The annual Kids Count ranking for 2016 once again places New Hampshire among the top states for child well-being, but increases in the numbers of children and families facing financial hardship should serve as a warning sign and inspire a closer look at policies that can enhance economic stability for working families.

Released on June 21, the annual Kids Count Data Book from the Annie E. Casey Foundation measures child well-being across four indicators: economic well-being, education, health, and family and community. While New Hampshire traditionally fares well among all states, it dropped from second to fourth place in the overall ranking, behind Minnesota, Massachusetts, and Iowa.

New Hampshire ranked seventh for economic well-being, a rank driven in part by increases in the numbers of children living in poverty and whose parents lack secure employment. In 2008, 9 percent of New Hampshire children lived in poverty; as of 2014 the number had increased to 13 percent, or 34,000 children. What’s more, in 2014, 64,000 children – or 24 percent – had parents who lacked secure employment, which raises concern for the future economic security of these children and their families.

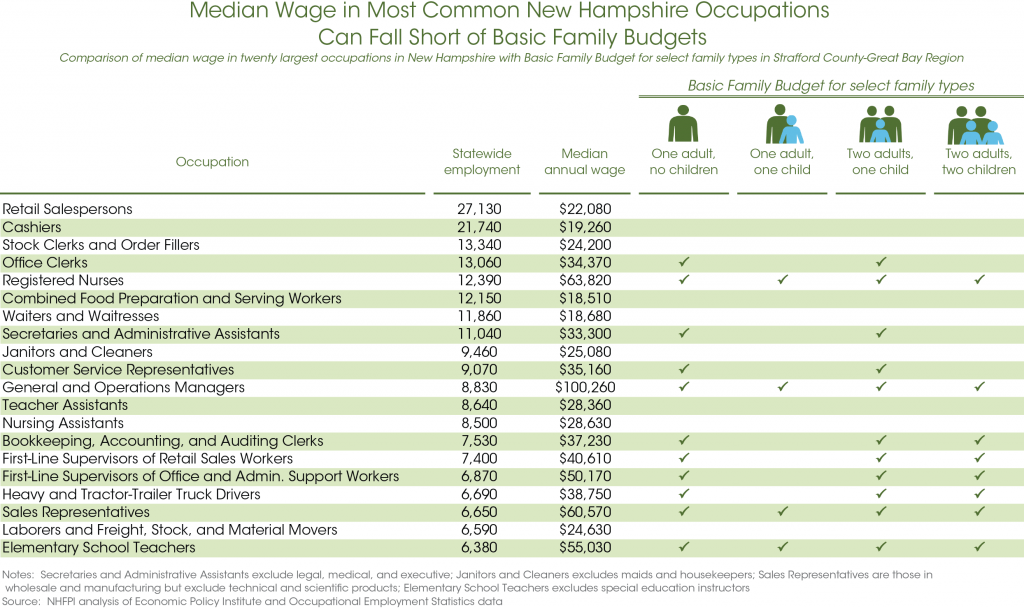

The finding that nearly one in four children have parents who lack secure employment is echoed in NHFPI’s Taking the Measure of Need report, released in March 2016. In this report, NHFPI examined the median incomes for many common types of employment and found that a sizeable number of jobs do not pay enough for many working families to afford housing, child care, food, transportation, and other basic needs. A review of the 20 most common occupations finds a large number of service-related positions, which may not offer a steady number of hours or provide sufficient income to meet family needs.

NHFPI’s The State of Working New Hampshire report further examined state employment trends and found that income for the typical household has declined since 2007, driven in part by a steady shift in the types of employment, as many higher wage manufacturing jobs have been lost over time and replaced by lower wage service-oriented positions.

As policymakers work to bring new jobs to the Granite State, they should be mindful that New Hampshire’s children depend upon the availability of employment opportunities that enable their families to earn sufficient income and achieve economic stability.