New Hampshire’s two primary business tax rates dropped for most businesses starting at the beginning of this calendar year, and state business tax revenues generated by the effects of the federal tax overhaul may be limited going forward, putting the state’s largest tax revenue stream at risk.

The federal tax overhaul dropped the top corporate tax rate from 35 percent to 21 percent, contributing to an estimated 31 percent decline in federal corporate tax revenues last federal fiscal year. New Hampshire revenues from business taxes have been abnormally and sharply higher since December 2017, but these increases are likely due to businesses changing their behavior, such as repatriating earnings from overseas, in response to the federal tax overhaul rather than any state tax policy changes or fundamental changes in the economy. Certain federal tax regulations remain unsettled, leading to more uncertainty about the durability of these state tax revenues.

Meanwhile, the rates for New Hampshire’s two primary business taxes, the Business Profits Tax and Business Enterprise Tax, are declining from 7.9 percent to 7.7 percent and 0.675 percent to 0.60 percent, respectively, in 2019. This decline is not based on any revenue trigger, unlike the 2018 rate cut. Under current law, rates are scheduled to decline again, independently of state revenues, in 2021.

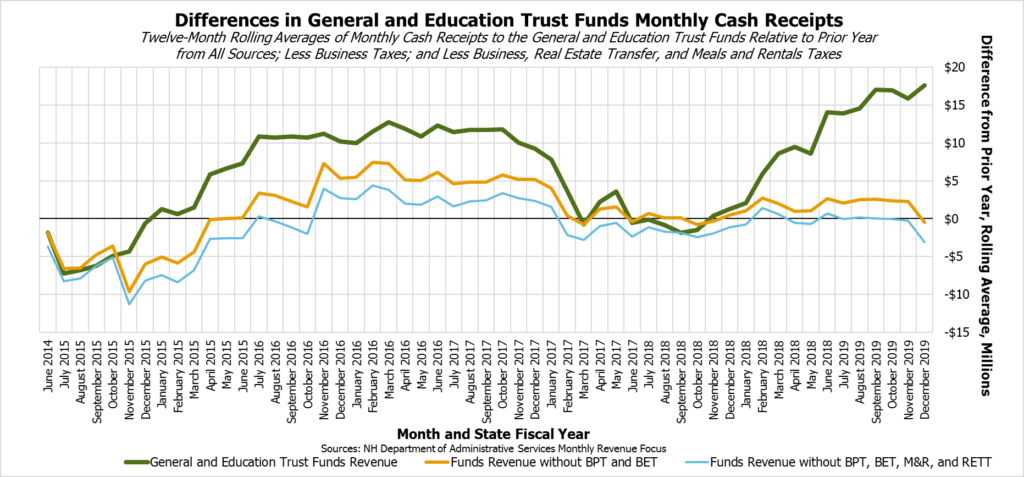

When state business tax revenue growth climbed during 2015 and 2016, it followed increased economic growth after a long, slow recovery in New Hampshire following the 2007-2009 Recession. The growth in the economy also pushed other tax revenue sources upward, including the Meals and Rentals Tax and the Real Estate Transfer Tax. Business tax receipts in 2018, however, were higher while other state tax revenue sources and indicators grew relatively little, suggesting revenue growth had less to do with dramatic economic growth and was more specific to businesses responding to federal tax changes.

New Hampshire’s recent state tax policy decisions likely have a minor effect on business behavior compared to the large December 2017 federal tax changes, and come in the context of recent higher corporate tax revenues for states throughout the country. New Hampshire’s state tax policy decisions, or momentous economic growth relative to prior periods, are very unlikely to be the driving force behind sharply higher business tax revenues. These revenues are much more likely due to anomalies in response to the federal tax overhaul, and policymakers should carefully evaluate available information when making revenue projections to plan and fund the next State Budget.

For more information on State revenue sources and trends, see NHFPI’s Revenue in Review resource.