As policymakers continue to consider State Budget options and choices during the ongoing continuing resolution, understanding State revenue trends remains critical to determining the State’s ability to pay for needed services and the policy choices that affect available resources. With State Fiscal Year (SFY) 2019 completed and SFY 2020 underway, recent months of revenue collections have provided some additional insight into whether the State might expect more revenue in future years. Questions remain about the future of business tax receipts in particular, which have been very difficult to predict due to recent abnormal behavior following the federal tax overhaul; however, recent data suggest anticipated declines in receipts may limit revenue going forward.

Although New Hampshire policymakers do not have control over the federal policy changes that spurred one-time revenues in the last year, they do have control over State policy; policymakers should work to ensure that needed services are still funded even as anomalous revenues from the federal tax overhaul decline. Recent business tax rate reductions do not appear to have spurred sufficient economic growth to generate more revenue than was likely lost due to the rate reductions, and policymakers should consider the potential benefits to the economy and the state’s residents by investing additional resources into vital services, such as health, education, and infrastructure, against the revenue forgone by reducing tax rates.

Monthly Revenue Trends

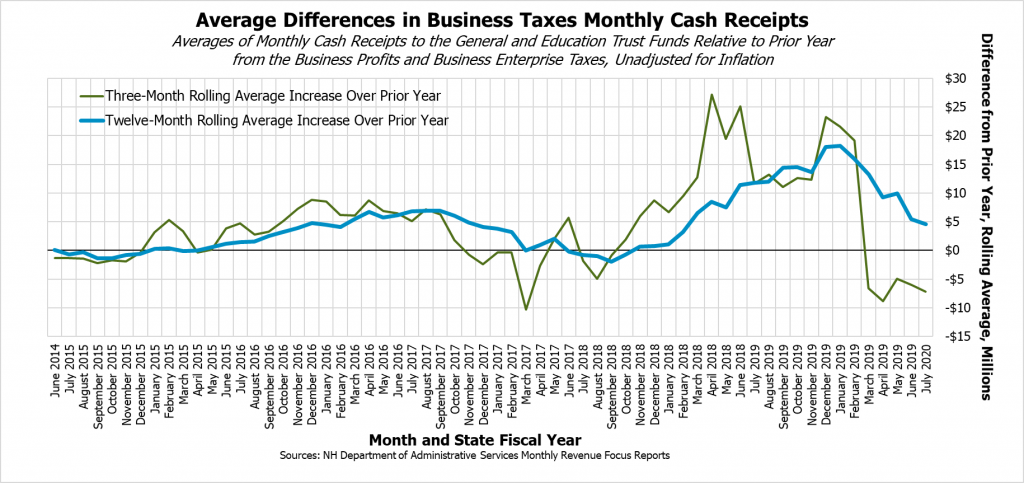

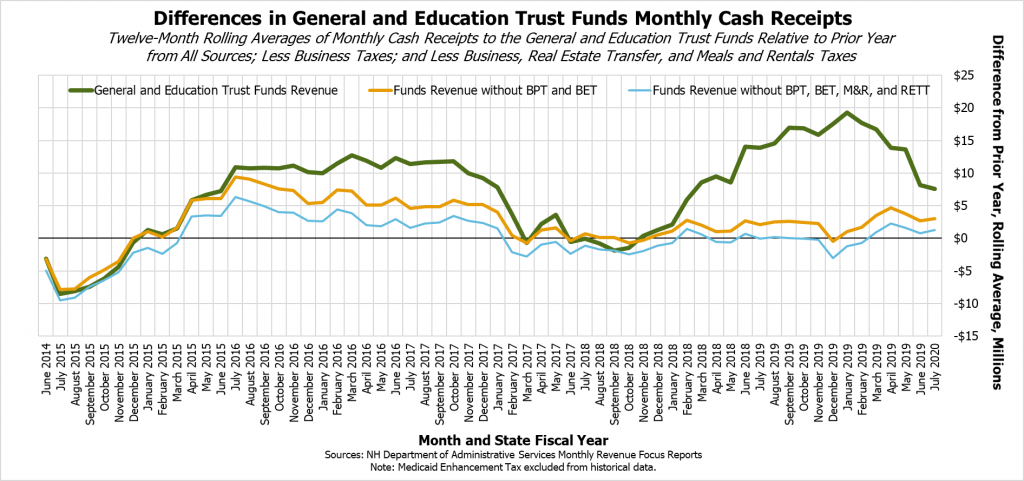

State revenues collected in May, June, and July show the potential for future declining receipts from the two primary business taxes, the Business Profits Tax and the Business Enterprise Tax, which are the first and fourth largest State tax revenue sources, respectively, and are typically collected and measured together. In total, combined cash revenue for the General and Education Trust Funds was $26.5 million (5.3 percent) lower for May, June, and July than a year before. From the combined business taxes, receipts in May, June, and July totaled $21.5 million (12.2 percent) lower than the same months a year earlier. Declines in business tax receipts were anticipated due to reduced revenues stemming from the one-time anomalies following the federal tax overhaul and some businesses making quarterly estimate payments based on a lower tax rate relative to the prior year.

Other major revenue sources produced a mixed result. While certain important revenue sources remain positive relative to the prior year, some key sources saw a decline in revenues between May, June, and July receipts and the year before. Tobacco Tax revenue was down about $4.9 million (8.7 percent) during this period, reinforcing the likelihood that this revenue source may decline in coming years, and some consumers may have moved to currently untaxed products, such as vaping products. Real Estate Transfer Tax revenues were down $0.9 million (2.1 percent), likely reflecting the constrained housing inventory that, while putting upward pressure on prices, limits the number of taxable transactions. State revenues from the Liquor Commission were also lower, by approximately $2.1 million (5.3 percent), although Lottery Commission revenues were $3.9 million (20.1 percent) higher than the same months of the prior year. Receipts from the Meals and Rentals Tax continue to grow at a healthy clip, bringing in $4.1 million (4.9 percent) more than the prior period. Interest and Dividends Tax revenues were also higher by $3.6 million (23.1 percent), while Insurance Premium Tax revenues added $2.2 million (78.6 percent). May, June, and July are not key months for some of these revenue sources, so relatively small dollar-value changes may translate into large percentage swings.

Comparing Yearly Revenues

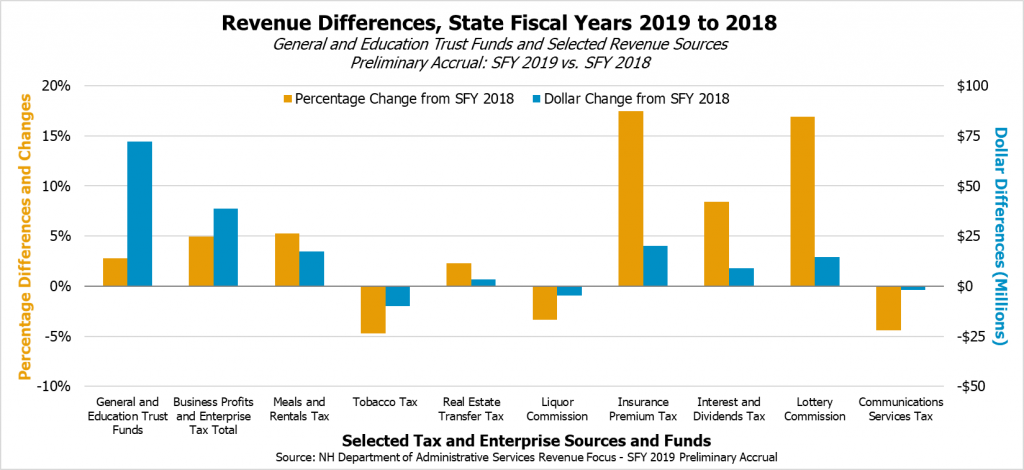

With the close of SFY 2019 and the preliminary accrual of revenues for the year calculated, year-over-year comparisons of revenue provide some insights into the longer-term trends in certain revenue sources.

Total revenue for the General and Education Trust Funds was $72.1 million (2.8 percent) higher than the prior year, propelled in large part by the continued growth in business tax revenues during the first half of SFY 2019. The two business taxes combined were $38.6 million (5.0 percent) above SFY 2018 for all of SFY 2019.

Meals and Rentals Tax receipts continued to push revenues higher than the previous year, adding $17.4 million (5.2 percent) to SFY 2019 revenues over the contributions from SFY 2018. However, two sources likely in long-term decline offset much of this increase, as Tobacco Tax receipts were $10.0 million (4.7 percent) lower, and Communication Services Tax revenues were $1.9 million (4.4 percent) behind the SFY 2018 total.

An increase in Insurance Premium Tax receipts, some of which may be one-time, helped push revenues up by $20.1 million (17.5 percent) over the prior year. Relatively volatile Interest and Dividend Tax receipts were up $8.9 million (8.4 percent), and slowing Real Estate Transfer Tax revenue growth left receipts $3.4 million (2.3 percent) above the prior year. As with the monthly totals, Liquor Commission revenues generated by operating profits remained behind the prior year by $4.6 million (3.3 percent), but increased Lottery Commission profits, buoyed in part by the new revenue from Keno gaming, totaled $14.5 million (16.9 percent) higher than in SFY 2018.

Funding Choices in the State Budget

Policymakers faced with determining the amount of revenue available to fund the State Budget and potential revenue policy changes to support key services should carefully consider the additional information available in the most recent revenue figures. The rise in revenue during the last two State fiscal years appears to have been driven by the federal tax overhaul, rather than past New Hampshire business tax rate reductions, and policymakers should not rely on rate reductions to generate additional revenue. Other key revenue sources are also exhibiting some long-term trends, particularly declines in Tobacco Tax receipts and slower growth in Real Estate Transfer Tax revenue, that policymakers should incorporate into their revenue policy and forecasting decisions. Maintaining business tax rates at 2018 levels may help ensure that sufficient revenue is available to fund key ongoing services for Granite Staters.

For more information on State revenues, see NHFPI’s May 2019 Issue Brief, Funding the State Budget: Recent Trends in Business Taxes and Other Revenue Sources.

– Phil Sletten, Policy Analyst