Most New Hampshire residents with lower incomes pay a higher percentage of the money they earn in state and local taxes than residents with higher incomes do. In a new report released yesterday, the Institute on Taxation and Economic Policy conducted evaluations of state and local government tax systems in each of the 50 states and modeled their impacts on non-elderly residents. The report concludes that 45 states have tax systems that ask a greater percentage of the incomes of those with low earnings than those with the highest incomes.

New Hampshire is one of those 45 states, in part due to a state and local tax system heavily dependent on property taxes for revenue. The report finds that property taxes usually fall more heavily on lower- and middle-income families in relative terms, as higher income families generally require a smaller percentage of their incomes to pay property taxes than families with lower incomes. New Hampshire’s property tax structure has limited opportunities for lower-income households to reduce their property tax liability, such as the small and underused Low and Moderate Income Homeowners Property Tax Relief program.

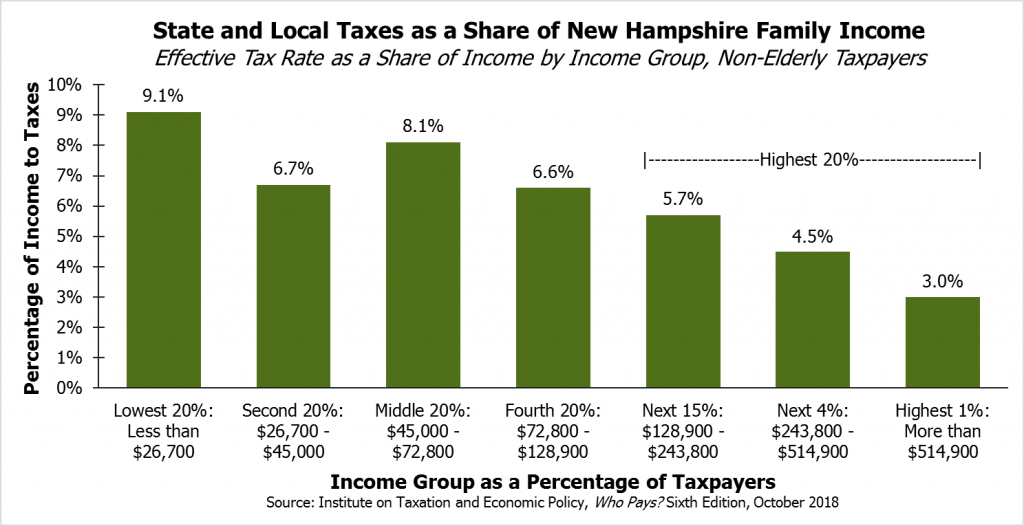

For the 20 percent of non-elderly people with the lowest incomes in New Hampshire, which the report estimates are those making less than $26,700 per year, state and local taxes absorb about 9.1 percent of their incomes. This represents the total effective tax rate on those people with these low incomes from state and local governments in New Hampshire, including portions of taxes passed through rent and motor vehicles fees. Those in the middle 20 percent, making between $45,000 and $72,800, see the greatest estimated share of their incomes being paid in property taxes of any group, at 6.3 percent, with a total effective tax rate of 8.1 percent from all state and local taxes. The report divides the top 20 percent into three sub-groups, and shows the top one percent of income earners, or those with more than $514,900 a year in income, paid about 3.0 percent of their incomes in state and local taxes.

To learn more about the analysis, read the full report from the Institute on Taxation and Economic Policy titled Who Pays? A Distributional Analysis of the Tax Systems in All 50 States. To learn more about the ways in which New Hampshire raises revenue, see NHFPI’s Revenue in Review resource.