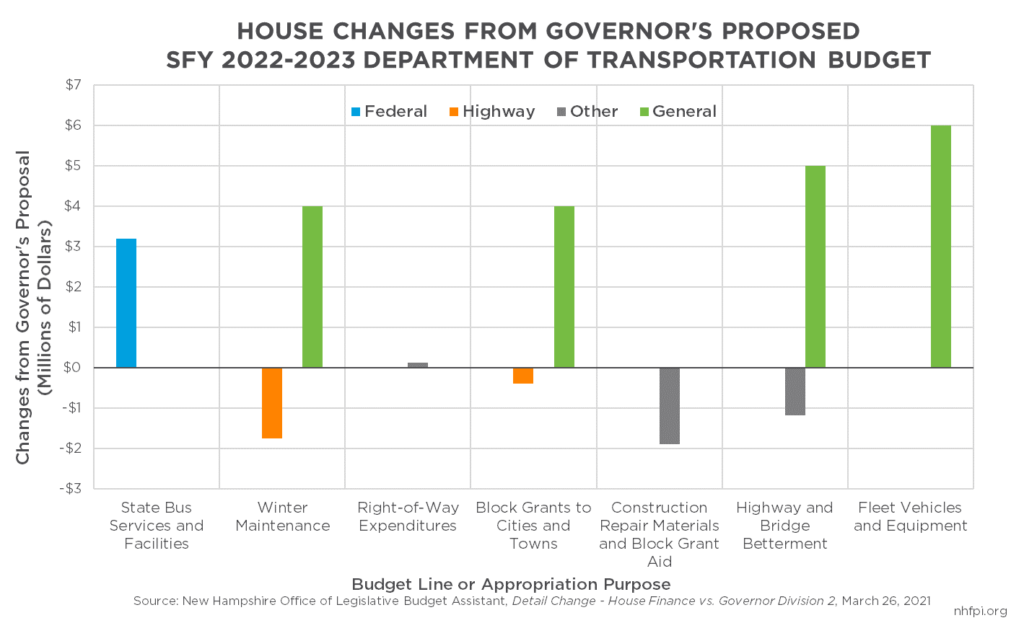

Transportation

The impacts of the pandemic have been significant for highway funding, as reduced traffic volume has resulted in lower revenues dedicated to transportation. These impacts were reflected in the Governor’s budget proposal, with lower projected transportation revenues and reduced overall appropriations for the Department of Transportation during the biennium. The House, however, boosted the Department of Transportation budget by more dollars than any other agency-level increase relative to the Governor’s proposal.

The House also reduced revenue from traditional sources for the Department of Transportation, trimming Highway Fund contributions to winter maintenance and block grants for cities and towns. Other funds for certain construction materials costs and highway and bridge repair were also trimmed relative to the Governor’s budget proposal. However, the House supplemented the Department of Transportation’s budget, which saw those declines in the agency’s budget lines, with an appropriation of $19.0 million in General Funds in the Trailer Bill. The Department of Transportation typically does not receive substantial amounts of General Fund support (the Governor’s budget proposed about $1.5 million per year in General Fund support for Transportation), and this transfer would be a one-time infusion.

The House deployed these General Funds to the Department of Transportation for four purposes. The House would allocate $6.0 million for purchasing fleet vehicles and equipment, $5.0 million for construction and repairs through the highway and bridge betterment program, $4.0 million for block grants to cities and towns for highway purposes, and $4.0 million for winter maintenance. These General Fund appropriations, in aggregate, exceed the declines in budgeted Highway Fund and Other Funds contributions by a total of $13.9 million.

In addition, the House voted to appropriate an additional $3.19 million in federal funding to support State bus services and facilities. This funding stems from Federal Transit Administration funding added as a result of federal COVID-19 relief and other appropriations passed by the U.S. Congress in December 2020.

Other Initiatives

The House proposed significant policy changes in other areas, including both carrying forward significant changes proposed by the Governor and making substantial changes to the Governor’s proposed statute and adding language from other legislative proposals into the State Budget. As with most other sections of this Issue Brief, the focus of this section is on the changes to the Governor’s budget proposal made by the House.

Liquor Commission Law Enforcement Authority Removed

The New Hampshire Liquor Commission, which operates the State’s liquor stores, is required to enforce State laws and regulations governing the purchase, consumption, and proper control of alcoholic beverages, as well as overseeing access to tobacco products.[xvi] In the proposed statutory language in the Trailer Bill, the House would remove this authority. The House would remove 21 law enforcement positions at the Liquor Commission, and enforcement would be conducted by county or city attorneys, sheriff’s departments, or town police. The House’s proposal would shift the focus of the Liquor Commission to education and licensing. This change in focus may have ramifications for federal and other partnerships the Liquor Commission currently participates in due to its status as a law enforcement agency.

Removal of Family Medical Leave Insurance

In his budget, the Governor proposed establishing the Granite State Family Leave Plan, which would be a required plan for State employees and a voluntary plan for other entities, including businesses and individuals, seeking to join. Eligible employees would receive 60 percent of their average weekly wage for a maximum of six weeks per year, with a cap on the wage calculation for higher income earners. Employees would be eligible as the result of the birth of a child or placement of a foster or adopted child within the past year, a serious health condition of a family member, or for certain military-related care. The Governor’s proposal also included a tax incentive for businesses to join. The House voted to remove the Governor’s family medical leave insurance plan, which is no longer included in the State Budget. The Governor did not include an appropriation for his proposal, so removing the program did not change appropriations.

Removal of Governor’s Student Debt Relief Program

The Governor’s budget proposal would have altered the New Hampshire Excellence in Higher Education Endowment Trust Fund, which collects revenue from two 529 College Tuition Savings Plans sponsored by the State of New Hampshire, to expand from supporting scholarships for students to also helping to alleviate the education debt of former students.[xvii] The Governor would direct the majority of the disbursements from the renamed New Hampshire Excellence in Higher Education Trust Fund to the Workforce Development Student Debt Relief Program to provide debt payment assistance for certain eligible graduates working full time in New Hampshire in key industries.

The House voted to remove the new program. Instead, the House would move the Governor’s Scholarship Program from the Office of Strategic Initiatives in the Governor’s office to the purview of the New Hampshire College Tuition Savings Plan Advisory Commission. The House’s proposed language would permit the Commission to transfer funds between the New Hampshire Excellence in Higher Education Endowment Trust Fund and the Governor’s Scholarship Fund.

Requirements for Family Planning Operations

The House proposal includes language that would require family planning operations that receive State funds to be separate, both physically and financially, from certain reproductive health facilities. This requirement would likely require many entities to split and establish new physical locations to continue providing existing services. The language also forbids contracts between entities receiving State funds for family planning and reproductive health facilities. The House also voted to add $50,000 in funding to the State Budget to incentivize entities contracting for the first-time with the State’s family planning program.

Limiting Duration of Governor’s Emergency Powers

The House voted to include in the Trailer Bill a provision that would limit the Governor’s ability to renew gubernatorial emergency powers through Executive Order. Under current law, the Governor can renew a State of Emergency for as many times as the Governor deems necessary. The House’s proposal would limit the Governor to renewing a State of Emergency only once before needing to go to the Legislature for additional authority; the Legislature could then renew the State of Emergency as many times as it finds necessary. The Governor could renew States of Emergency without going to the Legislature if half of either legislative body is found to be missing or incapacitated. The Legislature may also opt to declare a nominal State of Emergency as deemed necessary, such as in order to access federal funding.

Certain Restrictions on Teachings and Trainings

The House amended its State Budget proposal with legislation that would prohibit teachings or trainings, defined specifically in the proposed statute, for State officials, teachers in State-funded school districts, and contractors with the State government performing employee trainings, related to certain aspects or concepts tied to race, sex, racism, sexism, oppression or stereotypes based in those concepts, and associating actions with someone based on their identity. All trainings of State employees would have to be reviewed for compliance by the Department of Administrative Services, and all State contracts would have to include relevant language limiting workplace trainings.

Other Provisions

The House voted to make several other key changes to the Governor’s budget proposal, including:

- refunding businesses that were fined for violating COVID-19-related restrictions associated with the Governor’s Emergency Orders, with a $10,000 appropriation to refund these fines

- removing proposed mental health and social isolation programs targeted at older adults and veterans, respectively, with alternative funding identified for veterans’ services

- deleting an appropriation proposed by the Governor to support admission, discharge, and transfer notifications for patients of health care providers

- specifying expanded uses for the Education Trust Fund, and detailing transfers to the Fund from tobacco lawsuit settlement payments

- altering the commission proposed by the Governor to study the creation of a statewide entity to receive complaints about law enforcement misconduct by detailing membership and reporting requirements of the commission

- modifying statute governing the replacement of local school board vacancies to require replacements of missing members to be from the same originating city or town as the previous member

Revenue Projections and Tax Policy Changes

The Governor and the House used separate sets of revenue projections for both existing policies and proposed revenue policy changes as a basis for funding decisions in their State Budget proposals. With a dynamic economic landscape and a fast-changing outlook, particularly following the passage of the American Rescue Plan Act, revenue projections have changed significantly since the COVID-19 crisis reached New Hampshire. In an uncertain environment relative to both revenue collections and federal assistance, the House proposed adding more revenue reductions to the Governor’s budget proposal.

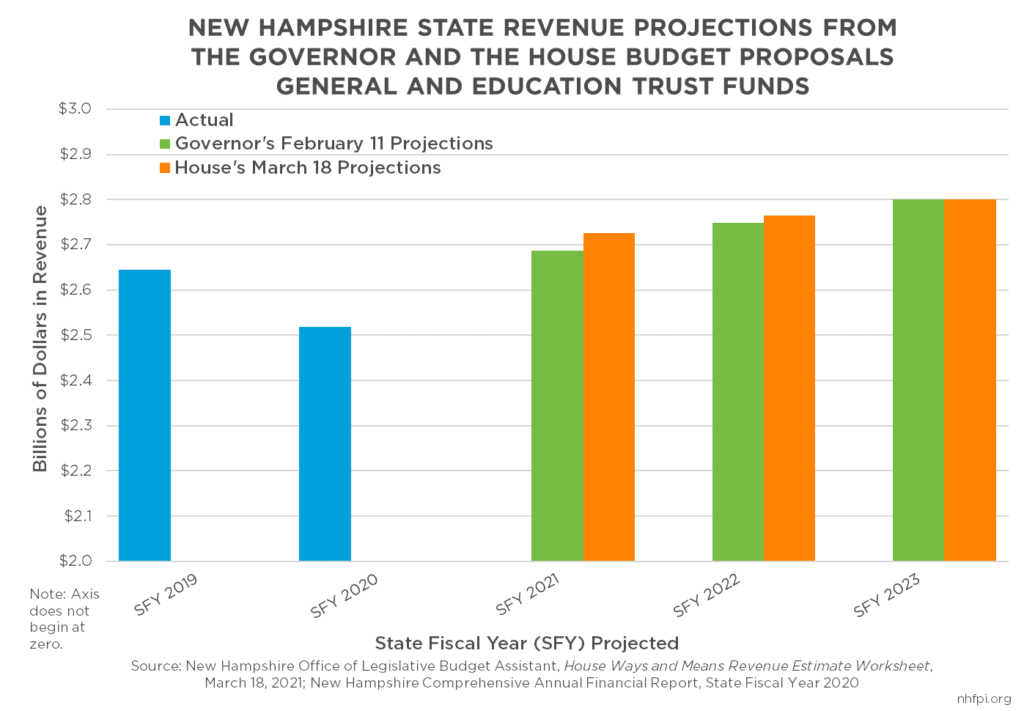

Governor and House Revenue Projections

The Governor started the State Budget process with revenue projections provided in his February 11, 2021 State Budget proposal. The House adopted the estimates of the House Ways and Means Committee, which met to create an initial set of estimates and subsequently revised them upward following the passage of the American Rescue Plan Act. The March 18, 2021 projections for the General and Education Trust Funds, used in the House’s version of the State Budget, exceeded the Governor’s original revenue projections for the biennium.

In total, the House Ways and Means Committee projected combined revenues for the General and Education Trust Funds would be $2.73 billion in SFY 2021, $2.76 billion in SFY 2022, and $2.80 billion in SFY 2023. Totals from the House Ways and Means Committee across the three fiscal years, all of which impact the amount of revenue available to deploy in the next State Budget, were $55.0 million higher than the Governor’s projections in aggregate. The House Ways and Means Committee started with a higher revenue base, benefitting from more recent State revenue information, but included less aggressive revenue growth than the Governor’s expectations for the biennium. Neither the Governor’s or the House’s revenue projections, as presented here, include proposed revenue policy changes; the Governor’s revenue projections were adjusted to remove the impacts of his proposed tax policy changes, and the House Ways and Means Committee assumes no policy changes in its revenue-projection process.[xviii]

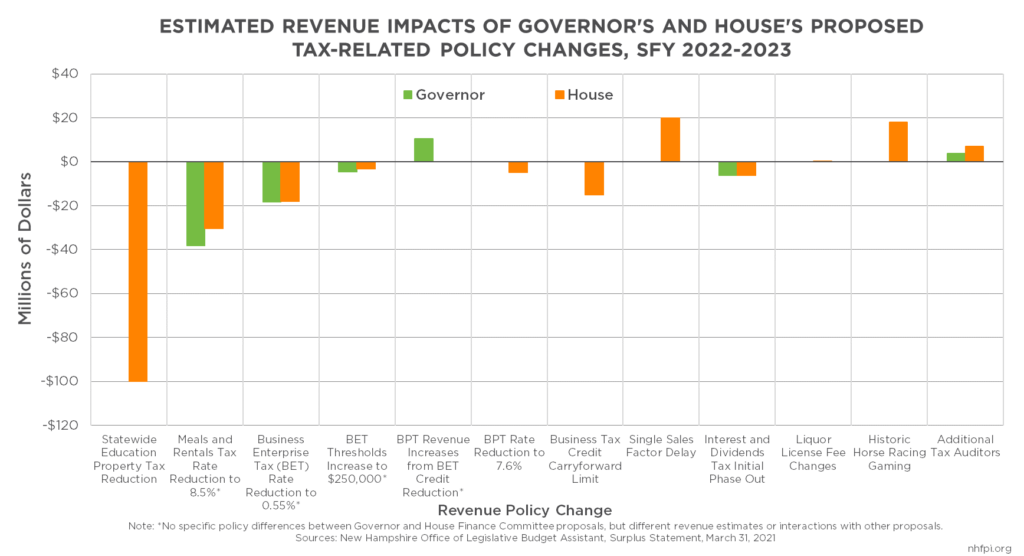

Revenue Policy Changes

The House retained the Governor’s proposed tax policy changes, and added several new tax and revenue policy changes into its proposal. The House left unchanged the Governor’s proposals to reduce the Business Enterprise Tax from 0.60 percent to 0.55 percent and to raise the two filing thresholds for the Business Enterprise Tax. The House also retained the Governor’s proposal to reduce the Meals and Rentals Tax from 9.0 percent to 8.5 percent, and to begin the phased elimination of the Interest and Dividends Tax during the State Budget biennium. The House developed slightly different estimates than the Governor as to the impacts of these tax policy changes, with the House estimating that these tax policy changes together would reduce revenue from these sources by about $57.8 million during the biennium.

The House also proposed several additional changes to the business taxes, in addition to those in the Governor’s budget. These changes include key alterations to the State’s largest tax revenue source, the Business Profits Tax. The House proposed lowering the Business Profits Tax rate from 7.7 percent to 7.6 percent, which would negate any positive revenue offset from the Business Enterprise Tax rate decrease (as payments to the Business Enterprise Tax can be used as a credit against the Business Profits Tax) and cost the General and Education Trust Funds an additional $4.9 million during the biennium in addition to foregone revenue from reduced applicable tax credits. The House also proposed delaying a change to business tax apportionment, which is the formula used to determine the tax liability to New Hampshire of businesses operating in multiple states, to a formula based on a single sales factor; delaying this change would result in more revenue, according to the House’s projections. Finally, the House altered a provision in the Governor’s proposal to limit the amount of business tax credits held by the State that can be carried forward into future tax years, raising the credit limits and projecting lost revenue from this provision, which the Governor did not anticipate in his revenue projections.

The single largest tax policy change added by the House is a one-year, $100.0 million reduction in revenue to be collected by the SWEPT. As discussed in the Local Public Education section of this Issue Brief, the SWEPT is a State tax that supports the Education Trust Fund but is not collected by the State. The State requires local governments to apply this property tax in their jurisdictions, based on calculations by the Department of Revenue Administration, to raise $363.0 million statewide to support local public education and offset a certain portion of the State’s statutory obligation to fund local public education under the education funding formula. Although the State does not collect the revenue from the SWEPT, the $100.0 million reduction is the equivalent of a reduction of that size in any other State tax revenue source, as other revenue sources would have to be used to offset that reduction and fulfill the State’s obligations.

Outside of tax policy changes, the House added the new revenue source of historic horse racing. This provision would allow wagering on horse races that have already occurred, set up in games that would not inform the player of which race had been selected but providing certain information about contestants. Gaming would be permitted for organizations licensed by the Lottery Commission, and electronic gaming at terminals would be permitted. The House estimated this revenue source would generate $18.0 million during the biennium for the Education Trust Fund, totaling $12.0 million in SFY 2023 when fully implemented.

The House voted to increase revenues by adding two tax auditor positions at the Department of Revenue Administration, which the House projected would add $3.0 million in SFY 2023 above the Governor’s projections. Finally, the House made changes to fees for liquor and tobacco licenses that would result in more revenue to the General Fund.

Tax Changes and Federal Assistance

Net reductions in State tax revenues may have additional implications due to a provision of the federal American Rescue Plan Act. The Act requires that flexible federal funds provided to States not be used, directly or indirectly, to offset net reductions in State tax revenue resulting from a change in law, regulation, or administrative interpretation that reduces any tax or delays the imposition of any tax or tax increase between March 3, 2021 and December 31, 2024. For every dollar in net State tax revenue reductions resulting from policy changes, the State would lose a dollar in federal aid through the Act.[xix]

The details of this provision’s implementation are still pending, as federal guidance and rules will provide critical insights into the manner in which these provisions will be implemented. However, net State tax revenue reductions from policy changes increase the risk of foregoing federal revenue to support services and the economy in New Hampshire. The net reduction in State tax revenues proposed by the House during the State Budget biennium, which encompasses only a portion of the period covered by this provision, is $157.7 million. Depending greatly on the final interpretation of this federal statute, New Hampshire could potentially forego $157.7 million in federal aid, in addition to the lost revenue through net tax reductions, during the budget biennium under the House’s budget proposal, with additional revenue losses in the next biennium.[xx]

Conclusion

The House’s proposal for the next State Budget would provide funding for public services during a critical time in the recovery from the COVID-19 crisis. The needs of New Hampshire residents will likely be higher early in the biennium as people, businesses, and communities recover from the pandemic. Many New Hampshire households continue to report difficulty paying for usual expenses.[xxi] Federal assistance will have a key role in providing economic supports, but continued intentional public policy responses may be needed to help ensure the recovery reaches everyone.

The House would reduce overall appropriations from the levels enacted in the current State Budget. Relative to the Governor’s proposal, the House would add more State-generated resources to support public education and transportation. The proposal would also reduce appropriations for health and social services, particularly relative to the Governor’s budget, and net reductions in State tax revenues would likely result in reduced federal aid.

Certain changes proposed by the House would bolster assistance to communities that may otherwise need to increase local taxes to maintain services. Increased support to counties for nursing home, long-term care, and home-based services was also incorporated, as well as language establishing requirements for future State funding levels. The House would deploy more funds through the State’s school building aid formula, which targets more assistance to communities based in part on median family income and taxable property wealth data. Providing flexibility for communities to use pre-pandemic counts of free and reduced-price school meal-eligible students, as proposed by the Governor and retained by the House, may help ensure that more resources are getting to the communities that have faced disproportionately higher levels of hardship during the pandemic. Additional transportation aid may help ensure that key infrastructure does not fall into disrepair even as key transportation-dedicated revenue sources have been negatively impacted by the pandemic. Policies to prevent a waitlist for child care services may help ensure families have access to child care, even as the House retained the Governor’s proposed lower levels of appropriations related to child care.

However, nonspecific back-of-budget funding reductions at the DHHS pose a potential risk to a wide variety of services, including health and economic supports that will be crucial for many Granite Staters recovering from the pandemic. Mental health and opioid crisis responses may be impacted by these reductions. The dynamic environment surrounding changes in the economic and public health landscapes, particularly with regard to potential impacts of future variants of the SARS-CoV-2 virus, increases the likelihood that more health and economic supports may be needed.

Additionally, net reductions in State tax revenue proposed in the House’s budget jeopardize the State’s ability to harness and deploy federal funds to support New Hampshire’s economy. The SWEPT reduction results in more State-generated resources being sent to communities, but would be less targeted in its provision of aid than assistance provided through the existing State Budget. The SWEPT reduction combined with reductions in the business taxes, the Meals and Rentals Tax, and the Interest and Dividends Tax would result in a net State tax revenue reduction of $157.7 million during the biennium, based on the House’s projections. Due to a provision of the American Rescue Plan Act, net State tax revenue reductions from policy changes could result in equivalent reductions in federal assistance to New Hampshire, potentially doubling the magnitude of lost revenue from any net tax reductions between March 2021 and December 2024.

Public policy can help build an inclusive, equitable, and sustainable economic recovery. Assistance to individuals and families with low incomes can both help enable those households to make ends meet and effectively boost economic growth. Direct services from the State government, assistance to local communities, and aid to organizations providing these services can all help support a robust and widespread recovery. Maximizing federal assistance to Granite Staters, through both State policy choices and connecting eligible individuals to services, would bolster the recovery locally and help ensure Granite Staters have the resources to support their families, engage in the economy, and help New Hampshire’s businesses and communities recover from the pandemic. The next State Budget will need deploy resources, both supplementing and complementing federal aid to meet the needs of New Hampshire residents, to foster a healthy economy and support Granite Staters in the pivotal years following the COVID-19 crisis.

Endnotes

[i] The analysis in this Issue Brief is based primarily on House Bill 1, as Amended by 2021-1045h, and House Bill 2, as Amended by 2021-1059h, both of which were passed by the New Hampshire House of Representatives on April 7, 2021. This Issue Brief also draws on analysis provided by the New Hampshire Office of Legislative Budget Assistant’s April 5, 2021 Comparative Statement of Undesignated Surplus for the Combined General and Education Trust Funds and April 8, 2021 Compare House to Governor Report. The Office of Legislative Budget Assistance also published detailed change reports by Division of the House Finance Committee, which provided additional insights for this analysis. To understand key differences between the Governor’s budget proposal and the current State Budget, see NHFPI’s March 11 Issue Brief The Governor’s Budget Proposal for State Fiscal Years 2022 and 2023. For relevant background on the economy and likely needs during the upcoming budget biennium, see NHFPI’s February 8 Issue Brief Designing a State Budget to Meet New Hampshire’s Needs During and After the COVID-19 Crisis.

[ii] This comparable amount includes the appropriations allocated in the current State Budget’s Trailer Bill (Chapter 346, Laws of 2019). These Trailer Bill appropriations totaled approximately $230 million in General and Education Trust Funds appropriations. Some of these Trailer Bill appropriations, particularly those relevant to Medicaid reimbursement rates, enabled significant federal matching funds; those funds are not included in these figures. Changes in the DHHS budget that have unbudgeted federal funds impacts in the House’s proposal for SFYs 2022 and 2023 are not included as well. For details, see the New Hampshire Office of Legislative Budget Assistant’s Comparative Statement of Undesignated Surplus from September 25, 2019.

[iii] To learn more about the changes proposed by the Governor relative to the current State Budget, see NHFPI’s March 11 Issue Brief The Governor’s Budget Proposal for State Fiscal Years 2022 and 2023.

[iv] For more information, see the University System of New Hampshire – Our Institutions.

[v] See information on each of the colleges and academic centers at the Community College System of New Hampshire – Colleges and Programs.

[vi] The description of technical corrections was provided in the summary document prepared by the Office of Legislative Budget Assistant for the April 5, 2021 House Finance Committee briefing.

[vii] Medicaid enrollment data from the New Hampshire Department of Health and Human Services, New Hampshire Medicaid Enrollment Demographic Trends and Geography, February 2021. For the cost of Medicaid, see NHFPI’s December 7, 2020 presentation The COVID-19 Crisis and State Budget Implications for New Hampshire.

[viii] To read more about Medicaid in New Hampshire, see NHFPI’s March 2018 Issue Brief Medicaid Expansion in New Hampshire and the State Senate’s Proposed Changes.

[ix] For more information, see the New Hampshire Department of Health and Human Services, Sununu Youth Services Center.

[x] For an example of declining average census counts, see Table 6 of the New Hampshire Department of Health and Human Services, Operating Statistics Dashboard, November 2019.

[xi] For information and research related to the importance of child care in the economy and the recovery from the COVID-19 crisis, see the Federal Reserve Bank of San Francisco Community Development Research Brief, Child Care, COVID-19, and Our Economic Future, September 2020.

[xii] For more information, see the September 1, 2020 Informational Item from the DHHS provided to the Governor and Executive Council.

[xiii] For more information, see the New Hampshire Department of Education’s School Building Aid Summary, March 3, 2021, provided to the House Finance Committee’s Division II.

[xiv] For more information on these expenditures, see the Department of Education’s March 3, 2021 Public School Infrastructure Fund Summary.

[xv] For more information, see NHFPI’s April 9, 2021 presentation Education Funding in New Hampshire: A Brief Overview.

[xvi] For more information, see the 2020 Comprehensive Annual Financial Report of the New Hampshire Liquor Commission.

[xvii] To learn more about the existing program, see the State Treasury Higher Education Division’s May 2, 2018 presentation UNIQUE Scholarship Programs.

[xviii] To see more information regarding the House Ways and Means Committee revenue estimates and process, see the Office of Legislative Budget Assistant, House Ways & Means Revenue Estimate Documents – February 2021.

[xix] For more information on the American Rescue Plan Act and further references, see NHFPI’s March 26, 2021 blog post Federal American Rescue Plan Act Directs Aid to Lower-Income Children, Unemployed Workers, and Public Services.

[xx] This figure does not include proposed revenue changes stemming from the addition of tax auditors, wagering on historic horse races, or changes to liquor and tobacco license fees, as those changes would not be changes in tax policy.

[xxi] For more information on the ongoing economic impacts of the pandemic, see NHFPI’s April 9, 2021 blog The COVID-19 Crisis After One Year: Economic Impacts and Challenges Facing Granite Staters.