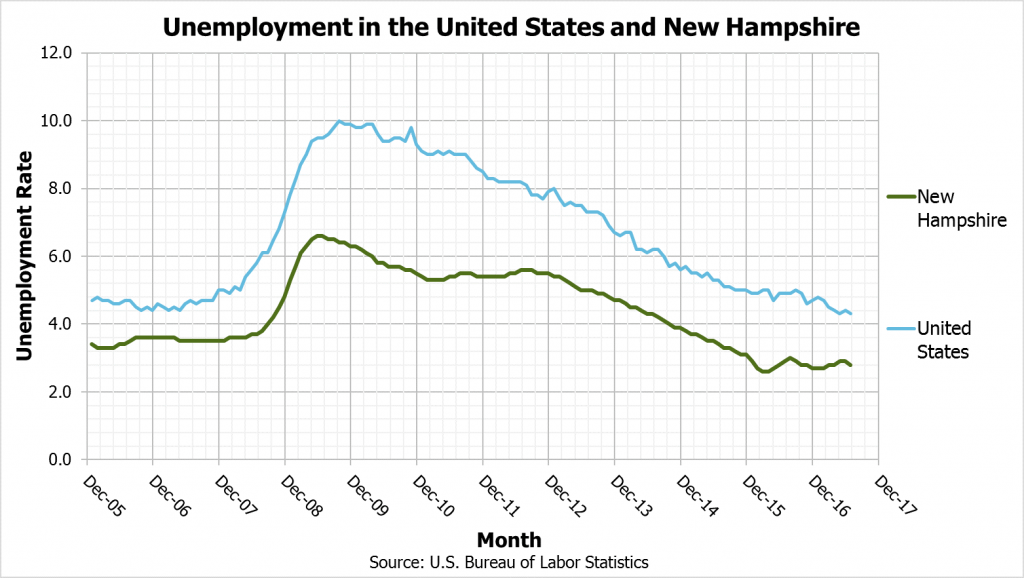

In the long economic recovery following the Great Recession, New Hampshire’s workers have faced slower job growth than the nation as a whole, and wages for many low-income workers have not kept pace with inflation, leaving many people with less purchasing power. New Hampshire’s job growth has been more robust in the most recent years of the post-Recession economic expansion, however. The state’s economy has been fully recovered by several key metrics for some time, and the unemployment rate remains below 3.0 percent, less than the pre-Recession levels of 2006. By most measures, it is a good time to be a worker in New Hampshire, but many of the jobs generated in the wake of the Recession offer workers less in compensation than those lost during the economic contraction.

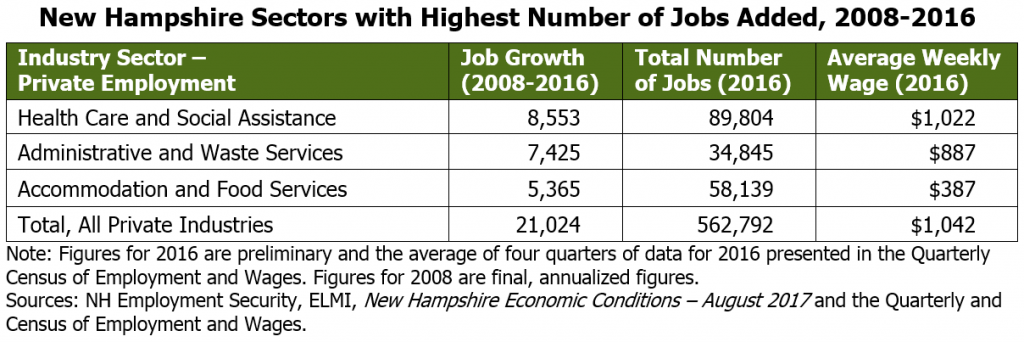

Since the Recession ended in 2009, job growth in New Hampshire has been strongest in three areas that have average wages lower than overall employment in the state. The New Hampshire Economic and Labor Market Information Bureau (ELMI) recently released an analysis showing which private industries added the most jobs between 2008 and 2016. The three sectors with the largest number of jobs generated during this period were Health Care and Social Assistance, Administrative and Waste Services, and Accommodation and Food Services.

NHFPI’s State of Working New Hampshire analysis from 2016 shows a similar pattern, with jobs earning an average of more than $1,000 per week dropping by 14,022 between 2007 and 2014, and those with below the $1,000-per-week average increasing by 10,626. This trend toward the generation of lower-wage jobs appears to be continuing, based on the preliminary 2016 data. However, overall wage growth in southern New Hampshire was faster than the national average between the third quarter of 2015 and a year later. Wage growth, should it continue, may aid some workers in paying for rising expenses, such as child care and housing, which are more difficult to afford with lower-wage jobs.

Despite similar levels of overall employment in 2008 and 2016, Retail Trade remains New Hampshire’s largest private sector industry employer with 96,785 jobs and an average weekly wage of $595 in 2016, according to preliminary, averaged data from the Quarterly Census of Employment and Wages. Health Care and Social Assistance is the second-largest industry by employment in the state, with 89,804 jobs.

ELMI’s 2017 review of the labor market noted that the number of people working part-time for economic reasons has dropped back to normal levels, but also that nonfarm jobs have been growing faster than state resident employment; this suggests, according to the ELMI, that more workers who are state residents may hold multiple part-time jobs or that more people are commuting from out-of-state to work in New Hampshire. These indicators, the low unemployment rate, and other factors point to a potential shortage of workers in New Hampshire. A new report from the ELMI identifies that higher and middle education occupations are projected to have roughly the same number of openings between 2014 and 2024, and the state may have many more job openings for lower entry-level education employment. A present or future labor shortage may provide workers with more leverage to seek higher wages, benefits, or flexible work hours.