The New Hampshire Housing Finance Authority recently released the findings of their 2019 Residential Rental Cost Survey for the state. Conducted annually in order to understand the condition of the unsubsidized rental market in the state, the latest report identifies several important ongoing trends.

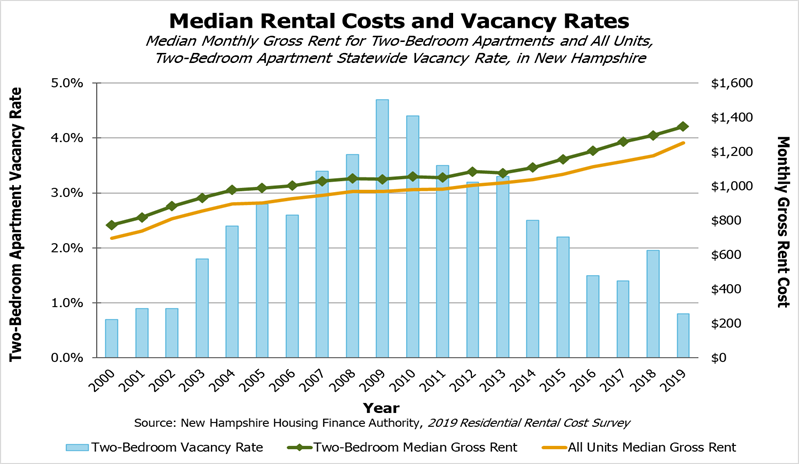

The overall increase of New Hampshire’s median rent and utility costs over the past decade continues into 2019, with total rental costs for residential units trending upward to the 2019 median level of $1,347 for a two-bedroom apartment. This new data suggests this rise in costs is occurring in large and small cities and towns, counties, and the state overall. In the past five years, rental costs for two-bedroom apartments in the state have increased by nearly 22 percent on average. Along with the continued increase for the cost of renting, vacancy rates of units across the state have continued to drop to levels that preceded the housing market crash and the Great Recession that began in 2007. Currently, the vacancy rate of rental units in New Hampshire is below 1 percent.

The New Hampshire Housing Finance Authority identifies a vacancy rate for a balanced rental market to be around 4 to 5 percent, which allows for a smoother transition of people into, out of, and between rental units. However, the current vacancy rate in the state being so low, and only recently achieving the 4 to 5 percent rate in the aftermath of a recession, implies that there is a severe shortage of rentable dwellings across the state. Data from the Recession period appears to show that an adequate level of vacant rentable dwellings only occurred during this economic downturn. This continued limited supply of apartments may be a factor contributing to the increasing rental costs in New Hampshire over time as the economy of the state has improved.

Although nearly all areas of the state are experiencing this increase in rental costs, along with a nearly 1 percent vacancy rate, the effects are more concentrated in certain areas. The southeastern counties of Hillsborough, Merrimack, and Rockingham see some of the highest rental rates and lowest vacancy rates in the state. The southeastern counties have also seen some of the largest increases in rental costs over the past five years. Rockingham County has the highest median two-bedroom rental rate, at $1,568, a nearly 27 percent increase from five years earlier. These trends may be influenced by these counties’ proximity to the Greater Boston area and population densities.

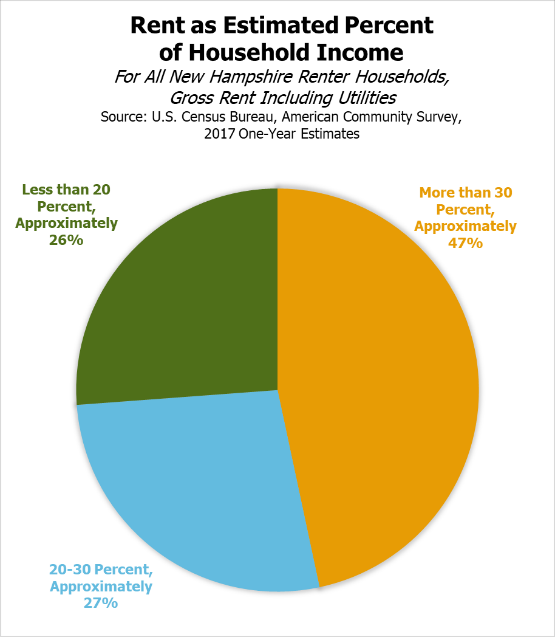

With the high demand in New Hampshire’s rental market coupled with a low supply of available apartments, renters are spending larger portions of their paychecks on housing. The U.S. Department of Housing and Urban Development states that, “Families who pay more than 30 percent of their income for housing are considered cost burdened and may have difficulty affording necessities such as food, clothing, transportation and medical care.” In 2017, 47 percent of New Hampshire’s renters were spending more than 30 percent of their income on rental costs. Nearly half of the renters in the state may be considered cost burdened due to the limited supply of available rental dwellings.

This fact points to a need for more rental housing in New Hampshire. A greater supply of apartments in the state would allow more choice in the amenities, location, and cost of rental housing. By decreasing the inflated cost of renting in the state, a greater number of individuals and families would find relief in their expenses. More apartments on the market in New Hampshire would provide a greater level of economic security for residents.

– Michael Polizzotti, Policy Analyst